Do you want to save more taxes and grow your money at the same time? You’re not alone. Most investors look for ways to legally reduce their tax burden while still earning good returns. Luckily, Income Tax Section 80C for the Old Tax Regimes gives you a wide range of tax-saving investment options.

But here’s the catch—not all of them work the same way. Some give better returns, others offer more safety. So, how do you pick the right one for your goals?

Let’s simplify it. We’ll walk you through the best tax-saving investments under Section 80C, their returns, lock-in periods, risks, and how to mix them for maximum benefit.

Table of Contents

ToggleTable of Contents

| Sr# | Headings |

| 1 | What Is Section 80C of the Income Tax Act? |

| 2 | Who Can Claim Section 80C Deductions? |

| 3 | Key Limits and Subsections of Section 80C |

| 4 | Top Tax-Saving Investment Options Under 80C |

| 5 | ELSS (Equity-Linked Savings Scheme) |

| 6 | PPF (Public Provident Fund) |

| 7 | EPF (Employee Provident Fund) |

| 8 | SSY (Sukanya Samriddhi Yojana) |

| 9 | Tax-Saving Fixed Deposits (FDs) |

| 10 | NSC (National Savings Certificate) |

| 11 | Life Insurance Premiums |

| 12 | How to Choose the Right 80C Investment? |

| 13 | Short-Term vs Long-Term Planning |

| 14 | Safe vs Market-Linked Returns |

| 15 | Conclusion |

What Is Section 80C of the Income Tax Act?

Section 80C is a provision under the Income Tax Act, 1961, that allows individuals and Hindu Undivided Families (HUFs) to claim deductions up to ₹1.5 lakh every year on specific investments or expenses.

In simpler terms, if you invest in certain schemes, the government allows you to deduct up to ₹1.5 lakh from your taxable income, which lowers your overall tax liability.

Who Can Claim Section 80C Deductions?

Both individual taxpayers and HUFs can claim this deduction—but only if you are under the old tax regime. If you’ve chosen the new tax regime, most of these deductions won’t apply.

So before you invest, make sure you are opting for the old tax regime to enjoy Section 80C benefits.

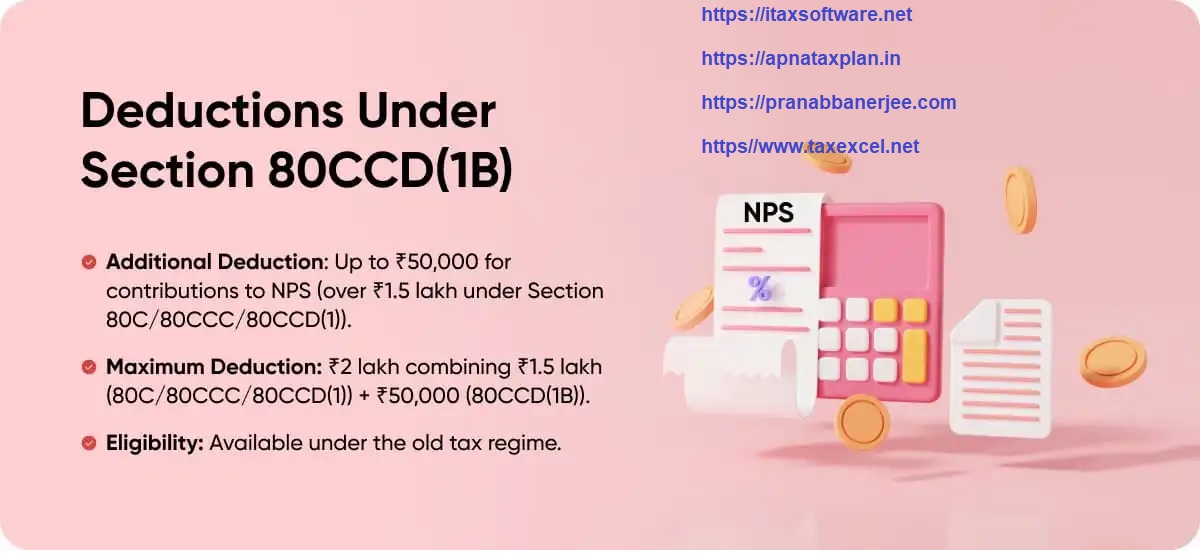

Key Limits and Subsections of Section 80C

Section 80C isn’t alone—it comes with related subsections. Here’s how they break down:

| Subsection | What It Covers | Limit |

| 80C | Investments like ELSS, PPF, EPF, and FDs | Up to ₹1.5 lakh |

| 80CCC | Pension policies | Included in the 80C limit |

| 80CCD(1) | Employee’s contribution to NPS | Part of ₹1.5 lakh |

| 80CCD(1B) | Additional NPS deduction | Extra ₹50,000 |

| 80CCD(2) | Employer’s NPS contribution | Over and above 80 °C |

Together, these offer a powerful way to save taxes while building wealth.

