Table of Contents

ToggleIntroduction

Filing income tax can feel like solving a puzzle with missing pieces—confusing, tedious, and often overwhelming. But what if you could replace all the confusion with a single click? That’s exactly what the Income Tax Preparation Software in Excel offers. Whether you’re a Government employee or working in the private sector, this all-in-one Excel-based solution, complete with Form 10E, is designed to make tax calculations for the Financial Year 2025-26 easy, accurate, and efficient.

Let’s dive into how this powerful tool can transform your tax preparation experience from stressful to seamless.

Table of Contents

| Sr# | Headings |

| 1 | What Is Income Tax Preparation Software in Excel? |

| 2 | Why Use Excel for Income Tax Preparation? |

| 3 | Features of the All-in-One Income Tax Software |

| 4 | How This Software Caters to Government Employees |

| 5 | Benefits for Non-Government Employees |

| 6 | Integration with Form 10E |

| 7 | How to Download and Use the Software |

| 8 | Important Sections Covered in the Tool |

| 9 | Automation Features That Save Time |

| 10 | Budget 2025 Updates in the Software |

| 11 | Common Mistakes Avoided by This Tool |

| 12 | Security and Data Privacy |

| 13 | Who Should Use This Excel Software? |

| 14 | Tips to Maximize Benefits |

| 15 | Final Thoughts and Call to Action |

1. What Is Income Tax Preparation Software in Excel?

Income Tax Preparation Software in Excel is a pre-formatted, automated spreadsheet designed to calculate your income tax, deductions, arrears, and generate reports based on the latest Indian tax laws. It’s ideal for salaried individuals from both the government and private sectors.

2. Why Use Excel for Income Tax Preparation?

Using Excel is like having a personal tax assistant on your desktop. Unlike online tools that require constant internet access or subscriptions, Excel is offline, customizable, and gives you full control. It’s a familiar platform and easy for most people to use.

3. Features of the All-in-One Income Tax Software

This Excel tool isn’t just a calculator—it’s a full suite that includes:

- Auto tax computation

- Auto-fill Form 10E

- Salary structure integration

- Deduction entries like 80C, 80D, and 80CCD(1B)

- Old and New Tax Regime Comparison

- Printable reports for submission

4. How This Software Caters to Government Employees

For government employees, the software comes with preloaded fields specific to their pay structure, allowances, and HRA components. The built-in formulas automatically consider updates from Budget 2025 for accurate computation.

5. Benefits for Non-Government Employees

Private sector employees benefit from salary breakup templates, customizable deduction entries, and automatic tax rebate calculations. It considers performance bonuses, variable pay, and professional tax differences.

6. Integration with Form 10E

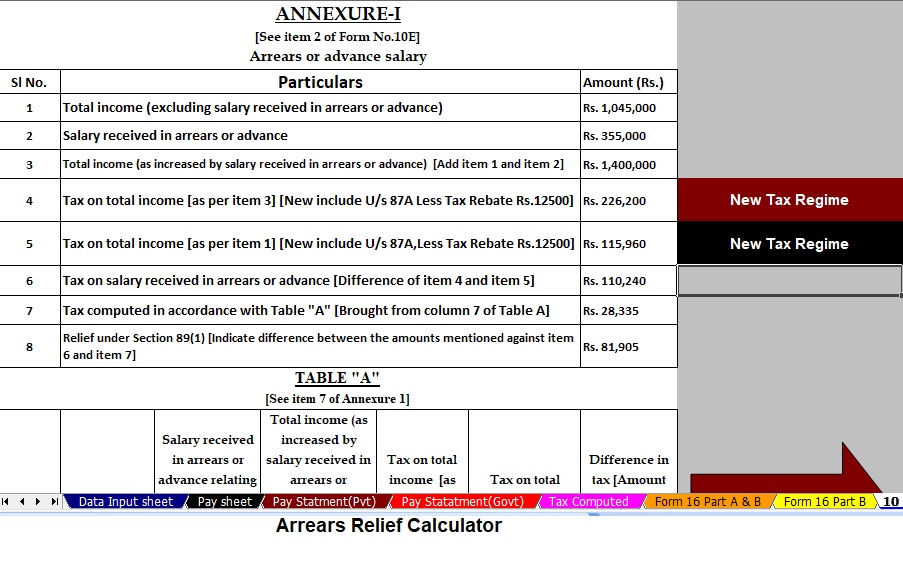

Form 10E is crucial if you’re claiming relief under Section 89(1) for arrears. The software auto-generates Form 10E based on your arrear entries, ensuring your return isn’t flagged by the Income Tax Department.

7. How to Download and Use the Software

- Visit itaxsoftware.net OR Direct Download from the link given Link

- Choose the version suitable for Govt or Non-Govt employees

- Download the Excel file

- Open and enable macros

- Enter your salary and deduction details

- Generate Form 10E and tax sheets instantly

8. Important Sections Covered in the Tool

The software covers all the critical sections:

- Section 10 (Exemptions)

- Section 80C to 80U (Deductions)

- Section 24 (Housing Loan Interest)

- Section 87A (Rebate)

- Section 89(1) (Arrears Relief)

Everything is logically grouped and easy to input.

9. Automation Features That Save Time

Imagine a tool that automatically:

- Calculates your gross salary

- Identifies eligible deductions

- Selects the best tax regime

- Generates all necessary forms

No formulas, no manual calculations—just input your details and get instant results.

10. Budget 2025 Updates in the Software

The latest version of the Income Tax Preparation Software in Excel includes all provisions from Budget 2025, such as:

- Updated tax slabs

- Revised deduction limits

- New standard deduction changes

- Adjustments for senior citizens and pensioners

11. Common Mistakes Avoided by This Tool

The software is programmed to avoid:

- Calculation errors

- Missing deductions

- Wrong regime selection

- Incorrect Form 10E details

That means fewer notices from the IT Department!

12. Security and Data Privacy

Since the software works offline in Excel, your financial data remains on your device. You don’t need to upload anything online—keeping your data private and secure.

13. Who Should Use This Excel Software?

This tool is ideal for:

- Salaried individuals (Govt and Private)

- Pensioners

- HR professionals

- Tax consultants

- Freelancers with consistent income

If you earn a salary or pension, this tool is designed for you.

14. Tips to Maximise Benefits

- Use updated salary slips

- Declare all deductions in advance

- Always compare both tax regimes

- Use Form 10E if you have arrears

- Print and review your tax computation before filing

15. Final Thoughts and Call to Action

Why spend hours doing what this software can do in minutes? The Income Tax Preparation Software in Excel is a simple, smart, and secure solution that helps you file your taxes confidently. Whether you’re in Sarkari service or a private job, this tool puts you in control of your taxes.

Download now from www.itaxsoftware.net and make tax season stress-free!

FAQs

- Can I use the Income Tax Preparation Software in Excel without internet access?

Yes, the software is fully offline. Once downloaded, you can use it without needing an internet connection. - Does the software support both Old and New Tax Regimes?

Absolutely! It lets you compare and choose the most beneficial regime for your salary. - Is Form 10E automatically generated in this software?

Yes, the software includes auto-generation of Form 10E for those claiming arrears under Section 89(1). - Can pensioners use this Excel software?

Yes, pensioners can easily enter their pension income and deductions to calculate accurate tax. - Is the software updated as per the Budget 2025 announcements?

Yes, the latest version is fully aligned with all tax updates introduced in Budget 2025.