Table of Contents

ToggleIntroduction

Paying income tax is your duty, but does it always have to feel like a burden? Absolutely not! With the right strategies, you can legally reduce your tax liability and keep more of your hard-earned money in your pocket. Think of tax planning as gardening—if you plant the right seeds (investments and deductions), you’ll reap healthy savings at the end of the year.

In this guide, we’ll explore how to save income tax in India in 2025 under both the old tax regime and the new tax regime. We’ll also explain how the latest Budget 2025 updates affect you and how an Automatic Income Tax Preparation Software All-in-One in Excel can simplify your planning.

Table of Contents

| Sr# | Headings |

| 1 | Understanding Tax Planning in India |

| 2 | Old Tax Regime vs. New Tax Regime |

| 3 | Tax Slabs for FY 2025-26 |

| 4 | Deductions Available Under the New Tax Regime |

| 5 | Deductions Available Under the Old Tax Regime |

| 6 | How to Save Income Tax on a ₹12 Lakh Salary |

| 7 | How to Save Tax from Rental Income |

| 8 | Popular Tax-Saving Investments |

| 9 | Hidden and Lesser-Known Tax Deductions |

| 10 | How to Save Income Tax as per Budget 2025 |

| 11 | Step-by-Step Tax Planning with Excel Software |

| 12 | Mistakes to Avoid in Tax Planning |

| 13 | How to Save 100% Income Tax Legally |

| 14 | Key Takeaways for Different Income Groups |

| 15 | Conclusion and Final Thoughts |

1. Understanding Tax Planning in India

Tax planning is not about avoiding taxes; it’s about using the Income Tax Act to your advantage. By understanding exemptions, deductions, and rebates, you can reduce taxable income without breaking the law. Whether you are a salaried employee, self-employed professional, or landlord, the strategy remains the same: plan, invest, and claim wisely.

2. Old Tax Regime vs. New Tax Regime

When it comes to saving taxes in India, you first need to choose the right tax regime.

- Old Tax Regime: Offers multiple deductions (like 80C, 80D, HRA, home loan interest) but comes with higher tax rates.

- New Tax Regime: Provides lower slab rates and a higher basic exemption but removes most deductions.

So, which is better? If you invest heavily in tax-saving instruments, the old regime may benefit you. If you prefer simple filing with fewer deductions, the new regime might suit you better.

3. Tax Slabs for FY 2025-26

New Tax Regime (FY 2025-26 & AY 2026-27):

- Up to ₹4,00,000 → 0%

- ₹4,00,001 – ₹8,00,000 → 5%

- ₹8,00,001 – ₹12,00,000 → 10%

- ₹12,00,001 – ₹16,00,000 → 15%

- ₹16,00,001 – ₹20,00,000 → 20%

- ₹20,00,001 – ₹24,00,000 → 25%

- Above ₹24,00,000 → 30%

Old Tax Regime (FY 2025-26 & AY 2026-27):

- Nil Tax: Up to ₹2,50,000 (₹3,00,000 for senior citizens, ₹5,00,000 for super seniors)

- 5%: Income between ₹2,50,001 – ₹5,00,000

- 20%: Income between ₹5,00,001 – ₹10,00,000

- 30%: Income above ₹10,00,000

4. Deductions Available Under the New Tax Regime

Although the new regime has removed most exemptions, some deductions remain:

- Standard Deduction: ₹75,000 for salaried and pensioners

- Employer’s Contribution to NPS: Up to 14% under Section 80CCD(2)

- Gratuity: Tax-free within prescribed limits

- Leave Encashment: Up to ₹25 lakhs for non-govt employees; fully exempt for govt employees

- Home Loan Interest (U/S 24): Allowed only for let-out property

5. Deductions Available Under the Old Tax Regime

The old regime remains popular because of multiple deductions:

- Standard Deduction: ₹50,000 for salaried/pensioners

- HRA Exemption: Based on rent paid, city of residence, and salary structure

- Section 80C: Up to ₹1.5 lakhs (PPF, EPF, ELSS, LIC, tuition fees, home loan repayment)

- Section 80D: Health insurance premium (₹25,000–₹75,000 depending on parents’ age)

- NPS Deduction (80CCD(1B)): Extra ₹50,000 beyond 80C

- LTA (Leave Travel Allowance): Exempt for two journeys in four years

6. How to Save Income Tax on a ₹12 Lakh Salary

Let’s assume you earn ₹12 lakhs annually. Under the old regime:

- Standard Deduction → ₹50,000

- Section 80C Investments → ₹1,50,000

- NPS (80CCD(1B)) → ₹50,000

- Health Insurance (80D) → ₹75,000

- HRA Exemption → ₹1,80,000

- Home Loan Interest → ₹2,00,000

Total deductions = ₹7,07,400

Your net taxable income reduces to ₹4.92 lakhs. With the Section 87A rebate, your tax becomes zero.

Yes, even with a ₹12 lakh salary, you can pay zero tax legally.

7. How to Save Tax from Rental Income

- Standard Deduction: Automatically, 30% of gross rent is deducted.

- Home Loan Interest: Up to ₹2 lakhs can be claimed.

- Property Tax: Fully deductible from rental income.

These three benefits can cut down your rental income tax liability significantly.

