Do you ever wonder how to reduce your Income Tax burden while staying compliant with the law? For most salaried individuals, understanding tax deductions under Chapter 6A can feel like decoding a complex puzzle. However, with modern tools like Automatic Income Tax Preparation Software/Calculator, the entire process becomes as easy as clicking a button.

Think of Chapter 6A as your financial umbrella—it shields your income from excess tax by allowing specific deductions. In this article, we’ll explore these deductions in depth, understand how they work, and see how technology can simplify your tax calculations for the Financial Year 2025-26.

Table of Contents

ToggleTable of Contents

| Sr# | Headings |

| 1 | Understanding Income Tax Deductions under Chapter 6A |

| 2 | Importance of Chapter 6A for Salaried Employees |

| 3 | Major Sections under Chapter 6A |

| 4 | Section 80C – Popular Investment-Based Deduction |

| 5 | Section 80CCC and 80CCD – Pension and NPS Contributions |

| 6 | Section 80D – Health Insurance Premium Deductions |

| 7 | Section 80E – Interest on Education Loan |

| 8 | Section 80G – Donations to Charitable Institutions |

| 9 | Section 80TTA and 80TTB – Savings and Senior Citizen Interest Deductions |

| 10 | Section 80U – Deductions for Disabled Persons |

| 11 | How Automatic Income Tax Preparation Software Helps |

| 12 | Step-by-Step: Using the Excel-Based Tax Calculator |

| 13 | Benefits of Using an Automatic Tax Software |

| 14 | Common Mistakes to Avoid During Tax Filing |

| 15 | Conclusion and Final Thoughts |

Understanding Income Tax Deductions under Chapter 6A

Chapter 6A of the Income Tax Act truly acts as a treasure chest of tax-saving opportunities. It includes several sections that allow taxpayers to claim deductions from their gross total income, thus helping them pay only what’s fair.

Moreover, these deductions promote financial discipline; in addition, they encourage individuals to invest in insurance, health, education, and savings. Consequently, taxpayers benefit both immediately and in the long run. Furthermore, Chapter 6A inspires responsible spending habits while also building a culture of financial awareness. Ultimately, it empowers citizens to take full control of their Income Tax liabilities.

Importance of Chapter 6A for Salaried Employees

For salaried employees, every rupee saved matters greatly. Chapter 6A plays a crucial role because it directly reduces taxable income. Additionally, it offers practical relief by lowering the total tax outgo. Likewise, employees gain higher take-home pay and achieve financial stability.

Furthermore, by claiming these deductions, employees secure their future through various investment and insurance schemes. Consequently, they build wealth while staying compliant with the law. Besides, this chapter encourages consistent financial planning and motivates workers to think beyond immediate savings.

Major Sections under Chapter 6A

This chapter covers multiple sections—80C, 80CCC, 80CCD, 80D, 80E, 80G, 80TTA, 80TTB, and 80U—each serving a distinct purpose. Collectively, these sections allow taxpayers to claim deductions across diverse investments and expenses.

Furthermore, they provide flexibility; similarly, they reward proactive investment behaviour. Therefore, taxpayers can easily align their goals with legal tax-saving provisions. In essence, Chapter 6A bridges the gap between income generation and responsible spending.

Section 80C – Popular Investment-Based Deduction

Without a doubt, Section 80C remains the most widely used deduction. It allows individuals to claim up to ₹1,50,000 for investments in instruments like:

- Life Insurance Premiums

- Public Provident Fund (PPF)

- Employee Provident Fund (EPF)

- Equity Linked Savings Scheme (ELSS)

- 5-year Fixed Deposit

Moreover, by investing wisely, taxpayers not only save on Income Tax but also create long-term financial security. Additionally, this section motivates people to adopt saving habits early in their careers. Consequently, they develop financial discipline that lasts a lifetime.

Section 80CCC and 80CCD – Pension and NPS Contributions

Both Section 80CCC and Section 80CCD encourage taxpayers to plan for retirement.

