Have you ever wondered how to make the most of your Income Tax benefits each financial year? Whether you are a government or non-government employee, understanding the tax-saving options available can make a real difference in your financial planning.

For the Assessment Year (A.Y.) 2026-27, which corresponds to Financial Year (F.Y.) 2025-26, the Income Tax Department offers several deductions, rebates, and exemptions. Therefore, to make this process easier, the Automatic Tax Calculator All-in-One for FY 2025-26 helps individuals and HUFs compute their tax liability in just a few clicks.

Let’s explore the major income tax benefits, understand who can claim them, and see how automation can simplify tax filing.

Table of Contents

ToggleTable of Contents

| Sr# | Headings |

| 1 | Understanding Income Tax for Individuals and HUFs |

| 2 | The Role of the Automatic Tax Calculator All-in-One |

| 3 | Old Tax Regime vs. New Tax Regime for FY 2025-26 |

| 4 | Key Income Tax Benefits for Individuals |

| 5 | Deductions under Section 80C |

| 6 | Additional Deduction under Section 80CCD(1B) |

| 7 | Health Insurance Deduction under Section 80D |

| 8 | Home Loan Benefits under Section 24(b) and 80EEA |

| 9 | Education Loan Interest under Section 80E |

| 10 | Rebate under Section 87A for FY 2025-26 |

| 11 | Tax Benefits for HUFs Explained |

| 12 | Exemption of Leave Travel Allowance (LTA) |

| 13 | Standard Deduction for Salaried Employees |

| 14 | Benefits of Using the Automatic Tax Calculator |

| 15 | Conclusion |

| 16 | FAQs |

Understanding Income Tax for Individuals and HUFs

Firstly, every taxpayer pays Income Tax to the government based on their annual income. Moreover, In other words, the government uses this tax to fund essential public services such as infrastructure, defence, and education. Furthermore, both Individuals and Hindu Undivided Families (HUFs) determine their tax liability depending on their income level, deductions claimed, and the chosen tax regime.

However, In simple terms, you gain income tax benefits as a reward for effective financial planning. Therefore, the more strategically you use deductions, the less tax you ultimately pay.

The Role of the Automatic Tax Calculator All-in-One

Next, the Automatic Tax Calculator All-in-One for FY 2025-26 acts as a user-friendly Excel-based tool that simplifies tax computation. It automatically calculates taxable income, applicable deductions, and final tax payable. Moreover, the tool eliminates manual errors, ensuring accuracy every time.

Furthermore, both government and non-government employees can use this calculator efficiently. Consequently, it saves time while guaranteeing precision. Think of it as your digital accountant — always ready, accurate, and efficient.

Old Tax Regime vs. New Tax Regime for FY 2025-26

The Government of India now allows taxpayers to choose between two tax regimes.

- The Old Tax Regime offers multiple deductions and exemptions.

- The New Tax Regime, however, features lower tax rates but fewer deductions.

Moreover, taxpayers can select whichever regime suits their financial goals best. For instance, if you invest heavily in insurance, provident fund (PF), or housing loans, the old regime may benefit you more. However, if you prefer simplicity and minimal documentation, the new regime can save you both time and effort.

Thus, choosing the right regime depends entirely on your income structure and investment pattern.

Key Income Tax Benefits for Individuals

The Government of India consistently encourages savings and investments through Income Tax benefits under various sections. Moreover, these benefits cover life insurance, health insurance, education loans, housing loans, and much more.

Furthermore, when you plan your finances wisely, you not only save a substantial portion of your income but also secure your family’s financial stability. Consequently, tax planning becomes both a strategic and protective measure.

Deductions under Section 80C

Section 80C remains the most popular deduction in the Income Tax Act. You can claim up to ₹1.5 lakh for investments in:

- Provident Fund (PF) and Public Provident Fund (PPF)

- Life Insurance Premiums

- Equity-Linked Savings Schemes (ELSS)

- Tuition Fees for Children

- Principal Repayment of Home Loan

Moreover, these investments not only reduce your taxable income but also promote long-term financial discipline. Therefore, Section 80C serves as the foundation of most taxpayers’ financial planning.

Additional Deduction under Section 80CCD(1B)

In addition to Section 80C, Section 80CCD(1B) provides an extra deduction of ₹50,000 for contributions to the National Pension System (NPS).

Furthermore, this section encourages individuals to build a retirement corpus while enjoying additional tax relief. Consequently, you can claim this deduction over and above the ₹1.5 lakh limit under Section 80C — making it a win-win option for long-term savers.

Health Insurance Deduction under Section 80D

Health truly is wealth, and the government recognizes its importance. Under Section 80D, you can claim deductions for health insurance premiums paid for:

- Self, spouse, and dependent children – up to ₹25,000

- Parents (senior citizens) – up to ₹50,000

Moreover, this deduction not only reduces your taxable income but also motivates you to protect your family’s health. Consequently, taxpayers benefit both financially and personally through this provision.