8. Popular Tax-Saving Investments

Some of the most common options include:

- PPF (Public Provident Fund)

- EPF (Employee Provident Fund)

- ELSS (Tax-saving mutual funds)

- NPS (National Pension Scheme)

- Life Insurance Premiums

- Tax-Saving FDs (Fixed Deposits)

9. Hidden and Lesser-Known Tax Deductions

- Education Loan Interest (80E) – No upper limit

- Savings Account Interest (80TTA/80TTB) – ₹10,000/₹1,00,000 for senior citizens

- Donations (80G) – 50% or 100% tax exemption depending on NGO/trust

10. How to Save Income Tax as per Budget 2025

Budget 2025 increased the basic exemption limit under the new regime to ₹4 lakhs. It also raised the standard deduction to ₹75,000. These two changes alone give relief to millions of taxpayers.

By combining NPS contributions, employer benefits, and home loan deductions, you can save substantial tax as per the latest budget.

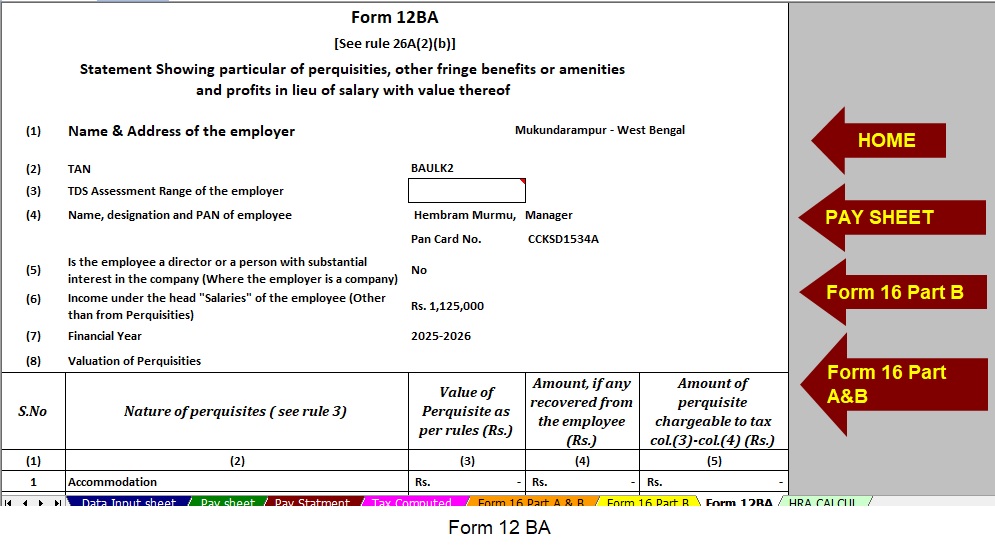

11. Step-by-Step Tax Planning with the help of Income Tax Preparation All-in-One Excel Software for the F.Y.2025-26

The Automatic Income Tax Preparation Software in Excel helps you:

- Enter your income details (salary, rent, interest, business).

- Choose your regime (old or new).

- Add deductions like 80C, 80D, and NPS.

- Automatically calculate tax liability.

- Get error-free Form 10E for arrears relief.

This software ensures accuracy and saves hours of manual calculation.

12. Mistakes to Avoid in Tax Planning

- Delaying investments until March

- Not comparing the old vs. the new regime before filing

- Ignoring employer benefits like NPS contribution

- Forgetting to claim rebates under Section 87A

13. How to Save 100% Income Tax Legally

You can reduce your taxable income to zero if:

- Under the old regime, your net income falls below ₹5 lakhs.

- Under the new regime, your net income falls below ₹12 lakhs (after applying Section 87A).

This is achievable with smart deductions and exemptions.

14. Key Takeaways for Different Income Groups

- ₹5–10 Lakhs: Maximise HRA, ELSS, and home loan deductions.

- ₹10–20 Lakhs: Combine NPS, health insurance, and 80C investments.

- ₹20–30 Lakhs: Use advanced options like HUF, trusts, and employer NPS.

- ₹30L+: Explore tax-free bonds, business deductions, and alternate investments.

15. Conclusion and Final Thoughts

Saving income tax in India is like solving a puzzle—you need the right pieces to see the full picture. The old regime favours investors, while the new regime simplifies compliance. With the right planning and tools like Automatic Income Tax Preparation Software All-in-One in Excel, you can minimise your liability and even pay zero tax on higher salaries.

FAQs

- How to save Income Tax as per Budget 2025?

You can save by using the higher standard deduction (₹75,000), NPS contributions, and home loan benefits, while also comparing both regimes. - Is a ₹12 lakh salary tax-free in India?

Yes, under the old regime, with proper deductions, you can bring taxable income under ₹5 lakhs and claim a rebate under Section 87A. - Can I save tax under the new regime?

Yes, but options are limited. You can claim standard deduction, NPS employer contributions, and home loan interest for a let-out property. - What is the difference between 80C and 80D deductions?

80C allows deductions up to ₹1.5 lakhs for investments like PPF, EPF, and ELSS. 80D allows deductions for health insurance premiums. - Which is better: Old or New Tax Regime?

It depends on your financial habits. If you invest regularly, the old regime works better. If you prefer a higher basic exemption with fewer investments, the new regime suits you.

Final Words for Readers

Tax savings may sound complicated, but once you break it down into choices, deductions, and strategies, it becomes much easier. With the Budget 2025 changes, you now have more flexibility in choosing between old and new regimes.

- If you’re a disciplined investor, stick with the old tax regime to maximise deductions.

- If you want simplicity, consider the new regime with a higher basic exemption and flat slab rates.

- And don’t forget—the Automatic Income Tax Preparation Software in Excel can do the heavy lifting for you by calculating everything in minutes.

At the end of the day, saving tax isn’t about dodging responsibility—it’s about being smart with your money. Why pay more when the law allows you to save?