Table of Contents

Toggle1. Introduction

Filing income tax returns is not just a legal responsibility but also a financial habit that every salaried person should maintain. With the financial year 2025-26 bringing in fresh tax slabs, updated rules, and revised exemption limits, employees across India—both government and non-government—need a smart, reliable, and easy-to-use tool to calculate and prepare their income tax. Traditionally, people relied on manual methods or hired professionals to prepare their returns, but that process is not only time-consuming but also prone to human error.

This is where the Automatic Income Tax Preparation Excel-Based All-in-One Software for FY 2025-26 comes into play. Designed specifically for both government and private sector employees, this tool ensures hassle-free income tax calculation and return preparation. Imagine having a personal tax consultant inside your computer, guiding you step by step and ensuring you never miss out on exemptions, deductions, or benefits—that’s exactly what this Excel-based software offers.

You may also like this Article:- Download Automatic Income Tax Preparation Software for only the Non-Government All-in-One in Excel for the F.Y.2025-26

Automation in tax preparation is no longer a luxury; it is a necessity. With deadlines approaching and compliance becoming stricter each year, individuals need a system that not only saves time but also improves accuracy. This software acts as a bridge between complex tax laws and the common man, translating numbers and rules into clear, actionable results. Whether you are a school teacher, a defence officer, a bank employee, or working in a private corporate job, this software is tailored to meet your specific needs.

In short, the year 2025-26 doesn’t have to be stressful when it comes to tax filing. Instead of scratching your head over numbers and forms, you can rely on a tested, user-friendly tool that puts everything in one place. By the end of this article, you’ll understand how this Excel-based software can become your trusted partner in tax filing.

2. What is Automatic Income Tax Preparation Excel Software?

At its core, the Automatic Income Tax Preparation Excel Software is a digital tool built on Microsoft Excel that simplifies the complicated process of income tax calculation. Unlike generic spreadsheets, this software is programmed with advanced formulas, macros, and built-in logic that align with the latest tax rules for FY 2025-26. Think of it as an intelligent tax calculator that does all the heavy lifting while you only need to input your income and investment details.

Normally, calculating income tax requires an understanding of various tax slabs, deductions under Section 80C, exemptions on house rent allowance (HRA), standard deductions, and other components like medical insurance and home loan interest. For the average employee, remembering and applying all these sections correctly is a challenge. That’s why errors and miscalculations are so common in manual tax preparation. However, this Excel-based software automatically applies the right slab rates, checks eligibility for deductions, and calculates your final taxable income.

Another major advantage of this tool is that it is All-in-One, meaning it can be used by both government and non-government employees without the need for separate versions. Whether your salary structure includes government allowances or private-sector perks, the formulas are flexible enough to accommodate both categories.

To put it simply, the software turns a complex manual process into a smooth, guided journey. Instead of browsing through tax laws or depending on costly consultants, you get everything inside a single Excel file that works even without the internet. For many, this is a game-changer in managing their finances.

You may also like this Article:- How to save your Tax for the F.Y.2025-26 as per Budget 2025

3. Why Choose Excel-Based All-in-One Software for FY 2025-26?

When we talk about digital tax preparation, many people immediately think of online portals or mobile apps. While those platforms are useful, they often come with restrictions like internet dependency, subscription costs, or compatibility issues. On the other hand, Excel-based software is lightweight, offline-friendly, and accessible to almost everyone. Let’s explore why this All-in-One Excel tool is the best choice for FY 2025-26:

Benefits for Government Employees

Government employees have a unique salary structure that includes allowances such as dearness allowance (DA), house rent allowance (HRA), leave travel allowance (LTA), and various other benefits. These components often come with specific exemptions and deductions under the Income Tax Act. The Excel tool is pre-programmed to handle these components, making it highly reliable for government workers. No more worrying about whether your DA is taxable or how much of your HRA can be exempted—the software does it automatically.

Benefits for Non-Government Employees

Private sector employees usually deal with a mix of fixed salary, performance bonuses, and allowances. They may also have deductions from EPF, insurance premiums, or investments in tax-saving instruments. The Excel software considers all these aspects, ensuring that you do not overpay or underpay your taxes. It also provides a breakdown of taxable vs. non-taxable components, which is useful when submitting proof of investment to HR departments.

Universal Advantages

- Offline usability: No need for constant internet access.

- Free from subscriptions: Unlike premium apps, this tool usually comes as a one-time download.

- Customizable: Since it’s Excel, you can tweak or add your own fields.

- Trustworthy: Excel is a globally trusted software platform, and this tool leverages its reliability.

In a nutshell, this Excel-based solution is practical, accessible, and efficient. It combines the flexibility of offline use with the power of automation, ensuring employees in all sectors can benefit.

