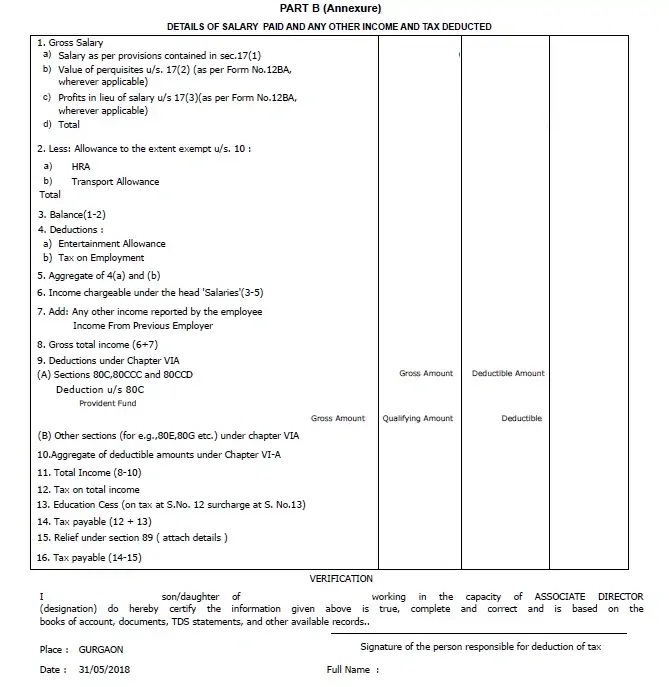

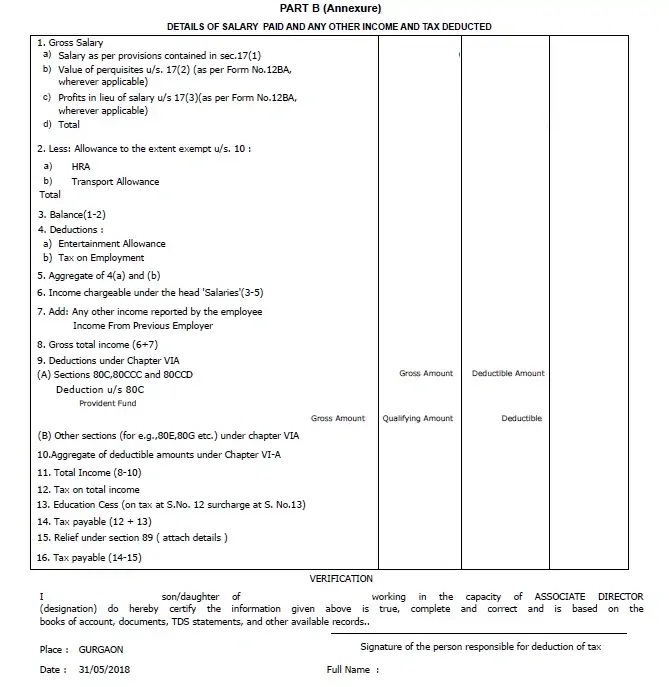

Download Automatic Form 16 Part A and B in Excel for Salaried Employees for FY 2025-26 & AY 2026-27

Income tax feels confusing, right? However, Form 16 makes life easier. In fact, it works like a report card for your salary and

Download Automatic Form 16 Part A and B in Excel for Salaried Employees for FY 2025-26 & AY 2026-27

Income tax feels confusing, right? However, Form 16 makes life easier. In fact, it works like a report card for your salary and

Download and Prepare at a Time 50 Employees Form 16 Part B for FY 2025-26

Have you ever wished that preparing Form 16 for a large team could be easier? Usually, issuing Form 16 can feel like packing

All-in-One Tax Calculator in Excel Download for FY 2025-26

Have you ever wished a simple tool could calculate your income tax without confusion? Now, the solution exists. The All-in-One Income Tax Calculator

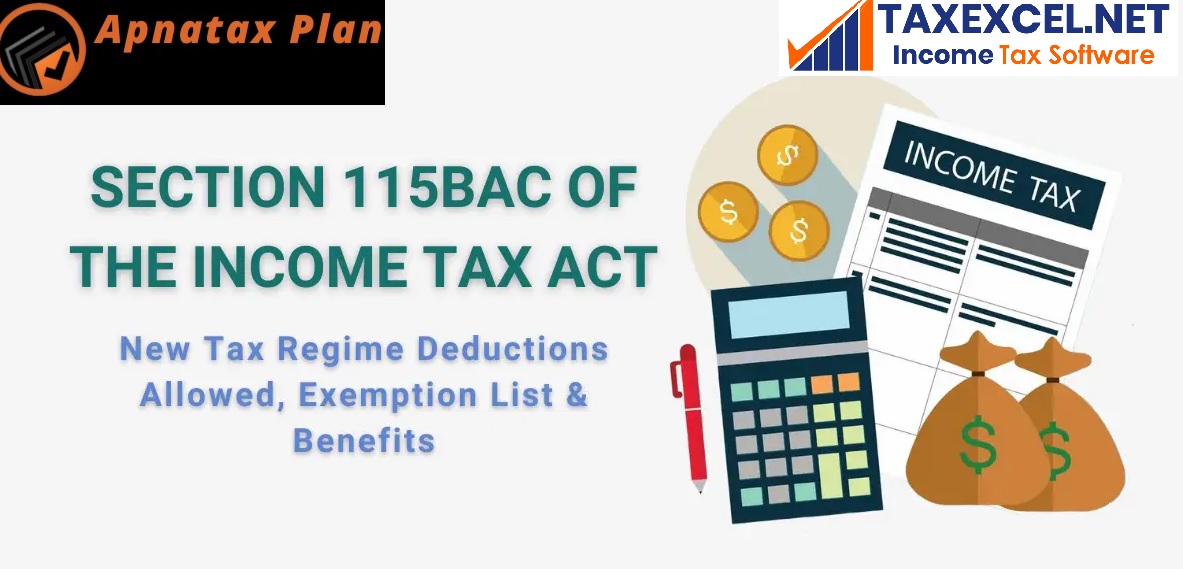

The New Tax Regime is becoming the central tax structure in Budget 2025. The government confirmed that nearly 80% of taxpayers have already

