Table of Contents

ToggleIntroduction

When it comes to choosing between the Old Regime and New Regime 2025, many taxpayers—especially non-government employees—feel confused. Budget 2025 has brought clarity, but the decision still depends on individual income, deductions, and planning. Think of it like choosing between a combo meal and à la carte at your favourite restaurant. The combo (old regime) offers many add-ons (deductions), while à la carte (new regime) gives simplicity and fewer choices. So, which suits you better?

Let’s break it down in a simple and human-friendly way using the Automatic Income Tax Calculator All in One for the Non-Govt Employees for the F.Y.2025-26 to help you make the best decision.

Table of Contents

| Sr# | Headings |

| 1 | What is the Old Tax Regime? |

| 2 | What is the New Tax Regime? |

| 3 | Key Changes in Budget 2025 |

| 4 | Income Slabs Comparison: Old vs New |

| 5 | Deductions and Exemptions Allowed |

| 6 | Who Should Choose the Old Regime? |

| 7 | Who Should Choose the New Regime? |

| 8 | Use of the Automatic Income Tax Calculator All-in-One |

| 9 | Step-by-Step: How to Use the Excel Calculator |

| 10 | Use of the Automatic Income Tax Calculator All in One |

| 11 | Tax Planning Strategy for FY 2025-26 |

| 12 | Impact on Salaried Individuals |

| 13 | Real-life Example of a Non-Government Employee |

| 14 | Mistakes to Avoid While Choosing a Regime |

| 15 | Final Thought: Which One is Better for You? |

1. What is the Old Tax Regime?

The Old Tax Regime allows you to claim various deductions and exemptions, such as HRA, LTA, Section 80C, 80D, and more. It benefits those who plan their taxes and investments carefully.

2. What is the New Tax Regime?

The New Tax Regime, introduced in 2020 and revised in Budget 2025, offers lower tax rates but no major exemptions or deductions. It is ideal for those who prefer a simple tax calculation without paperwork.

3. Key Changes in Budget 2025

- Revised tax slabs under the new regime.

- Increased standard deduction even in the new regime.

- Clarified treatment for pensioners and salaried individuals.

- Enhanced usability of automated Excel-based tax calculators for individuals.

4. Income Slabs Comparison: Old vs New

Old Regime:

- ₹2.5L – ₹5L: 5%

- ₹5L – ₹10L: 20%

- Above ₹10L: 30%

New Regime (Budget 2025):

- ₹0 – ₹3L: 0%

- ₹3L – ₹6L: 5%

- ₹6L – ₹9L: 10%

- ₹9L – ₹12L: 15%

- ₹12L – ₹15L: 20%

- Above ₹15L: 30%

5. Deductions and Exemptions Allowed

Old Regime includes:

- Section 80C (up to ₹1.5L for PF, LIC, etc.)

- Section 80D (Medical Insurance)

- HRA, LTA, NPS, Education Loan Interest

New Regime: Only Standard Deduction and limited exemptions.

6. Who Should Choose the Old Regime?

If you:

- Invest in PPF, ELSS, and LIC

- Claim HRA, LTA

- Pay home loan interest

- Have children’s tuition fees

Then the Old Regime may save you more tax.

7. Who Should Choose the New Regime?

If you:

- Don’t claim many deductions

- Don’t have loans or investments

- Prefer simplicity

- Want fewer compliance hassles

Then the New Regime may be your best bet.

