Table of Contents

ToggleIntroduction to the Automatic Income Tax Calculator for Maharashtra State Employees

Tax season is no one’s favourite, especially if you’re navigating the maze of forms, figures, and financial jargon alone. But what if a simple spreadsheet could automate the heavy lifting and help Maharashtra state employees file taxes accurately and efficiently? Welcome to the Automatic Income Tax Calculator All-in-One for F.Y.2025-26, customised to align with the newly introduced provisions in the Budget 2025.

In India, filing your income tax return (ITR) can be overwhelming due to frequent updates in tax laws, multiple deduction options, and a two-regime system that leaves even seasoned taxpayers scratching their heads. For government employees in Maharashtra, things become trickier as they have to consider allowances, pensions, and department-specific perks that affect taxable income. That’s where this All-in-One calculator steps in — saving time, reducing errors, and maximising your refund potential.

Automation in tax filing isn’t just a luxury anymore; it’s a necessity. The manual process not only consumes time but also invites human errors — a typo here, a miscalculation there — which can lead to incorrect tax filings or even penalties. With this calculator, you get auto-calculation, pre-programmed tax slab logic, deduction breakdowns, and comparison between old and new regimes. It’s like having a virtual Chartered Accountant at your fingertips — minus the consultation fee.

This article guides you through the new features of the calculator as per Budget 2025, step-by-step instructions to download and use it, and tips to make the most of this powerful tax tool. Whether you are a teacher in Pane, a clerk in Mumbai, or an officer in Nagpur, this tool is tailor-made for you.

Understanding the Income Tax Structure for F.Y.2025-26

Before diving into how the calculator works, you need to understand the income tax framework for the financial year 2025-26, especially how the Union Budget 2025 affects you. Budget 2025 introduced some pivotal changes, and if you’re not updated, you might miss out on deductions or end up paying more tax than necessary.

Highlights from Budget 2025:

- Increase in the standard deduction limit from ₹50,000 to ₹60,000 under the old tax regime.

- Additional deduction of ₹25,000 under Section 80D for medical insurance for senior citizens.

- Revised tax slabs under the new regime offer relief for middle-income earners.

- A simplified tax return form for salaried individuals with income up to ₹20 lakh per annum.

- Continued support for both tax regimes (old and new) with optional switching at the time of filing.

These changes specifically benefit government employees. Maharashtra state employees often fall within the ₹5-20 lakh income bracket and can significantly benefit from either regime, depending on their income structure and investments.

Income Tax Slabs for F.Y.2025-26:

| Income Range (₹) | Old Regime Rate | New Regime Rate |

| 0 – 2.5 lakh | Nil | Nil |

| 2.5 – 5 lakh | 5% | 5% |

| 5 – 7.5 lakh | 20% | 10% |

| 7.5 – 10 lakh | 20% | 15% |

| 10 – 12.5 lakh | 30% | 20% |

| 12.5 – 15 lakh | 30% | 25% |

| Above 15 lakh | 30% | 30% |

These slab changes are reflected in the automatic calculator to help you instantly see the tax implications under both regimes.

