Introduction As the new financial year 2025-26 began on April 1, 2025, the income tax slab and rate changes announced in Budget 2025

Introduction As the new financial year 2025-26 began on April 1, 2025, the income tax slab and rate changes announced in Budget 2025

Introduction The Budget 2025 has reshaped the way individuals approach their tax savings. With the introduction of new income tax slabs from April

Introduction Choosing between the Old and New Tax Regime in India for the financial year 2025-26 is like standing at a crossroad. One

The Union Budget 2025 introduced significant updates in India’s taxation system. While Finance Minister Nirmala Sitharaman did not announce new deductions or alter

Introduction As the new financial year 2025-26 began on April 1, 2025, the income tax slab and rate changes announced in Budget 2025

Introduction Do you sometimes feel like filing income tax is as confusing as solving a giant puzzle? You’re not alone! Many taxpayers struggle

Introduction If you are a salaried employee in West Bengal, especially for the Financial Year (FY) 2025-26, you might have already come across

Introduction Budget 2025 has once again brought the spotlight on the Old Vs New Tax Regime, leaving many salaried persons wondering: Which regime

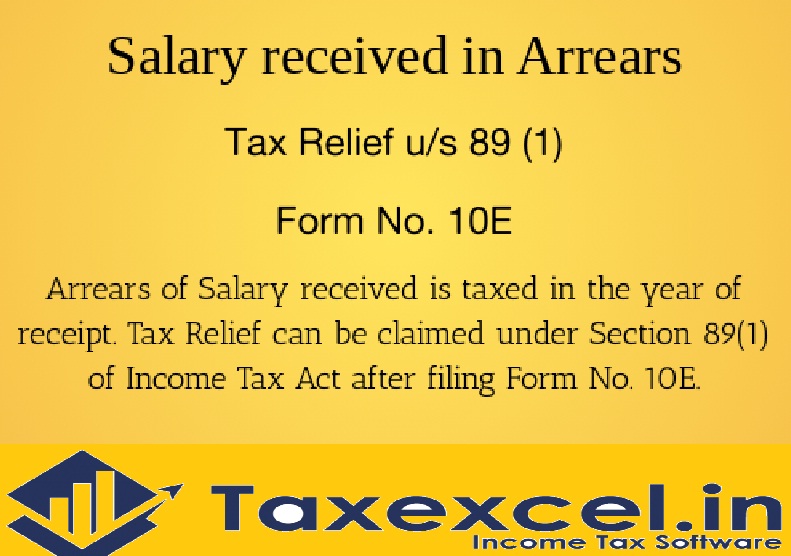

How to Calculate Income Tax Arrears Relief Calculation U/s 89(1) with Automatic Income Tax Arrears Relief Calculator in Excel with Form 10E from

Introduction Tax season can feel like trying to solve a 1,000-piece puzzle without the picture on the box. Numbers, forms, and rules pile

Introduction The New Tax Regime, as per Budget 2025, has changed the way individuals calculate their income tax. It’s like switching from a

Introduction The Budget 2025 has brought new changes to the New Tax Regime, making it more appealing for salaried individuals. Many people are

Introduction The New Tax Regime for the Financial Year 2025-26 (Assessment Year 2026-27) has caught the attention of both Government and Non-Government employees.

Filing your income tax return shouldn’t feel like decoding a rocket launch sequence. Yet, each financial year, many individuals find themselves juggling numerous

Introduction Are you a government employee in West Bengal wondering whether the new tax regime under Budget 2025 is better for you? You’re

Introduction Let’s face it — everyone loves earning interest on their savings, but no one likes paying taxes on it. What if we

Introduction Have you bought a house with your spouse or a family member? Are you also paying a home loan and wondering if

Introduction Are you planning a family vacation and wondering how to save tax through Leave Travel Allowance (LTA)? What if we told you

Introduction Have you ever wondered if you’re paying more tax than you should? You’re not alone. Many salaried individuals, especially non-government employees, are

1. Introduction Filing taxes can feel like navigating a maze, especially when you’ve got salary slips, deductions, exemptions, and multiple forms flying around.

© Copyright 2023 All Rights Reserved by Pranabbanerjee.com