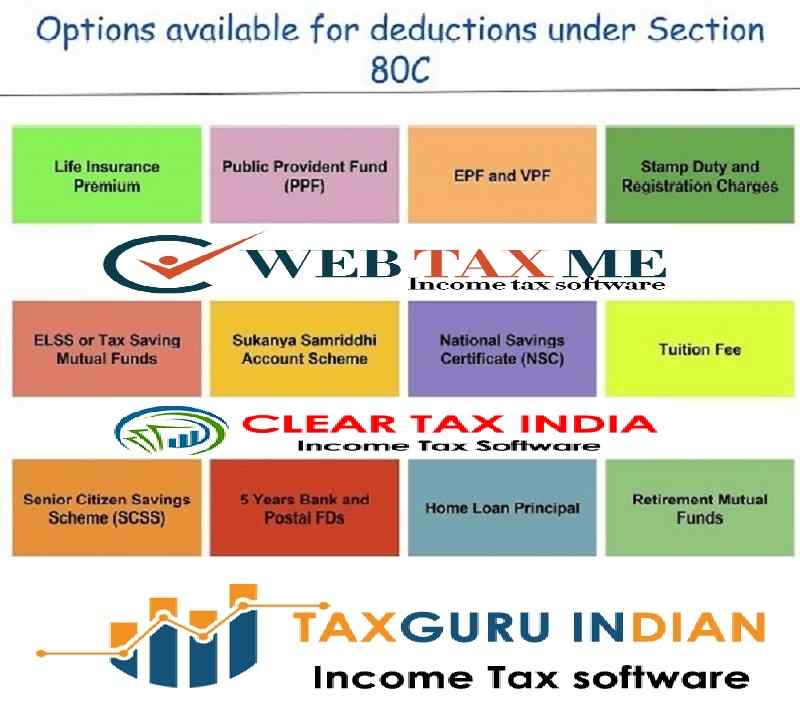

Top Tax-Saving Investment Options Under 80C

Let’s dive into the most popular Section 80C options that help you save taxes and earn returns.

ELSS (Equity-Linked Savings Scheme)

ELSS mutual funds are the only market-linked investment under Section 80C with a 3-year lock-in period—the shortest among all.

Why choose ELSS?

Because it can offer 10–15% returns, thanks to its 80% equity exposure.

If you’re okay with market ups and downs, ELSS can help you grow wealth faster than fixed-income options.

Key features:

- Returns: 10–15% (market-linked)

- Lock-in: 3 years

- Taxation: LTCG above ₹1 lakh taxed at 10%

- Ideal for: Growth-focused investors

PPF (Public Provident Fund)

PPF is one of the safest and most tax-friendly options under 80C. Backed by the government, it offers a fixed interest (7.1%), which is completely tax-free.

But remember, it comes with a 15-year lock-in—great for long-term goals.

Key features:

- Returns: 7.1% (fixed)

- Lock-in: 15 years

- Taxation: EEE (Exempt at all stages)

- Ideal for: Retirement, long-term savings

EPF (Employee Provident Fund)

Salaried employees automatically invest in EPF, with a part of their salary going into it. The employer also contributes.

EPF interest (currently ~8.25%) is tax-free if you withdraw after 5 years of continuous service.

Key features:

- Returns: ~8.25% (fixed)

- Lock-in: Till retirement/job change

- Taxation: EEE

- Ideal for: Salaried individuals

SSY (Sukanya Samriddhi Yojana)

Have a daughter under 10 years? Then this one’s for you.

SSY offers one of the highest fixed interest rates (8.2%), with full tax exemption.

You can invest till she turns 15, and the maturity is when she turns 21. Partial withdrawals are allowed for education after age 18.

Key features:

- Returns: ~8.2% (fixed)

- Lock-in: Until she turns 21

- Taxation: EEE

- Ideal for: Parents of girl children

Tax-Saving Fixed Deposits (FDs)

Tax-saving FDs are like regular FDs but with a 5-year lock-in and no early withdrawal.

Returns range from 6.5%–7.5%, but interest is taxable.

Key features:

- Returns: 6.5%–7.5%

- Lock-in: 5 years

- Taxation: EET (Interest is taxable)

- Ideal for: Conservative investors

NSC (National Savings Certificate)

NSC is a safe, post office-backed scheme with a 5-year term.

Interest (~7.7%) is compounded yearly but paid at maturity. The interest earned (except for the last year) is also eligible for 80C deduction.

Key features:

- Returns: ~7.7% (fixed)

- Lock-in: 5 years

- Taxation: EET

- Ideal for: Low-risk investors

Life Insurance Premiums

Life insurance protects your family financially and also gives you Section 80C benefits.

But don’t confuse it with investment—it’s primarily for protection. Only policies with a sum assured ≥10x of annual premium qualify for full deduction.

Key features:

- Returns: 2–6% (depends on policy)

- Lock-in: 5 years or as per policy

- Taxation: EEE

- Ideal for: Family protection

How to Choose the Right 80C Investment?

Ask yourself:

- Do I want guaranteed returns or higher growth?

- How soon will I need the money?

- How much risk am I okay with?

Then mix your investments accordingly.

For example:

- ELSS (growth + short lock-in)

- PPF (long-term + safety)

- Life insurance (protection + tax saving)

Short-Term vs Long-Term Planning

If your goal is short-term, like 3–5 years:

- Pick ELSS or tax-saving FDs

- They offer liquidity and moderate returns