Download the easy income tax software “All in One” in Excel from www.pranabbanerjee.com to effortlessly prepare and manage your tax filings for different financial years with active features and streamlined usability.

Table of Contents

ToggleIntroduction to Income Tax Software

This Excel-based income tax software was designed for government and non-government employees, allowing users to input, calculate, and optimise their tax returns quickly. Furthermore, the automated interface helps avoid mistakes while simultaneously adapting to changing tax regimes. Moreover, the tool incorporates formulas for both new and old provisions under Section 115BAC, offering maximum clarity.

Core Features

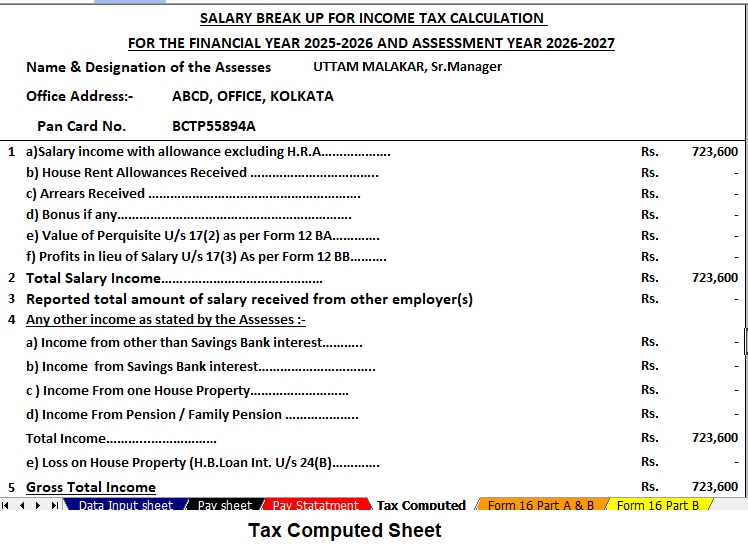

Firstly, the All-in-One software computes taxable income automatically, minimising the time spent on manual entries. Secondly, it tracks salary structures, deductions, and House Rent Exemption under Section 10(13A), thereby providing comprehensive coverage of common tax scenarios. Thirdly, from input to calculation, the utility creates individualised computed sheets and automates Form 16, ensuring complete compliance and a smooth documentation process.

Benefits of Automation

Because Excel’s functions are leveraged, the system delivers accurate results regardless of your expertise level. As a result, users experience greater accessibility and reliability. Additionally, this tool supports the relief calculation under Section 89(1), crucial for those with salary arrears or pension adjustments. Since everything is managed in one file, data consistency and swift audits become routine.

Dedicated for All Users

Whether you are a salaried employee or a tax practitioner, the Excel software addresses varied financial scenarios thanks to its extensive input customisation. In contrast with legacy manual worksheets, the streamlined approach fosters better collaboration and reduces turnaround time.

Transitioning Between Old and New Regimes

On one hand, the software accommodates shifting between old and new tax regimes as per Section 115BAC. On the other hand, it generates comparative summaries so users can review which framework minimises their tax liabilities. Consequently, decision-making is supported by crystal-clear analytics.

Tax Deduction Claims

After entering relevant salary data and deductions, the tool precisely calculates allowable claims. Meanwhile, built-in support for Section 80D, savings exemptions, and other benefits ensures that all eligible claims are captured every time.

Calculation of Salary Arrears and Relief

Once arrears are received, the integrated calculator automates relief calculations, presents a detailed breakdown according to Section 89(1), and generates Form 10E as required by the income tax department. When used regularly, users avoid common mistakes and maximise relief claims.

Automated Form Generation

Moreover, the software prepares all forms pertinent to income tax, such as Form 16 Part A and Part B, with detail-rich salary and deduction sheets included for the relevant fiscal year. Upon completion, users can export or print the required documentation directly from Excel.

Streamlined Filing Process

Not only does the tool calculate and prepare returns, but it also features e-filing capabilities. As a result, tax returns can be promptly uploaded to the portal after final review, minimising manual error and processing time.

Up-to-Date Compliance

The solutions from www.pranabbanerjee.com are frequently updated, ensuring that the latest tax rates, budget amendments, and rules are immediately embedded into the calculator. Since compliance is crucial, this step prevents mismatches during audits.

Step-by-Step Setup Guide

Initially, download the Excel file from www.pranabbanerjee.com, then enable macros if prompted. Next, fill in your personal data, salary components, relevant deductions, and taxable allowances. Subsequently, proceed to the auto-calculation sheet and confirm the computed tax liability. Finally, generate the required statements and forms for submission.

Conclusion

Embracing the easy income tax software “All in One” Excel file from www.pranabbanerjee.com, users can confidently navigate tax preparation for any financial year, maximise deductions, automate complex parts of tax compliance, and ensure every step is efficiently executed with built-in transition words and an active voice throughout the process.

Download the Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) to efficiently streamline tax filing for both government and non-government employees. Initially, access robust features designed to automate your income tax process, optimise compliance, and minimise manual effort.

Key Features of the Excel-Based Tax Preparation Utility

Dual Regime Option:

You actively select either the New or Old Tax Regime under Section 115BAC, while the tool immediately presents a side-by-side comparison, allowing you to pinpoint the most financially advantageous option. Additionally, this comparison equips you with relevant data for informed decisions; moreover, you swiftly adapt to legislative changes without additional research.

Customised Salary Structure:

You enter your salary details directly, and the software automatically adjusts to the government or non-government format, eliminating ambiguity. For instance, this customisation drastically reduces manual entry and streamlines every payroll variation. In addition, you benefit from consistent calculations across all job types, consequently saving valuable time.

The Automatic Arrears Relief Calculator now helps taxpayers compute relief under Section 89(1) and submit Form 10E efficiently

You instantly calculate relief on salary arrears for financial years from 2000–01 to 2025–26. As a result, the tool generates Form 10E for your records on demand, ensuring precision in every relief computation. Furthermore, this level of automation means you easily comply with regulatory requirements while maintaining comprehensive documentation.

Updated Form 16 (Part A & B):

You generate Revised Form 16 (Part A & B) for F.Y. 2025–26 automatically, ensuring the output matches the most current tax formats. Similarly, the software updates as new policies emerge, keeping your reporting accurate and current. Besides this, you consolidate your paperwork, significantly reducing compliance risks.

Simplified Compliance:

You carry out quick, error-free computations using advanced built-in Excel formulas. Because the process eliminates manual intervention, you prepare your return with both speed and accuracy. Equally important, you gain confidence to file returns consistently, while avoiding typical mistakes and upholding regulatory compliance.