8. Use of the Automatic Income Tax Calculator All-in-One

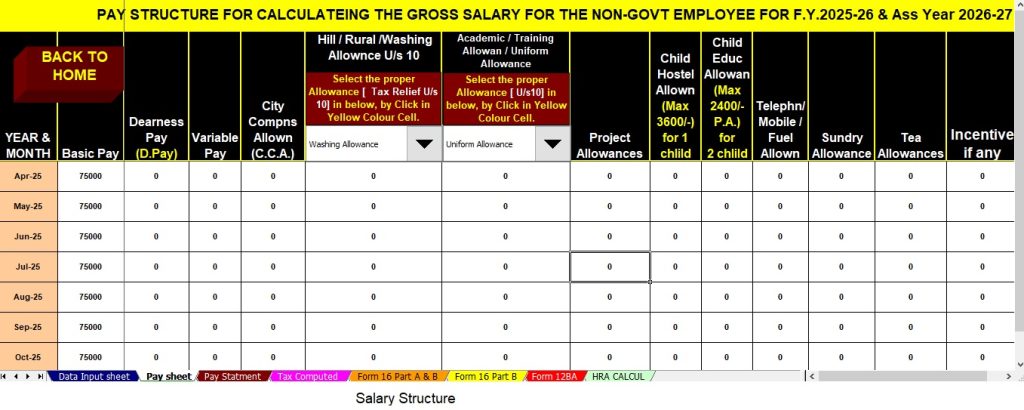

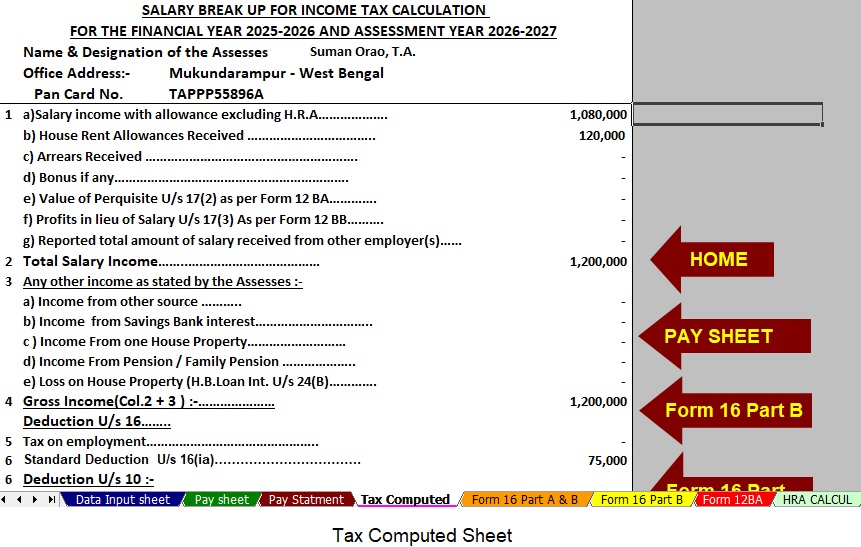

This Excel-based calculator is designed for non-government employees. It auto-computes tax for both regimes and shows a side-by-side comparison. You just need to fill in your income and deduction details.

9. Step-by-Step: How to Use the Excel Calculator

- Download the latest version for FY 2025-26 from the link below

- Enter salary and other income details.

- Add investment details if using old regime.

- The sheet will auto-calculate tax under both regimes.

- Compare and choose the lower tax option.

10. Real-Life Example of a Non-Government Employee

Let’s take Rahul, a 35-year-old private employee earning ₹10L annually:

- Invests ₹1.5L under 80C

- Pays ₹25K as medical premium (80D)

- Claims HRA worth ₹1L

Under the Old Regime, his taxable income drops significantly. The calculator shows that the Old Regime is better for Rahul.

11. Tax Planning Strategy for FY 2025-26

- Start planning in April, not March.

- Use the calculator to project your tax early.

- Choose your regime based on actual data, not assumptions.

12. Impact on Salaried Individuals

Salaried folks with:

- Multiple allowances

- Home loans

- Medical expenses

Often benefit more from the Old Regime. But single-income individuals with fewer claims may find the New Regime better.

13. Tips for Maximising Tax Savings

- Use all available deductions under 80C, 80D, 80G.

- Invest in tax-saving mutual funds, PPF.

- Claim HRA smartly using rent receipts.

14. Mistakes to Avoid While Choosing a Regime

- Ignoring your deductions completely

- Choosing without using the calculator

- Not declaring your choice to the employer

- Waiting till the last minute to plan

15. Final Thought: Which One is Better for You?

There is no one-size-fits-all answer. Your best tax regime depends on your income, deductions, and lifestyle. Using the Automatic Income Tax Calculator All in One for FY 2025-26 is like having a personal tax advisor—it helps you make the smart choice without guesswork.

Conclusion

Choosing between the Old vs New Tax Regime as per Budget 2025 isn’t just about tax rates. It’s about your personal financial habits, investment patterns, and comfort with paperwork. The good news? Tools like the Excel Income Tax Calculator take the complexity out of the process. Use them wisely and start planning early.

FAQs

1. What are the major changes in the New Tax Regime as per Budget 2025?

Budget 2025 revised the income slabs, retained standard deduction, and emphasised the New Regime as default for simplicity.

2. Can I switch between regimes every year?

Yes, salaried individuals can switch annually. Business professionals can switch only once unless their income ceases.

3. How do I decide which regime saves more tax?

Input your details in the All-in-One Excel Calculator and compare the tax payable under both regimes to make an informed choice.

4. Do I need to file Form 10E under the New Tax Regime?

Form 10E is used for arrear relief under Section 89(1), mostly relevant if you’re using the Old Regime with salary back-payments.

Download Automatic Income Tax Calculator All in One for the Non-Govt Employees for the F.Y.2025-26.

