Are you a small business owner juggling multiple responsibilities, including the daunting task of preparing Form 16 for your employees? Fear not! Therefore, In this guide, we’ll walk you through the process of efficiently creating 50 employees’ Form 16 Part A and B in Excel format for the Financial Year 2023-24. Let’s dive in!

Table of Contents

ToggleTable of Contents

| Sr# | Headings |

| 1 | Understanding Form 16 |

| 2 | Importance of Form 16 |

| 3 | Gathering Necessary Information |

| 4 | Setting Up Excel Template |

| 5 | Filling Part A: Employee Details |

| 6 | Filling Part B: Salary Details |

| 7 | Calculating Taxable Income |

| 8 | Deductions and Exemptions |

| 9 | Generating Form 16 in Excel |

| 10 | Reviewing and Cross-Checking |

| 11 | Distribution to Employees |

| 12 | Filing Form 16 with Authorities |

| 13 | Troubleshooting Common Errors |

| 14 | Staying Updated with Tax Regulations |

| 15 | Conclusion |

1. Understanding Form 16

Form 16 is a crucial document issued by employers to employees, summarizing the salary paid and the taxes deducted during a financial year. In other words, It acts as proof of TDS (Tax Deducted at Source) for salaried individuals.

2. However, the Importance of Form 16

Form 16 serves as a vital document for employees during income tax filing. It provides a comprehensive overview of their earnings, taxes deducted, and investments made, simplifying the tax filing process.

3. Above all, Gathering Necessary Information

Before diving into Excel, ensure you have all the required information handy, including employee PAN details, salary breakup, tax deductions, and investment declarations.

4. In addition, Setting Up Excel Template

Create a structured Excel template with designated sections for employee details, salary components, tax calculations, and more. In addition, This template will streamline the process and ensure consistency across all Form 16s.

5. After that, Filling Part A: Employee Details

Input employee information such as name, PAN, address, employer details, and period of employment in Part A of Form 16.

6. Similarly, Filling Part B: Salary Details

Enter salary particulars like basic pay, allowances, deductions, and other income details in Part B of Form 16.

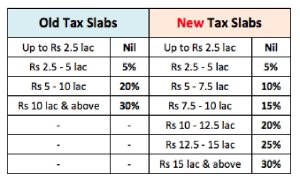

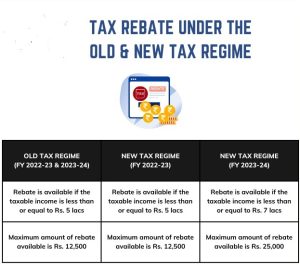

7. Calculating Taxable Income

Utilize Excel formulas to accurately calculate taxable income based on the salary components and deductions.

8. Deductions and Exemptions

Ensure proper inclusion of deductions under Section 80C, 80D, HRA exemptions, and other applicable provisions to minimize taxable income.

9. Generating Form 16 in Excel

Once all data is entered and verified, generate Form 16 in Excel format using built-in templates or customized sheets.

10. Reviewing and Cross-Checking

Thoroughly review each Form 16 to eliminate errors or discrepancies. Cross-check calculations and ensure compliance with tax laws.

11. Distribution to Employees

Distribute the finalized Form 16 to respective employees within the stipulated time frame, ensuring transparency and compliance.

12. Filing Form 16 with Authorities

Submit Form 16 to the Income Tax Department as per regulatory requirements, fulfilling your obligations as an employer.

13. Troubleshooting Common Errors

Be vigilant for common errors such as incorrect PAN details, mismatched figures, or formatting issues. Address these promptly to avoid complications.

14. Staying Updated with Tax Regulations

Keep abreast of evolving tax regulations and updates to ensure accurate and compliant Form 16 preparation year after year.

15. In conclusion,

Preparing Form 16 for 50 employees in Excel format may seem daunting, but with careful planning and attention to detail, it can be a streamlined process. By following the steps outlined in this guide, you can efficiently manage this essential task and empower your employees with accurate tax documentation.

Frequently Asked Questions (FAQs)

1. What is Form 16, and why is it essential for employees? Form 16 is a certificate issued by employers to employees, summarizing their income and taxes deducted during the financial year. It serves as proof of TDS and aids in income tax filing.

2. Can Form 16 be generated manually, or is Excel the preferred method? While Form 16 can be prepared manually, using Excel templates enhances efficiency and accuracy, especially for bulk generation.

3. Are there any penalties for errors in Form 16? Errors in Form 16 can lead to penalties or legal implications. It’s crucial to double-check all details and calculations to avoid such consequences.

4. How should employers handle Form 16 distribution to employees? Employers should ensure timely distribution of Form 16 to employees, preferably in electronic format, and maintain records of distribution for future reference.

5. Is Form 16 submission mandatory for all employers? Yes, employers are required by law to issue Form 16 to employees who have undergone TDS deductions during the financial year.

By adhering to these guidelines and best practices, For instance, you can navigate the Form 16 preparation process with confidence and accuracy, ensuring compliance with tax regulations and fostering trust among employees.

Download and Prepare at a time 50 Employees Form 16 Part A and B in Excel for the F.Y.2023-24