Table of Contents

ToggleIntroduction

Do you sometimes feel that income tax looks like a maze with endless turns and confusing dead ends? If so, you’re definitely not alone. In fact, many taxpayers, whether government employees or non-government employees, constantly struggle to understand how to save tax legally while still complying with all the rules. Fortunately, the good news is that with the right knowledge and an Automatic Income Tax Preparation Software in Excel All-in-One with Form 10E, you can easily transform tax filing into a smooth, simple, and hassle-free process for the financial year 2025-26.

Moreover, this article will guide you step by step. Specifically, we will walk through practical tax-saving strategies, explore multiple deductions and exemptions, and explain how Excel-based tax preparation software can serve as your personal digital assistant in tax planning. Therefore, you will not only learn how to save more but also how to file confidently without stress.

Table of Contents

| Sr# | Headings |

| 1 | Importance of Saving Income Tax in 2025 |

| 2 | Overview of the Indian Income Tax System |

| 3 | Key Tax Changes in Budget 2025 |

| 4 | Benefits of Using Excel-Based Income Tax Preparation Software |

| 5 | Understanding Form 10E and Its Role |

| 6 | Tax-Saving Options for Salaried Employees |

| 7 | Exemptions and Deductions under Section 80C |

| 8 | Additional Tax Benefits under Section 80D, 80CCD(1B), and 24(b) |

| 9 | Standard Deduction for Govt & Non-Govt Employees |

| 10 | Tax Relief under Section 89(1) with Form 10E |

| 11 | Housing Loan Benefits and Interest Exemptions |

| 12 | How Excel All-in-One Software Simplifies Tax Calculation |

| 13 | Step-by-Step Guide to Using the Software |

| 14 | Common Mistakes to Avoid in Tax Filing |

| 15 | Conclusion and Final Tips |

1. Importance of Saving Income Tax in 2025

First of all, saving tax does not simply mean reducing the amount you pay to the government. On the contrary, it means you actively maximise your hard-earned income. Moreover, every single rupee you save can be invested wisely, directed effectively toward your child’s education, or even contributed confidently to your retirement fund. In addition, tax savings create opportunities to build long-term financial stability and security.

Since the financial year 2025-26 introduces several policy updates and revised exemptions, understanding how to apply the right strategies becomes essential. Therefore, learning how to save efficiently is not just beneficial—it is more critical than ever for every taxpayer who wishes to make the most of available opportunities.

2. Overview of the Indian Income Tax System

To begin with, the Indian tax system operates under two regimes.

- Firstly, the Old Regime offers multiple deductions and exemptions.

- Secondly, the New Regime provides lower tax rates but fewer deductions.

Consequently, the choice between the two depends entirely on your salary structure, investments, and available deductions. Indeed, many salaried individuals find the Old Regime more effective, since it offers a wider range of tax-saving instruments. Moreover, the New Regime attracts those who prefer simplicity. Nevertheless, both regimes aim to ease taxpayer compliance. Therefore, understanding the difference is essential. Above all, you must evaluate carefully before deciding.

3. Key Tax Changes in Budget 2025

Interestingly, the Union Budget 2025 introduced several key updates.

- Most importantly, it revised tax slabs.

- In addition, it raised the standard deduction for salaried employees.

- Furthermore, it increased the deduction limit under Section 80C.

- Finally, it simplified filing for middle-class taxpayers using Excel-based tools.

Thus, taxpayers must analyse carefully. As a result, they need to compare both regimes before filing. In fact, this approach maximises benefits. On the other hand, failing to compare may cause financial loss. Consequently, taxpayers should remain updated.

4. Benefits of Using Excel-Based Income Tax Preparation Software

Why choose Excel? Because it offers unique advantages:

- Firstly, it is user-friendly, so you don’t need to be a tech expert.

- Secondly, it automates tax calculations instantly once you enter data.

- Thirdly, it minimises manual mistakes and stays error-free.

- Finally, it comprehensively covers deductions, exemptions, and Form 10E.

Therefore, Excel functions as a GPS for your taxes. Indeed, it consistently directs you to the best path for savings. Additionally, it reduces errors. Moreover, it ensures compliance. Consequently, you save both time and money.

