Income tax preparation can be a daunting task, especially for government employees in West Bengal. However, with the advent of advanced technology, All-in-One Income Tax Preparation Software has emerged as a saviour for those navigating the complexities of tax filing in the financial year 2023-24.

Table of Contents

ToggleIntroduction

In the digital age, income tax preparation software has become an indispensable tool for individuals and businesses alike. For West Bengal Government Employees, ensuring a hassle-free tax filing experience for the financial year 2023-24 is crucial. Therefore, Let’s delve into the specifics of why an All-in-One solution is the ideal choice for them.

Understanding Income Tax Preparation Software

Above all, Income tax preparation software is designed to streamline the process of calculating, filing, and managing taxes. In other words, Its primary purpose is to simplify complex tax regulations and ensure accurate submissions. When tailored for West Bengal Government Employees, this software becomes a game-changer.

Benefits of All-in-One Solutions

Time-saving features

In addition, One of the standout features of All-in-One software is its time-saving capabilities. However, With automated data entry and calculation processes, West Bengal Government Employees can complete their tax filings efficiently, freeing up valuable time for other responsibilities.

After that, the Simplified tax filing process

Similarly, The software offers a user-friendly interface that simplifies the tax filing process. Complex forms and calculations are handled seamlessly, allowing users to focus on providing accurate financial information rather than grappling with confusing paperwork.

Accuracy and error reduction

The software’s algorithms are designed to minimize errors, ensuring that tax filings are accurate and in compliance with regulations. This is particularly crucial for government employees who need to adhere to strict financial guidelines.

Key Features for West Bengal Government Employees

Customized forms and deductions

All-in-One solutions cater to the specific needs of West Bengal Government Employees by offering customized forms and deductions. This ensures that users can take full advantage of available tax benefits.

Integration with state-specific regulations

Given the unique tax laws in West Bengal, the software seamlessly integrates state-specific regulations, providing users with real-time updates and ensuring compliance with the latest laws.

Real-time updates on tax laws

The dynamic nature of tax laws requires constant vigilance. All-in-One software keeps West Bengal Government Employees informed about any changes, enabling them to make informed decisions during the tax preparation process.

User-Friendly Interface

Importance for government employees

Government employees often have busy schedules. The software’s user-friendly interface ensures that even those with limited technical expertise can navigate the system with ease, making tax filing a less daunting task.

Accessibility and ease of navigation

The software’s accessibility features cater to a diverse range of users. It employs a straightforward navigation system, allowing West Bengal Government Employees to access the information they need without unnecessary complications.

Security Measures

Encryption and data protection

Security is a top priority when it comes to handling sensitive financial information. All-in-One software employs robust encryption and data protection measures, giving West Bengal Government Employees peace of mind.

Compliance with government standards

The software complies with government standards for data protection, ensuring that user information is handled in accordance with legal requirements. This is essential for maintaining the trust of users.

Cost Efficiency

Comparison with traditional methods

All-in-One solutions offer cost efficiency compared to traditional tax filing methods. The initial investment in the software is outweighed by the long-term financial benefits and time saved.

Long-term financial benefits

By reducing the risk of errors and maximizing available deductions, the software contributes to long-term financial benefits for West Bengal Government Employees. It becomes an investment in a smoother and more financially sound future.

Step-by-Step Guide for Filing Taxes

Registration and account setup

After that, Getting started with the software is a breeze. Users can quickly register and set up their accounts, providing the necessary information to customize the software according to their needs.

Inputting financial information

Above all, The software guides users through the process of inputting their financial information. From income details to deductions, each step is clearly defined, ensuring that nothing is overlooked.

In addition, Validating data and ensuring accuracy

Before submission, the software prompts users to validate their data. This step-by-step validation process minimizes the risk of errors, guaranteeing that the final tax filing is accurate and in compliance with regulations.

However, Real-Life Success Stories

Testimonials from West Bengal Govt Employees

In other words, Don’t just take our word for it—here are real-life success stories from West Bengal Government Employees who have experienced the benefits of All-in-One Income Tax Preparation Software firsthand.

“I used to dread tax season, but with this software, it’s a breeze! It saved me time and ensured I got all the deductions I deserved.” – A satisfied user

Therefore, Common Challenges and Solutions

Addressing potential issues during tax preparation

While tax preparation can be challenging, the software anticipates common issues and provides solutions to guide users through the process seamlessly.

Troubleshooting guide for users

For instance, In the rare event of technical difficulties or questions, a comprehensive troubleshooting guide is available to assist West Bengal Government Employees, ensuring they receive the support they need.

In conclusion,

West Bengal Government Employees, enhance your tax-filing experience for the Financial Year 2023-24 with the Auto Calculate Income Tax Preparation Software All in One in Excel, available for download by Budget 2023.

This Excel Utility boasts the following features:

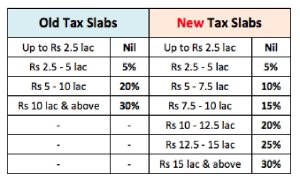

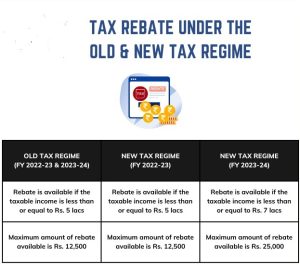

- It prepares and calculates your income tax based on the New Section 115 BAC, accommodating both the New and Old Tax Regime.

- For instance, You have the flexibility to choose between the New or Old Tax Regime using this Excel Utility.

- Specifically tailored for West Bengal Government Employees, this Excel Utility introduces a unique Salary Structure.

- For instance, Enjoy the convenience of automated Income Tax Revised Form 16 Part A&B for the F.Y.2023-24.

- Additionally, benefits from automated Income Tax Revised Form 16 Part B for the F.Y.2023-24.