Table of Contents

ToggleIntroduction

Filing income tax returns can feel like solving a jigsaw puzzle with missing pieces. But what if you had a smart Excel tool that does it all for you—fast, accurate, and stress-free? Welcome to the world of automatic income tax preparation software in Excel for the financial year 2025-26. Whether you’re a salaried professional, a retiree, or a first-time taxpayer, this software is like having a personal accountant inside your computer. Let’s explore how this handy Excel tool can make tax filing a breeze.

Table of Contents

| Sr# | Headings |

| 1 | What Is Automatic Income Tax Preparation Software in Excel? |

| 2 | Why Choose Excel-Based Tax Software? |

| 3 | Who Can Use It? |

| 4 | Key Features of the Software |

| 5 | How It Works Step-by-Step |

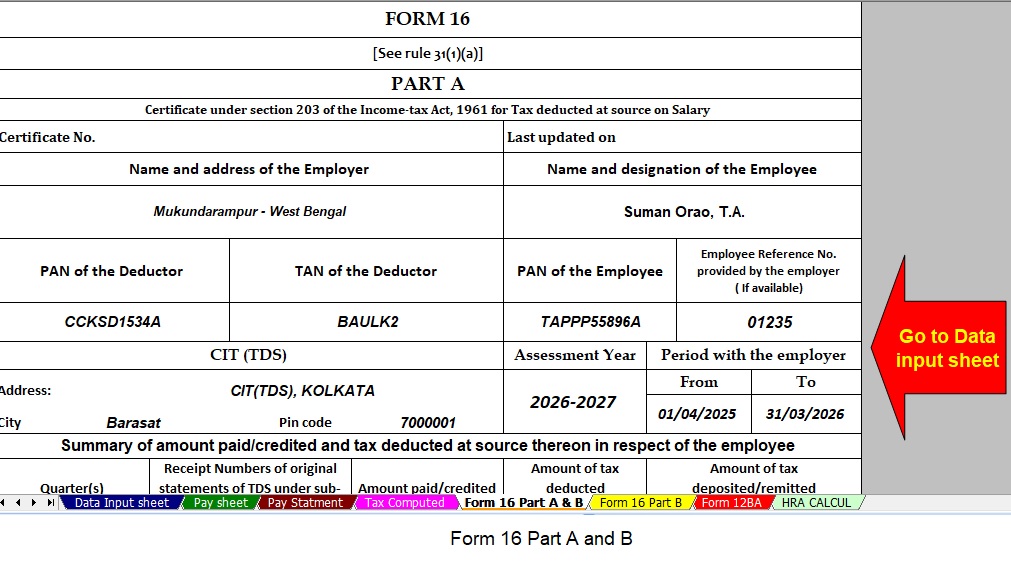

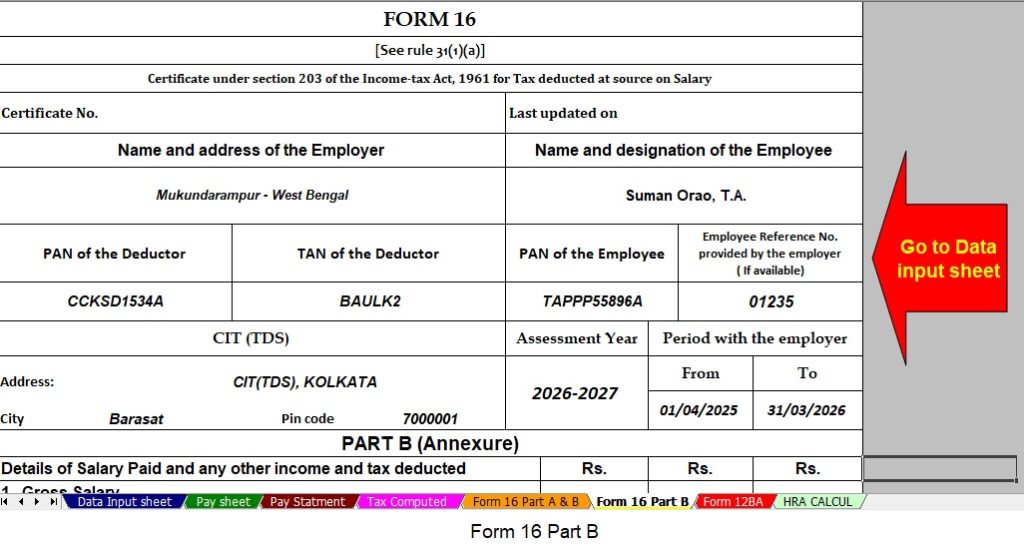

| 6 | Compatibility with Form 16 |

| 7 | Supports Old and New Tax Regimes |

| 8 | Tax Calculation Made Easy |

| 9 | Automatic Form 10E and Section 89(1) Relief |

| 10 | Accuracy and Error Reduction |

| 11 | Cost-Effective and Time-Saving |

| 12 | How to Download and Install |

| 13 | Data Privacy and Security |

| 14 | Real-Life Scenarios and Use Cases |

| 15 | Conclusion and Final Thoughts |

1. What Is Automatic Income Tax Preparation Software in Excel?

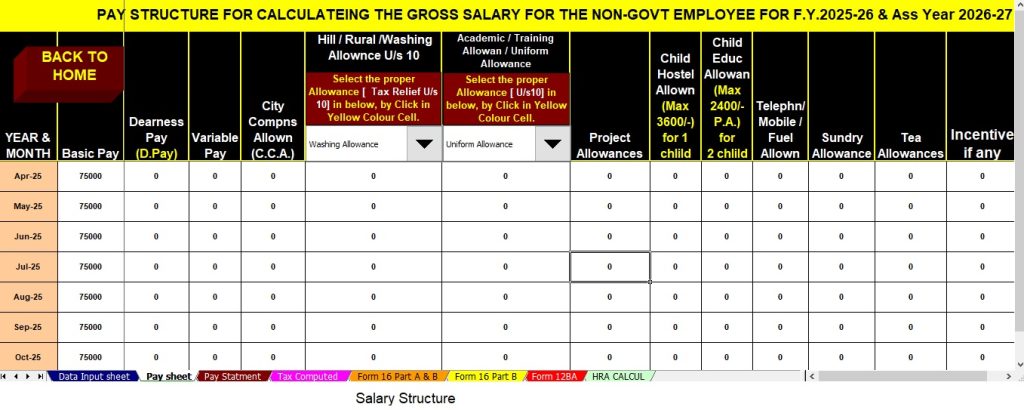

Automatic income tax preparation software in Excel is a smart spreadsheet template that calculates your taxes automatically. It’s built with formulas and macros to compute income, deductions, rebates, and final tax liability. Think of it as an intelligent calculator that understands tax rules.

2. Why Choose Excel-Based Tax Software?

You might wonder—why Excel? Well, Excel is familiar, flexible, and widely used. Unlike complicated web platforms, Excel is accessible even offline and doesn’t require a login or internet. It’s like using a notepad with a brain!

3. Who Can Use It?

This software is tailored for:

- Salaried individuals

- Government and Non-Government employees

- Pensioners and senior citizens

- Even small freelancers with fixed income can use it.

If your income sources are straightforward, this is perfect for you.

4. Key Features of the Software

Here’s what makes it stand out:

- Auto-filled Form 16 data

- Section-wise deductions (80C, 80D, 80G, etc.)

- Tax calculation under both regimes

- Automatic generation of Form 10E

- User-friendly interface

It’s like a Swiss Army knife for your taxes.

5. How It Works Step-by-Step

Here’s the simple process:

- Open the Excel file

- Enter your basic details and income

- Fill in deductions and HRA if applicable

- Choose your tax regime

- Let the sheet do the math

All tax figures, including total taxable income and payable tax, appear instantly.

