Have you ever wondered how to make the most of your Income Tax benefits each financial year? Whether you are a government or

Have you ever wondered how to make the most of your Income Tax benefits each financial year? Whether you are a government or

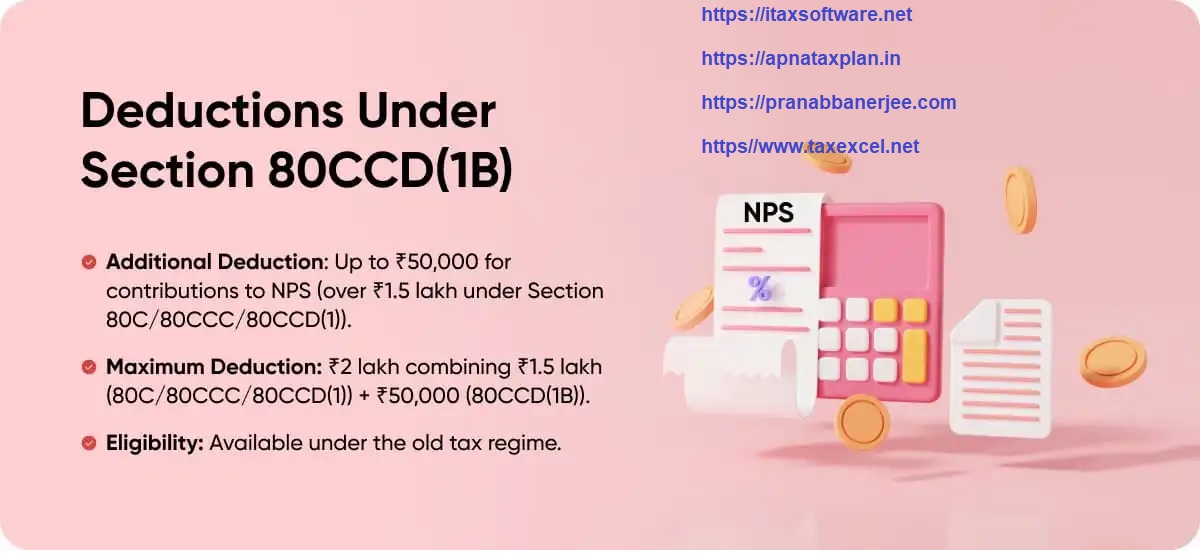

Introduction When it comes to saving taxes, every salaried employee—whether from the government or private sector—wants to make the most of available deductions.

Section 87A Tax Rebate Allowed on STCG in New Tax Regime – Relief for Salaried Taxpayers

Introduction If you’ve been confused about whether the Section 87A tax rebate applies to short-term capital gains (STCG) under the new tax regime,

Introduction When Budget 2025 was announced, the big question in everyone’s mind was this: “Which tax regime is better for me—Old or New?”

All taxpayers should opt for the New Tax Regime except the Old Tax Regime for F.Y.2025-26

All taxpayers should opt for the New Tax Regime except the Old Tax Regime for F.Y.2025-26 For the financial year (F.Y.) 2025-26, it

Choosing between the Old and New Tax Regime as per Budget 2025 feels a lot like choosing between two roads to your financial

Introduction Imagine earning a full year’s salary and not paying a single rupee in taxes. Sounds like a dream, right? Well, Budget 2025

Old Regime vs New Regime 2025: Which Tax Regime is Better for You?

Introduction The Union Budget 2025 completely reshaped India’s personal income tax landscape. Naturally, taxpayers across the country are wondering: “Should I continue with

Introduction The Union Budget 2025 has brought in some big updates for salaried employees that will take effect from April 1, 2025. These

What is Advance Tax? Deduction Process, Liability, and Penalties Explained

Introduction 1. Understanding Advance Tax Advance Tax, often called “Pay As You Earn”, is a way to pay your income tax in parts

Top Tax-Saving Investment Options Under Income Tax Section 80C for the Old Tax Regimes

Do you want to save more taxes and grow your money at the same time? You’re not alone. Most investors look for ways

Section 87A Tax Rebate Allowed on STCG in New Tax Regime – Relief for Salaried Taxpayers

Introduction If you’ve been confused about whether the Section 87A tax rebate applies to short-term capital gains (STCG) under the new tax regime,

Introduction Paying income tax is your duty, but does it always have to feel like a burden? Absolutely not! With the right strategies,

Have you ever wondered which tax regime saves you more money—the new or the old? As the Union Budget 2025 reshaped tax rules,

Introduction Do you sometimes feel that income tax looks like a maze with endless turns and confusing dead ends? If so, you’re definitely

Introduction Imagine a world where filing income tax no longer feels like solving a complicated puzzle. That’s exactly the vision behind Budget 2025,

Choosing the best tax regime for the Financial Year 2025-26 is one of the most important financial decisions for every taxpayer. Since the

New Income Tax Bill 2025: Replacing the 1961 Law – What Every Taxpayer Should Know

Have you ever felt confused while reading the old Income Tax Act of 1961? You’re not alone! With over 4000 amendments in six

Post Office MIS + RD Returns: Can You Really Earn 8.8%? The Truth Behind the Viral Claim

When social media says you can earn 8.8% returns from the Post Office MIS + RD combo, it sounds like a golden ticket,

Introduction Do you ever wonder why most taxpayers today prefer the new over the old? Think of it like choosing between a smartphone

© Copyright 2023 All Rights Reserved by Pranabbanerjee.com