Features of the All-in-One Income Tax Calculator

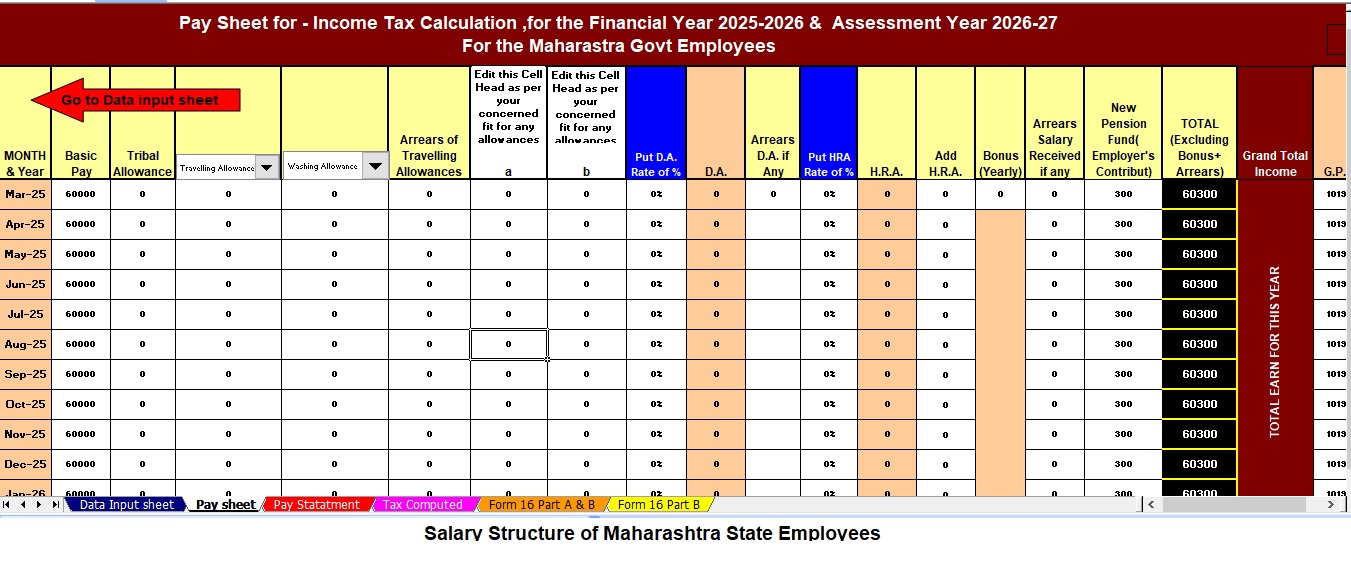

What sets this calculator apart from generic tax tools online is that it’s made specifically for Maharashtra state employees. It considers HRA (House Rent Allowance), TA (Transport Allowance), DA (Dearness Allowance), and more.

Top Features:

- Fully Automated Computation – No manual calculations needed.

- Support for Both Tax Regimes – Instantly compare old and new regime outcomes.

- Smart Deduction Inputs – Auto-fill for Sections 80C, 80D, 80TTA, etc.

- Monthly Salary Breakup Sheet – Understand your month-wise tax burden.

- Form 10E Integrated – Easily calculate tax relief under Section 89(1).

- Pre-Filled Department Codes – Ideal for quick use by Maharashtra state departments.

- Editable Cells & Auto Validation – Helps correct common user errors.

- Excel-Based File – No installation needed; open with MS Excel or Google Sheets.

Compatibility:

The calculator works on Microsoft Excel 2010 and above. It’s also compatible with Google Sheets (with minor macro limitations). Whether you’re on a PC or a Mac, you can download and use it without needing extra software.

Download the Calculator from the link given below

- Download and Safety Tips:

- Look for Excel file formats (macro-enabled).

- Always scan the file using your antivirus before opening.

- Enable “Edit” and “Macros” once you confirm the file is from a trusted source.

- Save a backup copy before entering your personal details.

- Quick Installation Steps:

- Click the download link.

- Open the Excel file.

- Enable content and macros (you’ll see a yellow ribbon on top).

- Follow the “READ ME” tab instructions inside the file.

- Enter your details under the correct columns.

That’s it! You now have a calculator that’s accurate, updated, and reliable for F.Y.2025-26.

How to Use the Automatic Calculator Effectively

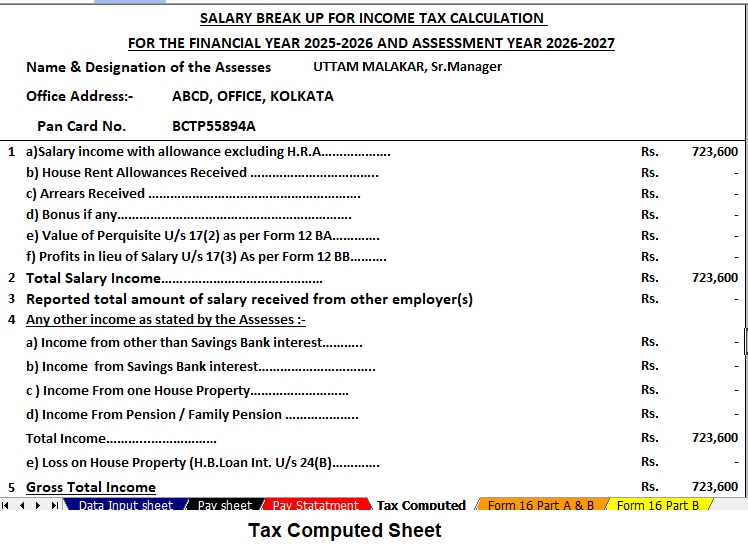

Once you have the file open, it’s time to put it to work. The calculator comes with multiple sheets, each targeting a specific area of your salary and deduction breakdown.

- Entering Salary Details:

Start by feeding your monthly gross salary in the input tab. Include:

- Basic Pay

- HRA

- DA

- TA

- Other Allowances

The sheet auto-calculates your annual income based on the monthly data. If you have bonuses or arrears, there’s a separate column for that as well.

- Including Deductions:

Use the Deductions tab to fill out:

- Section 80C: LIC, PF, PPF, NSC, tuition fees, principal on housing loan, etc.

- Section 80D: Medical insurance premium (self, spouse, children, parents).

- Section 80G: Donations to approved funds.

- Section 80TTA/80TTB: Interest on savings accounts for general and senior citizens.

- Section 24(b): Interest on home loan.

All values are validated to avoid exceeding the permissible limits. For instance, Section 80C has a ₹1.5 lakh cap, and the tool alerts you if you try to enter more than allowed.

By the end, you’ll see a summary that compares your tax liability under both the Old and New tax regimes, helping you make the smarter choice.

Comparison Between Old and New Tax Regimes Using the Calculator

Choosing between the old and new tax regimes can feel like trying to pick the lesser evil. The government’s dual-regime approach aims to give flexibility, but it often leads to confusion. This is where the Automatic Income Tax Calculator truly shines—it doesn’t just show numbers, it compares them side-by-side so you can make a smart financial decision based on your unique income structure.