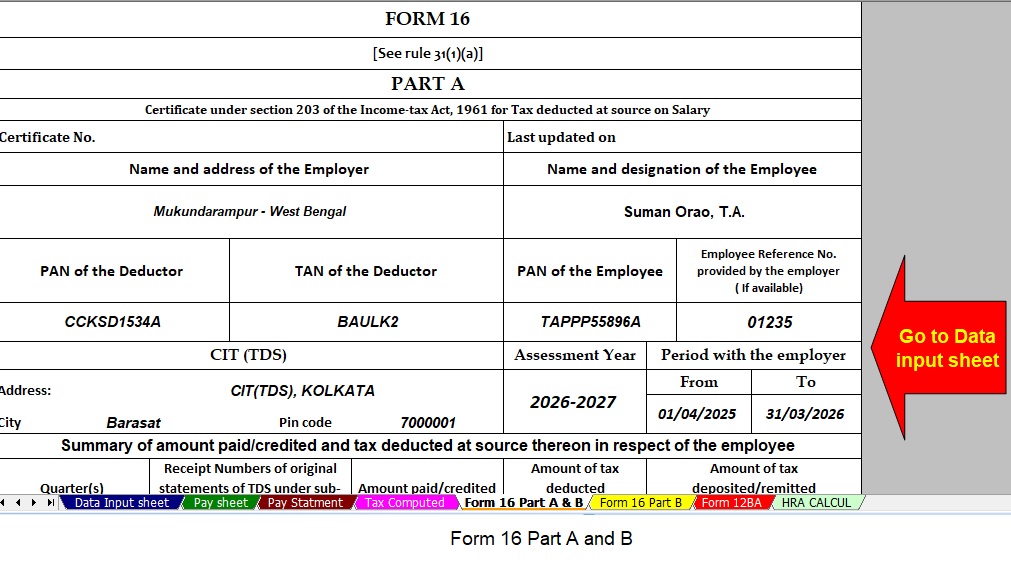

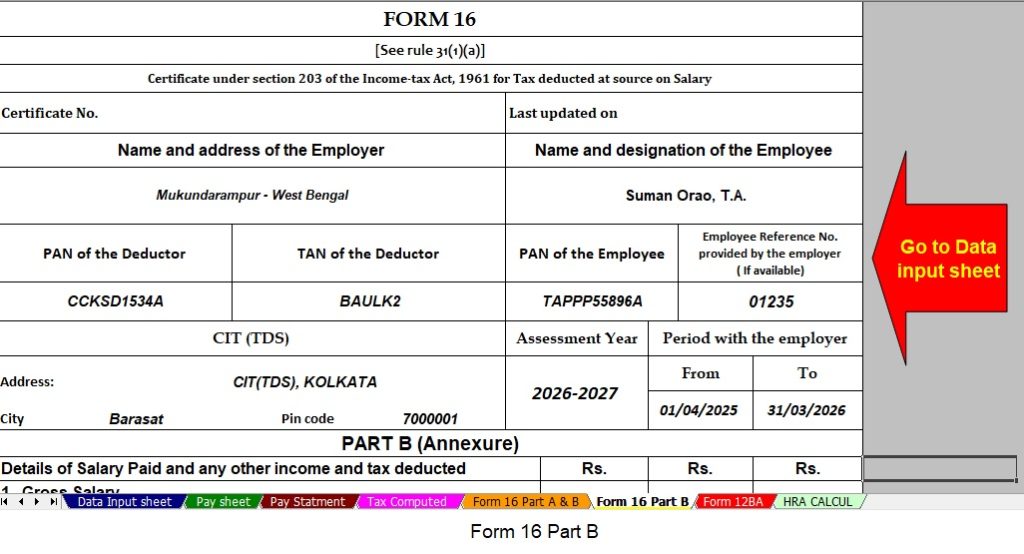

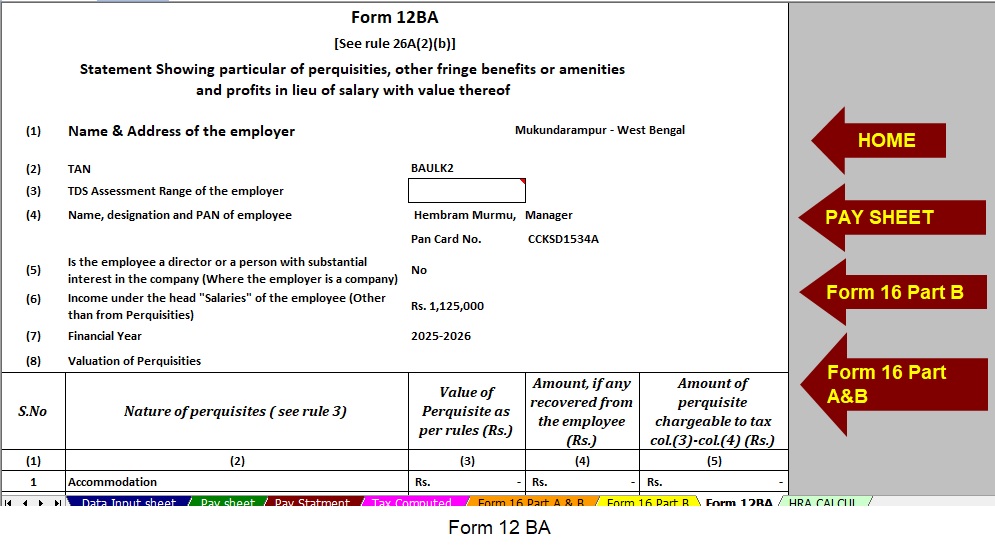

[This Excel Utility can prepare at a time your Income Tax liability as per Budget 2025 + Inbuilt Salary Structure as per the all Non-Government Employees Salary Pattern + Autofill Salary Statement + Auto Calculate H.R.A. Exemption U/s 10(13A) + Auto fill Form 12 BA + Autofill Form 16 Part A and B + Autofill Form 16 Part B]