Income Tax Calculator FY 2025–26 for Non-Government/Salaried Employees

If you are a salaried employee working in the private sector, you probably wonder, How much tax will I pay this year? Although

Understanding taxes can feel confusing, right? You might often wonder why two terms—tax deduction and tax exemption—sound so similar yet work differently. In

No Tax Up to ₹12.75 Lakhs? How Section 87A Makes It Possible (FY 2025-26)

Have you ever wondered how people keep saying “No Tax Up to ₹12.75 Lakhs?” and still sound confident? Well, you are not alone.

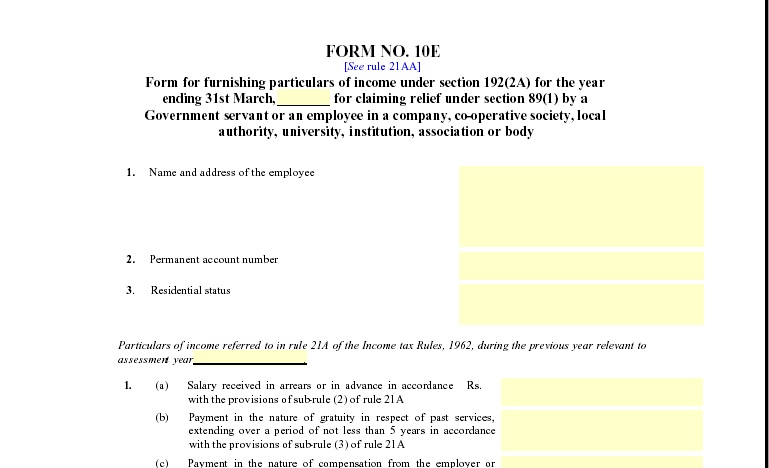

Automatic Arrears Relief Calculator U/s 89(1) with Form 10E for FY 2025–26

Everyone wants to save tax, and when arrears suddenly enter your salary slip, the tax burden often rises quickly. However, with the Automatic

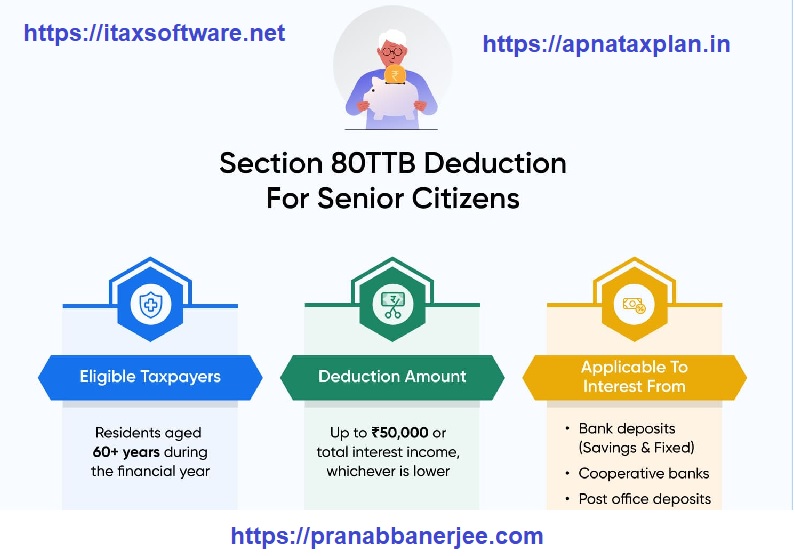

Excel-based income tax calculators for the Financial Year (FY) 2025-26 are readily available for download from several finance and tax-related websites . These

Income tax rules change almost every year, and FY 2025-26 brings important updates that affect salaried individuals. With the introduction of new slab rates in

Old vs New Tax Regime Comparison With Automatic Excel Tax Software

Introduction Choosing between the old and new tax regimes often feels like standing at a crossroads. Many taxpayers struggle to decide which path

Introduction Salaried employees often face the challenge of selecting the right tax system, and this decision can significantly shape their yearly savings. When

Introduction Have you ever wished you could calculate your income tax without stress, confusion, or long hours hunting for formulas? If yes, you’re

When you receive salary arrears, it often feels like an unexpected bonus. However, when you see the tax deduction on those arrears, it

Filing income tax, although common, still feels complicated for many employees. However, when you understand the basics and use smart tools like Tax

Introduction The Standard Deduction for the F.Y. 2025-26, announced under Budget 2025, brings significant relief to salaried individuals, pensioners, and family pensioners. Since

Automatic Arrears Relief Calculator U/s 89(1) with Form 10E for FY 2025–26

Sometimes, you receive salary arrears unexpectedly, right? However, that extra income may push you into a higher tax slab. Therefore, the Government created

Download Excel Tax Calculator All in One for FY 2025-26

Managing income tax often feels confusing, yet it doesn’t have to be. Imagine having one simple Excel sheet that calculates everything for you

Salary Arrears Relief Calculator U/s 89(1) with Form 10E from the FY 2000-01 to FY 2025-26

Have you ever received your salary arrears and felt confused about the high tax deduction? You’re not alone! Many salaried employees face this

Filing income tax can feel like walking through a maze—confusing, time-consuming, and stressful. But what if you had a smart guide to lead

© Copyright 2023 All Rights Reserved by Pranabbanerjee.com