- Section 80CCC allows deductions for contributions to annuity pension plans.

- Section 80CCD(1B) provides an additional deduction of ₹50,000 for National Pension System (NPS)

Furthermore, by investing in NPS, individuals save taxes today and secure pensions for tomorrow. Hence, these provisions ensure financial comfort during retirement. Moreover, they build a habit of consistent saving and foster financial independence.

Section 80D – Health Insurance Premium Deductions

Health is indeed wealth, and the government rewards those who protect it. Under Section 80D, taxpayers can claim deductions for premiums paid toward medical insurance for themselves, their families, and their parents.

You can easily claim a deduction of up to ₹25,000 for yourself, your spouse, and your children. Moreover, this benefit directly reduces your taxable income and, consequently, lowers your overall tax burden.

Additionally, you can claim an extra ₹50,000 for senior citizen parents. Therefore, not only do you save tax, but you also gain peace of mind regarding healthcare expenses. Ultimately, this section reinforces financial security and promotes health awareness.

Section 80E – Interest on Education Loan

Education empowers individuals, and Section 80E supports this principle. It allows deductions for the interest paid on education loans for higher studies. Furthermore, this deduction has no upper limit, offering huge relief to families.

Additionally, by claiming it, taxpayers invest in future opportunities while reducing their present tax liability. Consequently, education becomes both affordable and aspirational.

Section 80G – Donations to Charitable Institutions

Generosity not only uplifts others but also reduces tax liability. Under Section 80G, taxpayers can claim deductions for donations to approved charitable organisations.

Moreover, depending on the institution, they receive a deduction ranging from 50% to 100% of the donated amount. Consequently, this provision encourages social responsibility and builds a more compassionate society. Likewise, it connects financial well-being with community welfare.

Section 80TTA and 80TTB – Savings and Senior Citizen Interest Deductions

Interest from savings accounts may seem minor, yet it adds up significantly. Section 80TTA permits individuals to claim up to ₹10,000 as a deduction on interest from savings accounts.

For senior citizens, Section 80TTB enhances this benefit to ₹50,000. Moreover, these provisions reward consistent savers and protect retirees from inflation. Therefore, taxpayers retain more income while building a safety net for the future.

Section 80U – Deductions for Disabled Persons

This section empowers differently-abled individuals by offering fixed deductions based on the severity of their disability:

- ₹75,000 for normal disability

- ₹1,25,000 for severe disability

Furthermore, it supports equality and reduces their financial challenges. Consequently, it creates a fairer tax system that honours inclusivity and social justice.

How Automatic Income Tax Preparation Software Helps

Manual tax computation feels like walking through a maze. However, the Automatic Income Tax Preparation Software simplifies this entire process. It calculates deductions, applies tax slabs, and even completes Form 10E automatically.

Moreover, it reduces errors, saves time, and ensures compliance with updated tax rules. Consequently, taxpayers gain confidence while filing returns accurately.

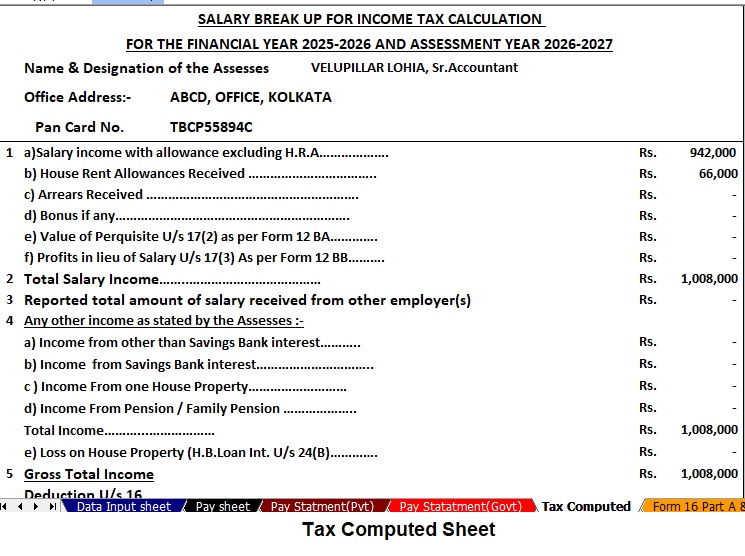

Step-by-Step: Using the Excel-Based Tax Calculator

- Download the Excel-based software designed for FY 2025–26.