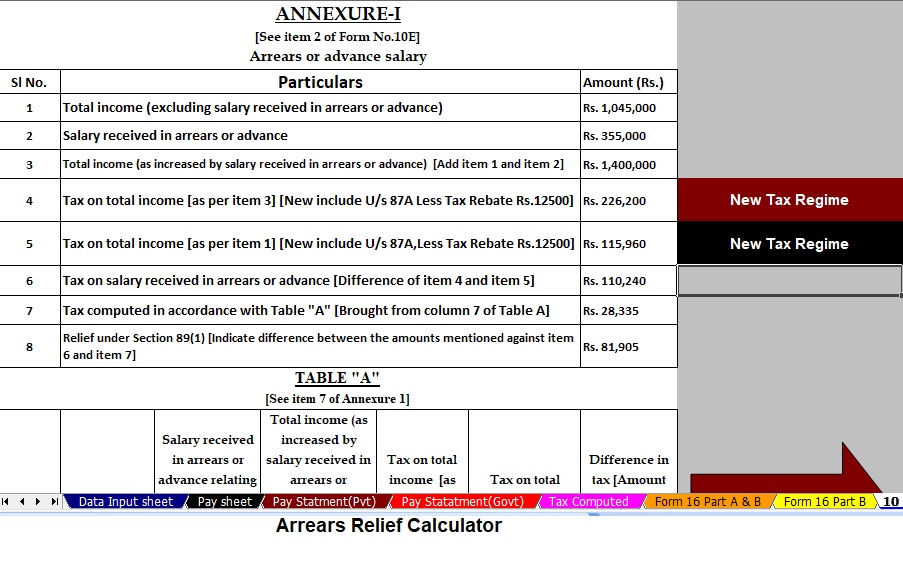

You may also like this Article: Download Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E in Excel from the F.Y.2000-01 to 2025-26

4. Key Features of the All-in-One Excel Tool

Every software tool is judged by the features it offers, and this All-in-One Excel-based income tax software is no exception. For FY 2025-26, it comes packed with features designed to make tax preparation easy and stress-free. Let’s break them down:

- Preloaded Tax Slabs for FY 2025-26

The software is already updated with the latest tax slabs as per the government’s announcement for FY 2025-26. No need to manually look up slab rates—the file applies them automatically. - User-Friendly Interface

You don’t need to be a tech genius or an accountant to use it. The layout is clean, with clearly labelled sections for income, deductions, exemptions, and final tax calculation. - Automatic Calculation

Once you enter your salary and investment details, the software instantly calculates your gross income, taxable income, and final tax payable. It even provides a summary sheet for easy reference. - Error-Free Reporting

Manual entry often leads to small mistakes that can cause big issues later. The Excel tool minimizes errors by using preset formulas and validation rules. - Covers Both Old and New Tax Regimes

Since taxpayers can choose between the old regime with exemptions or the new simplified regime, the software shows calculations for both. This allows you to compare and pick the most beneficial option. - One File, Multiple Users

It’s called “All-in-One” for a reason. A single file can be used by multiple employees, making it ideal for HR departments, small offices, or families.

In essence, this tool doesn’t just help with calculations—it gives you confidence and clarity in your tax filing journey.

5. How This Software Simplifies Tax Filing

Tax filing often feels overwhelming because of the many forms, rules, and numbers involved. However, the All-in-One Excel software simplifies this process into a few clear steps:

- Input Your Salary Details

Enter your basic pay, allowances, and other income components. - Add Deductions and Investments

Fill in your investments under Section 80C (like LIC, PPF, ELSS), health insurance premiums under Section 80D, and home loan interest. - Select Regime Preference

The software calculates tax liability under both regimes and highlights which one saves you more money. - Instant Tax Calculation

With just a click, you see your gross income, deductions, net taxable income, and final tax liability.

Download the Automatic Income Tax Calculator All in One for Government and Non-Government Employees in Excel for the F.Y. 2025-26

- This Excel Calculator instantly prepares your Tax Computed Sheet as per Budget 2025, ensuring accuracy and compliance.

- Moreover, it includes an inbuilt salary structure for both Government and Non-Government Employees, making salary input simple and quick.

- In addition, it automatically generates a Salary Sheet, which saves you time and effort.

- Furthermore, it calculates the H.R.A. Exemption under Section 10(13A), helping you maximise your eligible benefits.

- It also computes Income Tax Form 12BA automatically, simplifying allowance and perquisite reporting.

- Along with that, it prepares Form 16 Part A and B automatically, streamlining the issue of salary certificates.

- Finally, it automatically creates Income Tax Form 16 Part B, ensuring complete and error-free documentation.