5. Understanding Form 10E and Its Role

Above all, Form 10E is mandatory if you want relief under Section 89(1) for arrears or advance salary. Otherwise, your employer will not grant relief, and the Income Tax Department may issue notices. Fortunately, Excel’s All-in-One software includes auto-filled Form 10E. Thus, it saves time. In addition, it removes confusion. Indeed, it makes compliance smoother. As a consequence, you avoid penalties. Moreover, you build confidence in filing.

6. Tax-Saving Options for Salaried Employees

Additionally, salaried employees can adopt several strategies:

- Invest in PPF, ELSS, or Life Insurance (80C).

- Pay health insurance premiums (80D).

- Contribute to NPS (80CCD(1B)).

- Claim home loan interest (24b).

Most importantly, the Excel software calculates eligibility. Furthermore, it compares savings across all options. Likewise, it guides you toward maximum benefits. Therefore, you can plan smarter. In fact, you optimize income efficiently.

7. Exemptions and Deductions under Section 80C

Notably, Section 80C allows deductions up to ₹1.5 lakh.

- For example, you can invest in the Public Provident Fund (PPF).

- Similarly, the Equity Linked Savings Scheme (ELSS) offers benefits.

- Additionally, Life Insurance Premiums qualify.

- Finally, principal repayment of a housing loan is included.

Thus, Section 80C remains the most popular choice for salaried taxpayers. Indeed, it continues to attract maximum investments. Consequently, individuals prefer it for steady tax savings.

8. Additional Tax Benefits under Section 80D, 80CCD(1B), and 24(b)

Moreover, taxpayers can enjoy deductions beyond Section 80C.

- Firstly, Section 80D covers medical insurance premiums.

- Secondly, Section 80CCD(1B) gives an extra ₹50,000 deduction for NPS contributions.

- Thirdly, Section 24(b) allows home loan interest deduction up to ₹2 lakh.

As a result, these sections provide substantial relief. Likewise, when combined, they maximise savings. Indeed, they create powerful planning tools. Therefore, wise taxpayers always utilise them.

9. Standard Deduction for Govt & Non-Govt Employees

Equally important, Budget 2025 increased the standard deduction. Consequently, salaried employees now receive automatic relief without paperwork. In addition, both government and non-government workers benefit equally. Therefore, this revision ensures fairness. Moreover, it reduces complexity. Thus, employees feel encouraged. Indeed, everyone gains equally.

10. Tax Relief under Section 89(1) with Form 10E

Whenever you receive arrears or advance salary, you risk paying higher tax in the current year. However, Section 89(1) offers relief by adjusting income across earlier years. Since filing Form 10E is mandatory, you must comply. Therefore, Excel software ensures accuracy. Consequently, you achieve peace of mind. Moreover, you avoid mistakes. Likewise, you meet all requirements. Finally, you file confidently without stress.

11. Housing Loan Benefits and Interest Exemptions

Buying a house? You can claim:

- Principal repayment (80C).

- Interest payment (24b).

- Additional deduction for first-time buyers (80EEA, if applicable).

This significantly reduces taxable income.

12. How Excel All-in-One Software Simplifies Tax Calculation

The software includes:

- Automatic tax calculation.

- Built-in Form 10E preparation.

- Old vs New Regime comparison.

- Deduction and exemption summaries.

It’s like having a personal accountant in your laptop.

13. Step-by-Step Guide to Using the Software

- Download the Excel software.

- Enter your salary details.

- Input investment and deduction data.

- Select regime preference.

- Generate Form 10E if required.

- Review tax liability instantly.

14. Common Mistakes to Avoid in Tax Filing

- Forgetting to file Form 10E before claiming arrear relief.

- Missing out on deductions due to a lack of awareness.

- Not comparing old and new regimes.

- Entering wrong data in Excel sheets.

Avoiding these ensures smooth filing without notices.

15. Conclusion and Final Tips

Saving tax in 2025 is no longer a puzzle if you know the rules and use the right tools. The Automatic Income Tax Preparation Software in Excel All-in-One with Form 10E is your shortcut to stress-free filing. Whether you’re a government or non-government employee, this tool ensures compliance, accuracy, and maximum savings.

FAQs

- What is the best way to save income tax in 2025?

The best way is by using deductions under Sections 80C, 80D, and 24(b), along with Excel-based Income Tax Preparation Software for accuracy. - Is Form 10E mandatory for all taxpayers?

No, it is only mandatory if you’re claiming relief under Section 89(1) for arrears or advance salary. - Can non-government employees use the Excel Income Tax Preparation Software?