- Enter salary details, allowances, and deductions.

- Input investments under various Chapter 6A

- Review the auto-calculated tax liability with the summary sheet.

Moreover, the calculator provides transparent results and removes manual errors. Hence, it makes tax filing quick, precise, and reliable.

Benefits of Using an Automatic Tax Software

Using this automated software offers numerous benefits:

- Saves time and effort

- Ensures accuracy

- Minimizes mistakes

- Facilitates future planning

- Generates printable reports

Additionally, it acts as your personal tax assistant—available 24/7. Consequently, you file taxes faster, avoid stress, and plan investments wisely.

Common Mistakes to Avoid During Tax Filing

Even minor mistakes can cost you dearly. Avoid these:

- Failing to declare all income sources

- Misreporting deductions

- Ignoring Form 10E submission

- Missing deadlines

Therefore, always double-check entries. Furthermore, cross-verify all figures before submission to prevent penalties.

Conclusion and Final Thoughts

In conclusion, Chapter 6A deductions truly serve as the cornerstone of smart tax planning for salaried employees. Moreover, when you pair them with Automatic Income Tax Preparation Software, tax filing becomes effortless, efficient, and accurate.

Therefore, remember—Income Tax planning isn’t about evasion; it’s about precision. So, start today: download the Excel-based calculator, enter your details, and take control of your Income Tax for FY 2025–26.

FAQs

- What is Chapter 6A under the Income Tax Act?

Chapter 6A lists sections that allow various tax deductions on investments, insurance, donations, and other eligible expenses. - Can I use Automatic Income Tax Software for multiple years?

Yes, most Excel-based calculators are updated yearly and can be reused by changing the financial year. - Is the NPS contribution under Section 80CCD(1B) different from 80C?

Yes. It offers an additional deduction of ₹50,000 over and above the ₹1,50,000 limit under Section 80C. - How does the software handle Form 10E?

Automatic Income Tax Software can auto-fill Form 10E details if arrears or relief under Section 89(1) are applicable. - When is the deadline to file Income Tax for FY 2025-26?

The last date for filing returns without late fees is generally 31st July 2026, unless extended by the government.

Download Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) for Government and Non-Government Employees

Key Features of the Excel-Based Tax Preparation Utility

- Dual Regime Option:

You can easily choose between the New or Old Tax Regime under Section 115BAC. Moreover, the software automatically compares both regimes, identifies the most beneficial one, and instantly displays the tax-saving difference. Hence, you can confidently select the regime that best suits your income structure. - Customised Salary Structure:

The software automatically adjusts to your specific salary format, whether you work in a Government or Non-Government organisation. Furthermore, it customises all components, minimises manual entry, and significantly saves time. As a result, you experience smooth and accurate salary-based tax computation. - Automatic Arrears Relief Calculator [Section 89(1) + Form 10E]:

The system precisely calculates arrears relief for financial years from 2000–01 to 2025–26. Additionally, it instantly prepares Form 10E for submission, guaranteeing flawless compliance. Consequently, you receive accurate relief computations without tedious manual calculations. - Updated Form 16 (Part A & B):

The utility automatically generates Revised Form 16 (Part A & B) for FY 2025–26. Likewise, it keeps your Form 16 aligned with the latest tax rules and formats. Therefore, you can seamlessly download and print your tax forms without errors or outdated information. - Simplified Compliance:

This advanced tool ensures quick and error-free tax computation through smart in-built formulas. In addition, you can confidently file your return with zero manual intervention, ensuring both accuracy and speed. Ultimately, it simplifies the entire compliance process, making tax filing effortless and reliable.