Home Loan Benefits under Sections 24(b) and 80EEA

Owning a home symbolises stability and growth. Under Section 24(b), you can claim a deduction up to ₹2 lakh on home loan interest. Moreover, Section 80EEA offers an additional deduction of ₹1.5 lakh for affordable housing loans sanctioned before March 31, 2026.

Therefore, this dual advantage not only reduces your tax liability but also supports your goal of homeownership. Consequently, it helps individuals fulfil a major life aspiration while enjoying tangible tax benefits.

Education Loan Interest under Section 80E

Education represents an investment in your future potential. Under Section 80E, you can claim a deduction on interest paid for education loans — for yourself, your spouse, or your children.

Furthermore, there is no upper limit on this deduction, and it is available for eight consecutive years. Thus, this provision eases the financial burden of higher education while promoting lifelong learning.

Rebate under Section 87A for FY 2025-26

If your total income is up to ₹7 lakh, you can claim a rebate of ₹25,000 under Section 87A (as per the new tax regime). Moreover, this rebate ensures that you pay zero tax if your income doesn’t exceed the limit.

In addition, consequently, the government effectively supports low and middle-income earners through this inclusive tax policy.

Tax Benefits for HUFs Explained

A Hindu Undivided Family (HUF) functions as a separate taxable entity under the Income Tax Act. It can own assets, earn income, and claim deductions independently. Moreover, this structure allows families to manage wealth collectively while optimising tax efficiency.

Some key Income Tax benefits for HUFs include:

- Deductions under Sections 80C, 80D, 80G, and 80TTA

- Tax-free gifts received from family members

- Income splitting between members to reduce total tax liability

Consequently, forming an HUF can be a powerful tax planning strategy that benefits the entire family.

Exemption of Leave Travel Allowance (LTA)

Employees can claim Leave Travel Allowance (LTA) for travel within India, provided they meet specified conditions. Moreover, this exemption can be claimed twice in a block of four years, allowing you to explore India while reducing your taxable income.

Thus, LTA combines recreation with tax advantage, making it one of the most appreciated Income Tax benefits for salaried individuals.

Standard Deduction for Salaried Employees

For instance, the standard deduction offers a flat ₹75,000 reduction from your salary income (as per Budget 2025). Moreover, it replaces multiple small exemptions, simplifying your overall tax computation process.

Furthermore, this straightforward deduction serves as a welcome relief for millions of employees. Therefore, it makes tax filing easier, quicker, and less stressful for every salaried taxpayer.

Benefits of Using the Automatic Tax Calculator

Above all, the Automatic Income Tax Calculator All-in-One for FY 2025-26 truly saves time, ensures accuracy, and simplifies computation.

Key Features Include:

- Predefined formulas for both old and new regimes

- Auto-updated tax slabs as per the latest Budget

- Simple deduction entry fields

- Automatic preparation of Form 10E

Moreover, this tool becomes an essential companion for government and non-government employees. Consequently, it helps you calculate your tax confidently without complicated formulas.

Likewise, using it feels like navigating with GPS instead of an old paper map — precise, efficient, and completely stress-free.

Conclusion

In conclusion, tax planning does not need to be complicated. With a clear understanding of Income Tax benefits and the assistance of the Automatic Tax Calculator All-in-One, you can optimise your savings for A.Y. 2026-27 (F.Y. 2025-26).

Moreover, whether you invest in NPS, purchase a home, or pay health insurance premiums, each action provides personal growth and financial rewards. Therefore, start planning early, stay informed, and let automation simplify your tax journey.

Finally, remember that smart tax planning today means financial freedom tomorrow.

FAQs

- What are the main Income Tax benefits available for FY 2025-26?

You can claim deductions under Sections 80C, 80D, 80E, 80CCD(1B), and 24(b). Moreover, you can enjoy a rebate under 87A and a standard deduction of ₹75,000. - Who can use the Automatic Tax Calculator All-in-One for FY 2025-26?

Both government and non-government employees can use this Excel-based calculator to compute income tax quickly and accurately. - Can HUFs claim the same deductions as individuals?

Yes. HUFs can claim deductions under Sections 80C, 80D, and 80G, and receive tax-free gifts from family members. Moreover, this helps minimise the total tax burden. - How does the standard deduction help salaried employees?

It automatically reduces taxable income by ₹75,000, simplifying tax computation and increasing savings. - Is it better to choose the old or the new tax regime for FY 2025-26?

It depends on your income and investments. Moreover, the old regime benefits those with multiple deductions, while the new regime favours those seeking simplicity and lower tax rates.