Yes, the software is designed for both government and non-government employees. - How does Excel software compare the old and new regimes?

It auto-calculates tax under both regimes, showing which saves you more. - Can I use the software for multiple employees in one file?

Yes, many All-in-One versions allow bulk preparation for multiple salaried persons.

Download the All-in-One Excel-Based Software for Income Tax Preparation, specially designed for both Government and Non-Government (Private) Employees for the F.Y. 2025-26 and A.Y. 2026-27. This Excel utility not only simplifies tax calculations but also ensures compliance with the latest rules.

Key Features of this Excel Utility:

- Firstly, it follows the 2025 Budget guidelines for tax calculations and incorporates both the New and Old Tax Regimes under Section 115BAC.

- Moreover, it applies a dedicated salary structure tailored for Government as well as Non-Government (Private) employees.

- In addition, it automatically prepares the Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from FY 2000-01 to FY 2025-26 in Excel.

- Furthermore, it generates your Income Tax Computation Sheet automatically. You only need to input your data, and the tool fills it in for you.

- Seamlessly, it calculates your House Rent Exemption U/s 10(13A) with complete accuracy.

- Additionally, it lets you manage a separate Salary Sheet within the Excel Utility for better organisation.

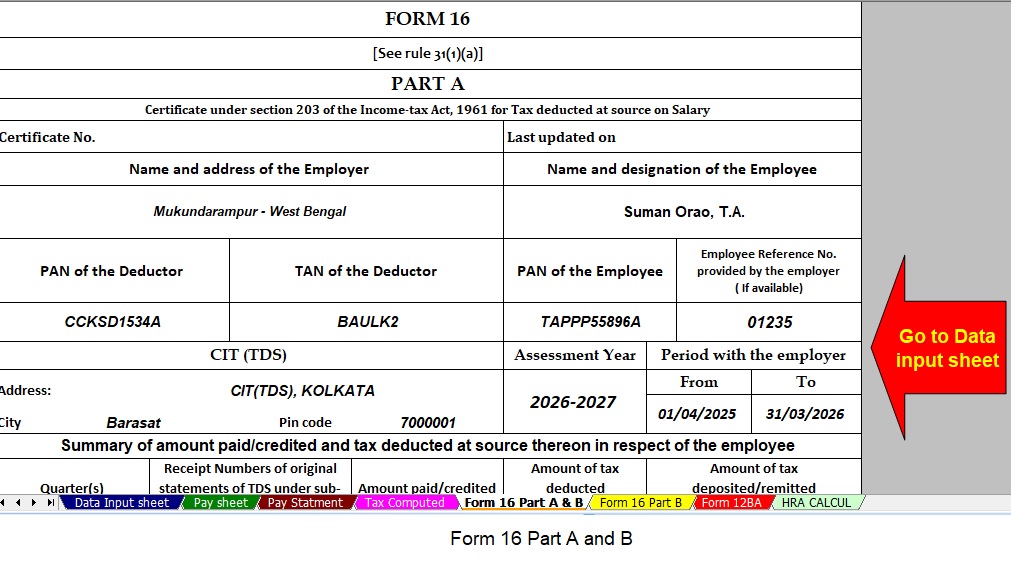

- Instantly, it prepares Form 16 Part B for FY 2025-26 in one go without manual effort.

- Finally, it prepares Form 16 Part A and B together automatically for FY 2026-27, saving both time and effort.

Key Features of this Excel Utility:

- Firstly, it follows the 2025 Budget guidelines for tax calculations and incorporates both the New and Old Tax Regimes under Section 115BAC.

- Moreover, it applies a dedicated salary structure tailored for Government as well as Non-Government (Private) employees.

- In addition, it automatically prepares the Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from FY 2000-01 to FY 2025-26 in Excel.

- Furthermore, it generates your Income Tax Computation Sheet automatically. You only need to input your data, and the tool fills it in for you.

- Seamlessly, it calculates your House Rent Exemption U/s 10(13A) with complete accuracy.

- Additionally, it lets you manage a separate Salary Sheet within the Excel Utility for better organisation.

- Instantly, it prepares Form 16 Part B for FY 2025-26 in one go without manual effort.

- Finally, it prepares Form 16 Part A and B together automatically for FY 2026-27, saving both time and effort.