Imagine receiving an automatic discount on your tax bill—without keeping a single receipt! That’s exactly what the Standard Deduction under Section 16(ia) offers.

Imagine receiving an automatic discount on your tax bill—without keeping a single receipt! That’s exactly what the Standard Deduction under Section 16(ia) offers.

Filing income tax can feel like walking through a maze—confusing, time-consuming, and stressful. But what if you had a smart guide to lead

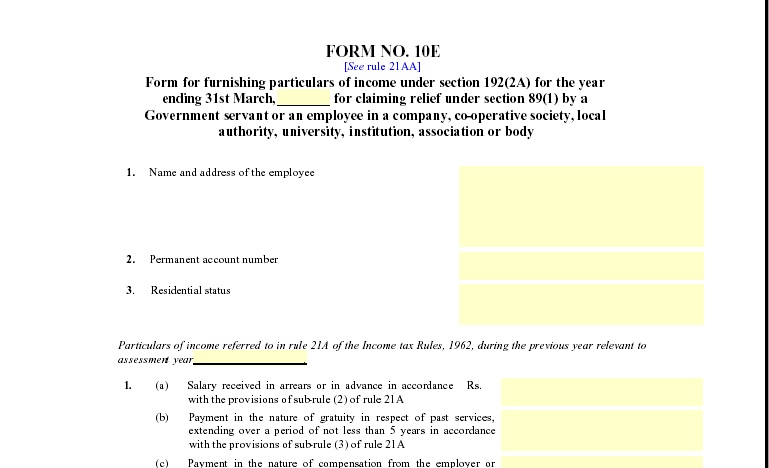

Salary Arrears Relief Calculator U/s 89(1) with Form 10E from the FY 2000-01 to FY 2025-26

Have you ever received your salary arrears and felt confused about the high tax deduction? You’re not alone! Many salaried employees face this

The Union Budget 2025 introduced significant reforms to simplify the Indian taxation system, particularly through the New Tax Regime. For non-government employees, this

To determine the best tax regime for the Financial Year (FY) 2025-26, you will need to perform a comparative calculation using your specific

Rebate U/s 115BAC for FY 2025-26 as per Budget 2025 with Automatic Income Tax Form 10E

The Rebate U/s 115BAC for FY 2025-26 under the New Tax Regime introduces a simpler, fairer, and more transparent way of calculating taxes.

The Union Budget 2025 reshaped India’s tax landscape by refining the New Tax Regime—now the default tax structure for FY 2025-26 (AY 2026-27).

Which Tax Regime Is Better for the Middle Class in FY 2025–26: Old or New?

Introduction The Budget 2025 has once again stirred the age-old debate—Old Tax Regime vs. New Tax Regime. For India’s middle-class taxpayers, this choice

Download the easy income tax software “All in One” in Excel from www.pranabbanerjee.com to effortlessly prepare and manage your tax filings for different financial years

Income Tax Calculator all in one in Excel for the F.Y.2025-26 for the Govt and Non-Govt Employees

Excel-based income tax calculators for the Financial Year (FY) 2025-26 are readily available for download from several finance and tax-related websites . These

Old vs New Income Tax Regime 2025: Which One Is Better for You? Following the Union Budget 2025, Indian taxpayers now face a

Have you ever wondered why so many taxpayers are now opting for the New Tax Regime as per Budget 2025? The answer is

Introduction Have you ever wondered which tax regime truly saves you more money — the old or the new? For the Financial Year

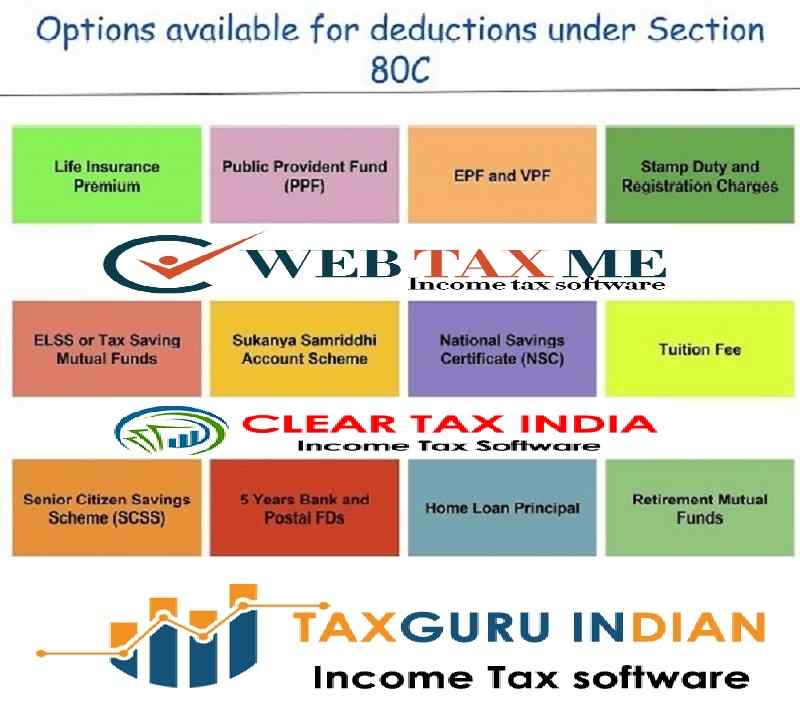

Introduction Are you wondering how you can save more tax in the Financial Year 2025-26? Well, here’s some good news! The Section 80C

Have you ever wondered how to make the most of your Income Tax benefits each financial year? Whether you are a government or

Introduction When it comes to saving taxes, every salaried employee—whether from the government or private sector—wants to make the most of available deductions.

Section 87A Tax Rebate Allowed on STCG in New Tax Regime – Relief for Salaried Taxpayers

Introduction If you’ve been confused about whether the Section 87A tax rebate applies to short-term capital gains (STCG) under the new tax regime,

Introduction When Budget 2025 was announced, the big question in everyone’s mind was this: “Which tax regime is better for me—Old or New?”

All taxpayers should opt for the New Tax Regime except the Old Tax Regime for F.Y.2025-26

All taxpayers should opt for the New Tax Regime except the Old Tax Regime for F.Y.2025-26 For the financial year (F.Y.) 2025-26, it

Choosing between the Old and New Tax Regime as per Budget 2025 feels a lot like choosing between two roads to your financial

© Copyright 2023 All Rights Reserved by Pranabbanerjee.com