Download Automatic Income Tax Preparation Software All in One in Excel for Government and Non-Government Employees (F.Y. 2025-26)

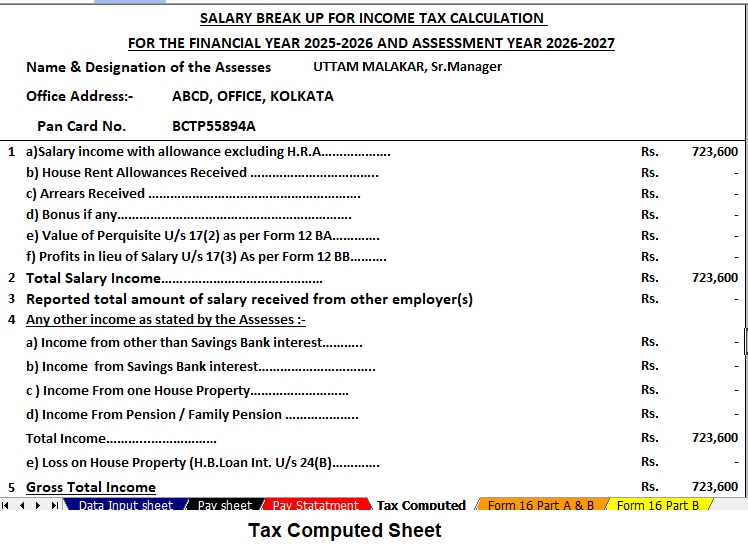

Now you can download the Automatic Income Tax Preparation Software All-in-One in Excel for both Government and Non-Government employees for the Financial Year 2025-26. This advanced Excel-based tool simplifies your tax computation, ensures accuracy, and keeps your data fully compliant with the latest Budget 2025 updates. Moreover, it automates every stage of your salary and tax preparation, saving you valuable time and effort.

Key Features of This Excel Utility

✅ Instantly Prepares Your Tax Computation Sheet as per Budget 2025

This software instantly generates your complete tax computation sheet in line with the latest Budget 2025 provisions. Consequently, your calculations always remain accurate and compliant with the current tax structure.

✅ Includes Inbuilt Salary Structures for Both Government and Non-Government Employees

It comes preloaded with ready-to-use salary structures, so you can quickly enter your income details without designing complex templates. Furthermore, this saves you from formatting hassles and data errors.

✅ Automatically Generates Your Salary Sheet

With just a few clicks, the utility creates your salary sheet automatically. Therefore, you can avoid manual data entry and eliminate formula mistakes effortlessly.

✅ Calculates HRA Exemption under Section 10(13A) Automatically

The tool accurately computes your HRA exemption based on your salary, rent paid, and city type, following Section 10(13A). Besides, it ensures each calculation aligns with the latest Income Tax Rules.

✅ Computes Income Tax Arrears Relief under Section 89(1) with Form 10E

It automatically calculates arrears relief and prepares Form 10E, helping you claim accurate relief under Section 89(1). In addition, it prevents common errors that usually occur during manual computation.

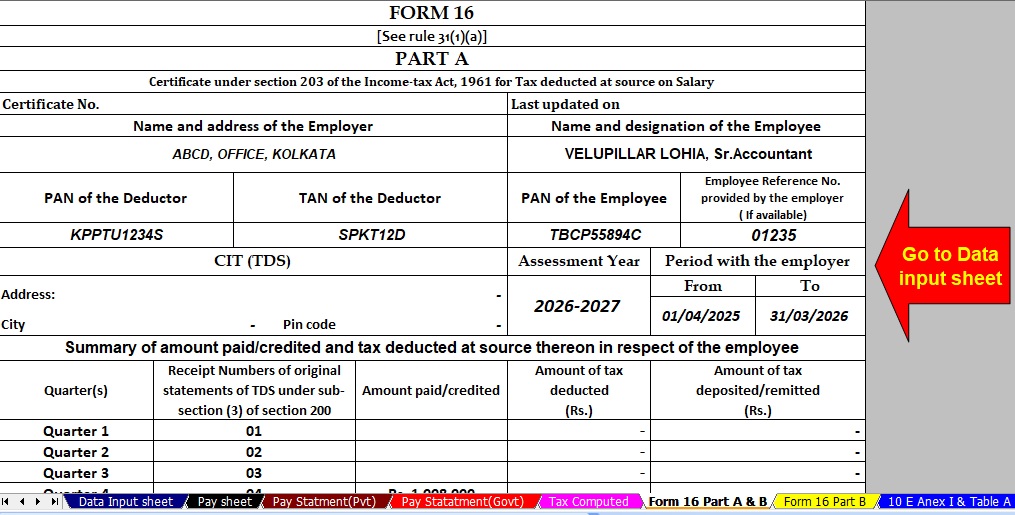

✅ Generates Form 16 Part A and Part B Automatically

The utility prepares both Part A and Part B of Form 16 with precision. Also, it helps employers and employees file returns easily and maintain compliance with Income Tax regulations.

✅ Creates Automatic Form 16 Part B Separately

Furthermore, it generates a standalone Form 16 Part B, ensuring your tax documentation is complete and ready for submission in minutes.

In Summary

The Automatic Income Tax Preparation Software All-in-One in Excel acts as your digital tax assistant for the F.Y. 2025-26. Thus, it streamlines your tax computation, enhances accuracy, and stays fully aligned with the latest Section 115BAC updates and Income Tax Rules. Finally, with automation at your fingertips, you can file taxes confidently, efficiently, and stress-free.