The calculator offers a dedicated comparison sheet. Once you’ve entered all your income sources and deductions, it instantly shows:

- Total taxable income under each regime

- Total tax payable

- Net savings or additional tax burden in both cases

- A recommendation on the better option based on your data

Let’s say you’ve invested ₹1.5 lakh in PPF and LIC, paid ₹30,000 as medical insurance, and have a home loan interest of ₹2 lakh. Under the old regime, you’re eligible for all these deductions. Under the new regime, these won’t apply, but lower slab rates might compensate. With this calculator, instead of manually crunching numbers or second-guessing, you get instant clarity.

The visual layout also helps—taxable income, deductions, and final liability are displayed in contrasting colors for both regimes, making it very easy to spot the better deal. This side-by-side transparency is crucial because even a ₹10,000 difference in taxes can impact your savings, investments, or monthly budget.

So, whether you’re a fresh recruit or a nearing-retirement officer, always compare before you decide which regime to go with—and this calculator makes that decision hassle-free.

Common Mistakes Maharashtra Employees Make While Filing Taxes

No matter how experienced or cautious we are, tax filing leaves room for common yet costly errors. The good news? Most of these can be avoided by using an intelligent tool like the All-in-One Calculator.

Mistake #1: Ignoring Exemptions

Many employees forget to declare HRA properly or fail to provide rent receipts, thereby missing out on big savings. The calculator prompts users to input these correctly and calculates exemptions under Section 10(13A).

Mistake #2: Incorrect Deduction Claims

Filing for deductions beyond permissible limits is a widespread issue. For example, Section 80C has a cap of ₹1.5 lakh, yet people enter ₹1.8 lakh expecting it to be considered fully. The calculator validates these fields and shows warnings.

Mistake #3: Choosing the Wrong Tax Regime

Sometimes employees choose the new regime without realising how much they could save under the old one. This happens particularly when they’ve already made heavy investments or taken home loans. With the calculator’s comparative tool, this blunder is avoidable.

Mistake #4: Manual Calculation Errors

Using a calculator or trying to figure things out with pen and paper can lead to rounding mistakes or misinterpretation of clauses. Automation removes the risk completely.

Mistake #5: Forgetting to Include Income from Other Sources

Bank interest, freelance earnings, or rental income often go unreported. The calculator has a tab for “Other Income” ensuring nothing slips through the cracks.

Avoiding these mistakes can not only save you money but also prevent legal troubles or notices from the IT department.

Benefits of Using the Automatic Calculator for Government Employees

Maharashtra state government employees have specific needs and salary structures that differ from private sector employees. From fixed allowances to retirement benefits, many elements impact their tax liability. A generic calculator might not consider these. But this All-in-One tool is designed with them in mind.

Time Efficiency:

Instead of spending hours trying to match deduction limits or cross-check slab calculations, the entire process can be completed in under 30 minutes.

Accuracy:

Thanks to embedded formulas, the calculator minimises chances of error, ensuring accurate tax liability computation every time.

Updated with Budget 2025:

All recent changes—be it new slabs, increased deduction limits, or form changes—are already incorporated, making this tool completely up-to-date.

Support for Special Cases:

The calculator includes provisions for tax relief under Section 89(1) and caters to those drawing arrears or having undergone transfers mid-year.

Peace of Mind:

There’s a sense of comfort knowing your tax details are precise. When it’s time to file ITR online or submit it to your office’s DDO, you have a ready summary, ready-to-print Form 16 calculations, and even pre-filled values aligned with the department’s expectations.

In short, this tool is a one-stop solution for Maharashtra’s government staff looking to file taxes stress-free and smartly.

User Testimonials and Real Experiences

You don’t have to take this article’s word for it. Let’s hear from real users who’ve used the calculator and saved time, money, and unnecessary stress.

Sunita G., School Teacher from Thane:

“Every year I would struggle with which regime to choose and how to compute my HRA exemption. This calculator not only made it super easy but also helped me realise I was overpaying tax earlier!”

Rajendra D., Police Sub-Inspector in Nagpur:

“Being in the police force, I hardly get time for paperwork. I downloaded the tool on my mobile, filled out the sheet during lunch break, and my tax was done in 20 minutes. Hats off to the creators!”

Meera J., Clerk in Mumbai Municipal Corporation:

“I’ve been using this calculator for three years now, and it keeps getting better. This year’s version with the Budget 2025 changes is especially helpful. Loved the new UI and direct download guide!”

These testimonials reflect how user-friendly and impactful the calculator is for people from all walks of government service.

Download Automatic Income Tax Calculator All in One for the Maharashtra State Employees for the F.Y.2025-26 as per Budget 2025

[This Excel Calculator can prepare at a time your Tax Computed Sheet as per Budget 2025 + Inbuilt Salary Structure of the Maharashtra State Employees + Automatic Salary Sheet + Automatic calculation of H.R.A. Exemption U/s 10(13A + Automatic Form 16 Part A and B + Automatic Income Tax Form 16 Part B]