Introduction to Income Tax Arrears Relief U/s 89(1)

- You start saving tax effectively when you understand the arrears rules under Section 89(1).

- You use Form 10E to claim relief in the correct financial year.

- You reduce unnecessary tax burden when you calculate your arrears properly.

- You prevent mistakes by using an automatic income tax arrears relief calculator U/s 89(1).

- You make filing easier when you follow the step-by-step method.

- You avoid confusion by learning how arrears impact your taxable income.

- You benefit more when you compute relief before filing your ITR.

- You handle salary arrears more confidently through automation.

- You simplify calculations when you input correct figures in the calculator.

- You ensure accuracy when you use a trusted and updated tool for FY 2025-26.

- You follow tax rules better when you understand each component of arrears.

- You claim your relief correctly when you follow the Income Tax Act provisions.

- You save time when you avoid manual calculations for U/s 89(1).

- You reduce errors by relying on pre-programmed formulas.

- You increase compliance when you maintain proper documentation.

- You stay confident because the software guides you step by step.

- You minimise stress when your arrears computation becomes automatic.

- You submit Form 10E easily once your arrears relief is calculated.

- You use transitional expressions like “firstly” to move smoothly through each concept.

- You quickly recognise that relief U/s 89(1) prevents excess taxation on salary arrears.

Why Salary Arrears Occur

- You receive arrears when your employer revises your salary.

- You also receive arrears when promotions take effect late.

- You receive arrears when increments get delayed.

- You may get arrears due to revised pay commissions.

- You encounter arrears because organisations regularise old payments.

- You get arrears when court orders require retrospective pay changes.

- You see arrears added to your income even when they belong to earlier years.

- You pay more tax unintentionally when arrears push you into a higher slab.

- You mitigate excess tax using Section 89(1).

- You compare tax payable with and without arrears to compute the relief.

- You understand better how arrears distort your actual tax liability.

- You correct this distortion through the relief mechanism.

- You avoid overpayment because the law protects your income structure.

- You appreciate that Section 89(1) exists for fairness.

- You gain clarity as soon as the automatic arrears calculator computes differences.

- You proceed confidently because the calculator simplifies multi-year comparisons.

- You avoid confusion when the software separates income year-wise.

- You follow the instructions because the tool guides you through each step.

- You accept that arrears need accurate distribution across past years.

- You use the calculator to perform this distribution accurately.

Importance of Using an Automatic Arrears Relief Calculator

- You save a significant amount of time when automation performs lengthy calculations.

- You avoid mathematical errors because formulas are built in.

- You follow standardised rules consistently through the calculator.

- You ensure compliance with the latest FY 2024-25 tax slabs.

- You benefit from quick results that help you file Form 10E faster.

- You eliminate guesswork in computing past-year tax liability.

- You avoid misreporting because the calculator validates your inputs.

- You improve accuracy through automatic tax-slab application.

- You enhance reliability since the tool updates slabs automatically.

- You trust the results because they match Income Tax Department expectations.

- You increase confidence when filing your ITR.

- You move ahead quickly using the built-in features.

- You simplify the entire relief process with digital tools.

- You avoid penalties by submitting correct arrears data.

- You stay organised because the calculator structures your calculations cleanly.

- You maintain proper records since the calculator often generates printable reports.

- You complete Form 10E faster with readily available values.

- You experience smoother filing because all figures are ready.

- You free yourself from complex year-wise tax comparisons.

- You rely on the tool because it applies all tax rules automatically.

Understanding Section 89(1) in Simple Terms

- You understand Section 89(1) better when you know its purpose.

- You apply it when arrears change your tax slab unfairly.

- You calculate relief by comparing the tax payable with and without arrears.

- You see the difference clearly when using the calculator.

- You notice that the relief refunds only the excess tax burden.

- You calculate relief only for arrears of previous years.

- You learn that relief depends on old tax slabs.

- You understand that old slabs reduce excessive tax.

- You realise relief does not apply automatically; you must claim it.

- You claim relief by filing Form 10E online.

- You must complete Form 10E before filing your ITR.

- You follow rules strictly because the Income Tax Department verifies details.

- You avoid ITR processing issues by filing Form 10E on time.

- You ensure smooth processing when you submit accurate figures.

- You appreciate how simple the process becomes with automation.

- You move forward logically through each step the calculator provides.

- You complete the computation faster than manual methods.

- You stay compliant with legal procedures.

- You understand each step because the tool explains the required data.

- You appreciate Section 89(1) once you see your tax relief amount clearly.

Role of Form 10E in Claiming Relief

- You must file Form 10E to claim arrears relief successfully.

- You submit this form through the Income Tax e-filing portal.

- You provide details of the salary received in advance or arrears.

- You also specify year-wise breakups.

- You use the calculator-generated values to fill the form correctly.

- You ensure accuracy when you match figures carefully.

- You avoid discrepancies by following calculator results strictly.

- You include all affected years in the form.

- You review your details before submission.

- You verify tax amounts with and without arrears.