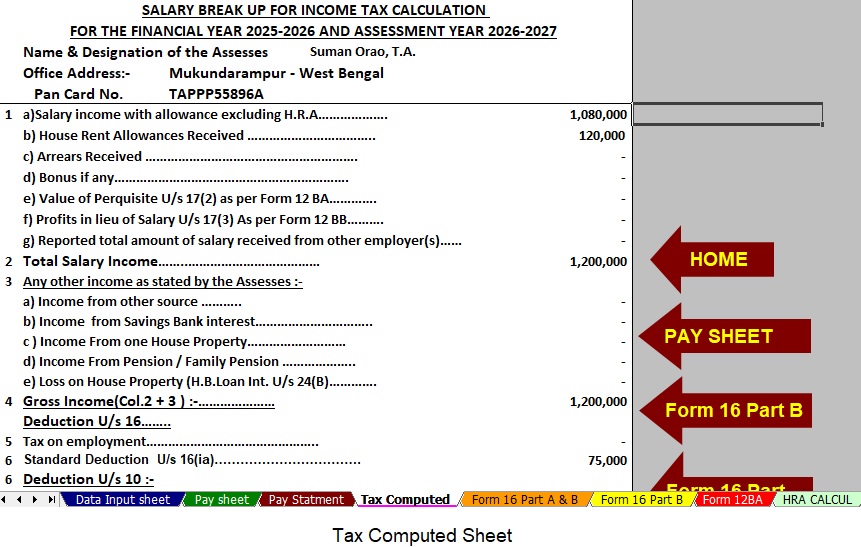

6. Compatibility with Form 16

The software is designed to match the structure of Form 16 issued by employers. Just plug in the values from your Form 16 and the rest is automated. It even breaks down salary components just like your official statement.

7. Supports Old and New Tax Regimes

Still confused between the old tax regime and the new one? No problem. The software calculates tax for both and shows you a comparison. You can decide which one saves you more money.

8. Tax Calculation Made Easy

Forget online calculators that need inputs one by one. This Excel software auto-calculates:

- Gross income

- Deductions under Chapter VI-A

- Net taxable income

- Tax liability

- Rebate under section 87A (if eligible)

All in a single view.

9. Automatic Form 10E and Section 89(1) Relief

If you’ve received arrears of salary, you’ll need Form 10E for tax relief under Section 89(1). This tool includes that too. You just input previous years’ data, and it computes the relief amount automatically.

10. Accuracy and Error Reduction

Manual calculation errors are common and risky. This software reduces errors using built-in logic and cross-check formulas. Like a spell-check for your taxes, it warns you if something looks off.

11. Cost-Effective and Time-Saving

Why pay ₹500–₹1000 to a tax consultant when you can do it yourself in 15 minutes? That’s what makes this Excel tool popular—it saves both money and time.

12. How to Download and Install

Usually available on tax advisory websites or financial forums, downloading is simple:

- Click the download link

- Open the

.xlsxfile - Enable macros (if needed)

- Start using

No installation or registration required.

13. Data Privacy and Security

Unlike online tools, Excel works offline, keeping your data private. You’re not uploading your salary details to unknown servers. Your financial info stays in your hands.

14. Real-Life Scenarios and Use Cases

Let’s say you’re a private school teacher with HRA, LIC premiums, and PPF investments. You simply input those details, and the software shows:

- Total deductions

- Best tax regime

- Refund or dues

This is also helpful for retirees and small business owners with fixed incomes.

15. Conclusion and Final Thoughts

In a world where taxes are getting more digital and complex, the automatic income tax preparation software in Excel for FY 2025-26 gives you simplicity, accuracy, and control. It’s affordable, user-friendly, and tailor-made for common taxpayers. Think of it as your digital tax buddy—always ready to help, never asking for a fee.

FAQs

1. Can this Excel-based software be used for business income too?

No, this is ideal for salaried individuals and pensioners. Business incomes may need professional help or ITR-3/ITR-4 forms.

2. Is this software compatible with Mac computers?

Yes, as long as you have Excel installed with macro support. Some features may vary slightly.

3. Does the software file ITRs online?

No, it helps prepare your data. You’ll need to log in to the income tax e-filing portal and upload the ITR yourself.

4. Can I use it for multiple people or only one PAN?

You can use it for multiple PANs. Just save different copies for each individual’s data.

Let your tax season this year be stress-free with the power of automatic income tax preparation software in Excel. It’s like putting your tax process on autopilot.

Download Automatic Income Tax Preparation Software All in One in Excel for the FY 2025-26