Prepare Form 16 for 50 employees efficiently using Excel automation for FY 2025-26

Why Automate Form 16 Employers handle massive workloads during tax season. Therefore, manually creating Income Tax Form 16 for 50 employees leads to

Prepare Form 16 for 50 employees efficiently using Excel automation for FY 2025-26

Why Automate Form 16 Employers handle massive workloads during tax season. Therefore, manually creating Income Tax Form 16 for 50 employees leads to

Tax season burdens many salaried individuals in India. However, an automatic income tax preparation software in Excel changes that dynamic for FY 2025-26.

Download Automatic Income Tax Form 16 Part B in Excel for FY 2025-26

Why Choose Automatic Form 16 Part B Excel? Employers issue Form 16 Part B to detail TDS deductions and salary breakup. Consequently, employees

Download Automatic One by One Preparation Tax Form 16 in Excel FY 2025-26

Employers rush to prepare Tax Form 16 for FY 2025-26 as deadlines approach. This automatic Excel tool simplifies the process, generating forms one

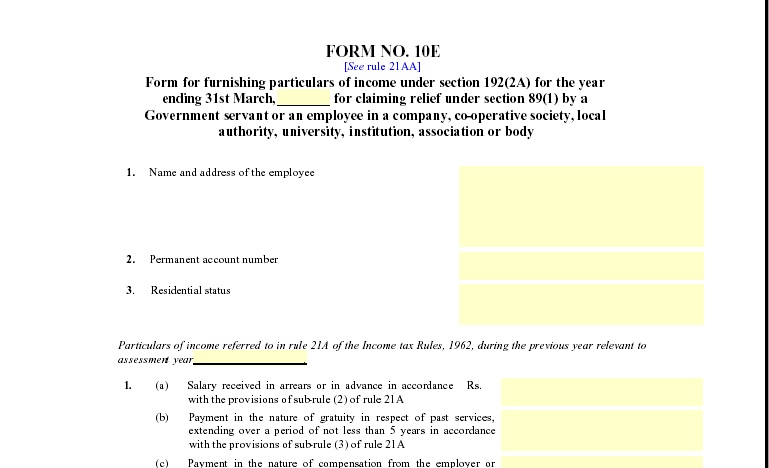

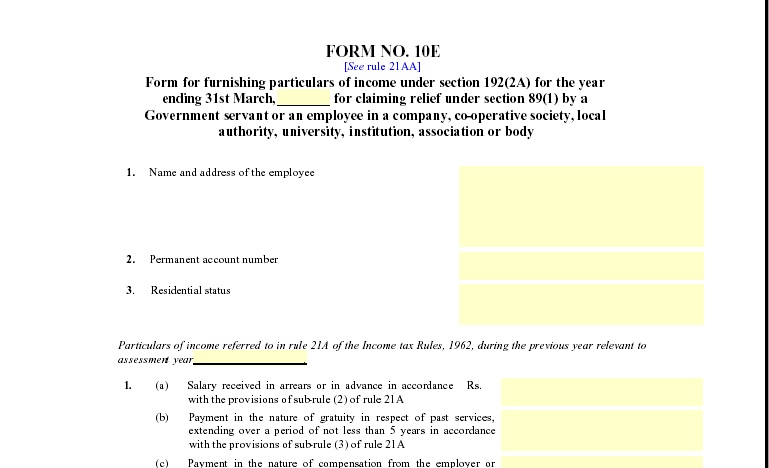

Automatic Income Tax Arrears Relief Calculator with Form 10E in Excel for FY 2025-26

Salaried employees often receive arrears, which push them into higher tax brackets unexpectedly. Consequently, they qualify for relief under Section 89(1) of the

Government and non-government employees face mounting pressure during tax season. Consequently, many struggle with complex rules, manual errors, and tight deadlines for FY

Employers streamline Form 16 Part B preparation for FY 2025-26 using Excel automation. This approach ensures accuracy and compliance with Income Tax Department

Prepare at a time 50 Employees Form 16 Part A and B in Excel for FY 2025-26

Prepare at a time 50 Employees Form 16 Part A and B in Excel for FY 2025-26 Employers streamline tax compliance by generating

Prepare at a time 50 Employees Automatic Income Tax Form 16 Part B for FY 2025-26 in Excel

Preparing Automatic Income Tax Form 16 Part B for FY 2025-26 in Excel has become a priority for employers, accountants, and tax professionals.

Automatic Income Tax Preparation Software in Excel for Govt & Non-Govt Employees for FY 2025-26

Paying income tax often feels like carrying a heavy bag uphill. However, what if you could replace that burden with a smooth trolley?

Download and Prepare at a Time 50 Employees Form 16 in Excel for FY 2025–26

Firstly, preparing income tax documents accurately saves time and avoids future complications. Secondly, employers must issue Form 16 correctly to every employee before

Download and Prepare Automatic Form 16 in Excel for 50 Employees (FY 2025-26)

Issuing Form 16 can feel like packing 50 lunches at once, because one missing item slows everything down. Still, you can finish on

Prepare One by One Automatic Income Tax Form 16 for the FY 2025-26 in Excel

Preparing income tax documents often feels like walking through a maze, doesn’t it? However, when it comes to Form 16, clarity matters more

Prepare 50 Employees Form 16 Part B in Excel for FY 2025-26 – A Complete Step-by-Step Guide

Preparing income tax documents often feels like juggling too many balls at once. However, when you need to prepare Form 16 Part B

Download Automated Income Tax Form 16 Part B in Excel for AY 2025-26

Paying taxes is unavoidable. However, managing tax documents does not have to be stressful. In fact, it can be surprisingly simple. If you

Prepare at a Time Automatic Income Tax Computed Sheet for FY 2025-26

Let’s be honest—income tax preparation often feels like solving a puzzle with missing pieces. You sit with salary slips, allowances, exemptions, and forms,

Paying income tax often feels like solving a puzzle without the picture on the box, doesn’t it? However, what if you could simplify

Filing income tax often feels like solving a complex puzzle, doesn’t it? You sit with salary slips, deductions, exemptions, and multiple forms, yet

Have you ever received salary arrears and suddenly felt confused about your tax burden? If yes, you are not alone. In fact, many

Download Automatic Income Tax Arrears Relief Calculator U/s 89(1) in Excel (FY 2000-01 to 2025-26)

Have you ever received salary arrears and suddenly felt your tax burden jump like a surprise speed breaker on a smooth road? If

© Copyright 2023 All Rights Reserved by Pranabbanerjee.com