- You attach nothing physically because the portal stores your form digitally.

- You must complete Form 10E before submitting ITR.

- You avoid processing delays by filing on time.

- You make your filing easier when you rely on accurate digital tools.

- You maintain compliance with Income Tax rules.

- You upload your return confidently after submitting the form.

- You avoid mismatches because calculations are already precise.

- You improve filing accuracy with reliable data.

- You streamline your tax process through automation.

- You follow the sequence correctly to receive your relief.

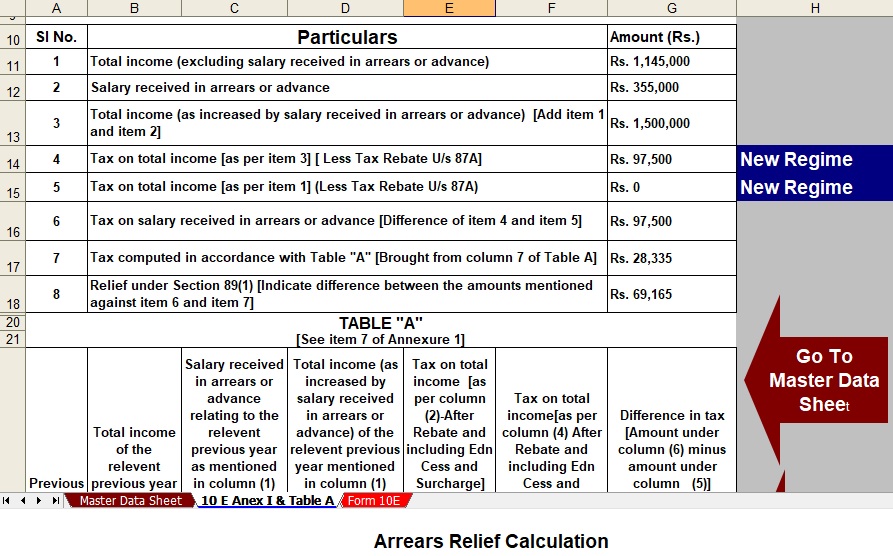

How the Automatic Calculator Works

- You enter your salary arrears in the calculator.

- You enter the year to which the arrears belong.

- You also enter your income for those previous years.

- You input the tax paid for those years.

- You allow the calculator to apply past tax slabs automatically.

- You generate tax liability with arrears.

- You also generate tax liability without arrears.

- You compare both values instantly.

- You find the difference automatically.

- You treat the difference as relief U/s 89(1).

- You receive the final relief amount instantly.

- You use it while filing Form 10E.

- You make corrections easily if figures change.

- You depend on the calculator for accurate year-wise distribution.

- You match software results with your pay records.

- You trust the automated comparison process.

- You appreciate the clarity of the relief amount.

- You see how easily the entire process becomes manageable.

- You finalise details without stress.

- You proceed confidently to the Form 10E page.

Benefits of Using the Calculator for FY 2025-26

- You save time during tax season.

- You avoid guesswork in complex arrears calculations.

- You get correct relief because the software uses updated slabs.

- You reduce errors drastically.

- You enjoy smooth ITR filing.

- You stay compliant with tax regulations.

- You get clarity about actual tax savings.

- You benefit from modern digital tax tools.

- You proceed step by step with ease.

- You access clear instructions directly in the tool.

- You avoid confusion by following guided inputs.

- You calculate relief for multiple years quickly.

- You prevent miscalculations effectively.

- You handle complicated cases more easily.

- You enter the correct basic pay, arrears, and year details.

- You rely on the tool because it handles all arithmetic.

- You get accurate totals each time.

- You maintain consistency across records.

- You avoid manual mistakes entirely.

- You trust the calculator for reliability.

Detailed Steps for Calculating Relief

- You begin by gathering salary arrears information.

- You check your pay slips for arrear amounts.

- You identify the years to which the arrears belong.

- You note your income in those years.

- You collect tax paid during earlier years.

- You enter these details in the calculator.

- You follow the tool’s guidance carefully.

- You generate tax for the current year, including arrears.

- You generate tax for the earlier year,s excluding arrears.

- You compare the two values.

- You compute the difference automatically.

- You treat that difference as relief under Section 89(1).

- You record the final relief amount.

- You use this figure while filing Form 10E.

- You ensure consistency between your records and calculator values.

- You verify old income details again.

- You update incorrect inputs when necessary.

- You finalise the computed amount confidently.

- You complete the process without any complex calculations.

- You keep the generated report safely.

- You use it during the ITR filing stage.

- You proceed to the e-filing portal easily.

- You enter details in Form 10E precisely.

- You confirm your entries before submission.

- You avoid mismatches during processing.

- You achieve a smooth filing experience.

- You received tax relief successfully.

- You complete the entire process quickly.

- You feel satisfied with the outcome.

- You appreciate how effortlessly the automatic calculator simplifies the calculation.

Download Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the FY 2000-01 to FY 2025-26[Update Version]

Post Views: 149