Imagine receiving an automatic discount on your tax bill—without keeping a single receipt! That’s exactly what the Standard Deduction under Section 16(ia) offers. As per the Budget 2025 (Finance Act, 2025), the government enhanced this simple yet powerful deduction, making tax-saving easier and smarter—especially under the new tax regime.

For both salaried individuals and pensioners, this deduction of ₹75,000 not only reduces taxable income but also simplifies compliance. Whether you work in a private firm or enjoy retirement benefits, this provision ensures a smoother tax experience.

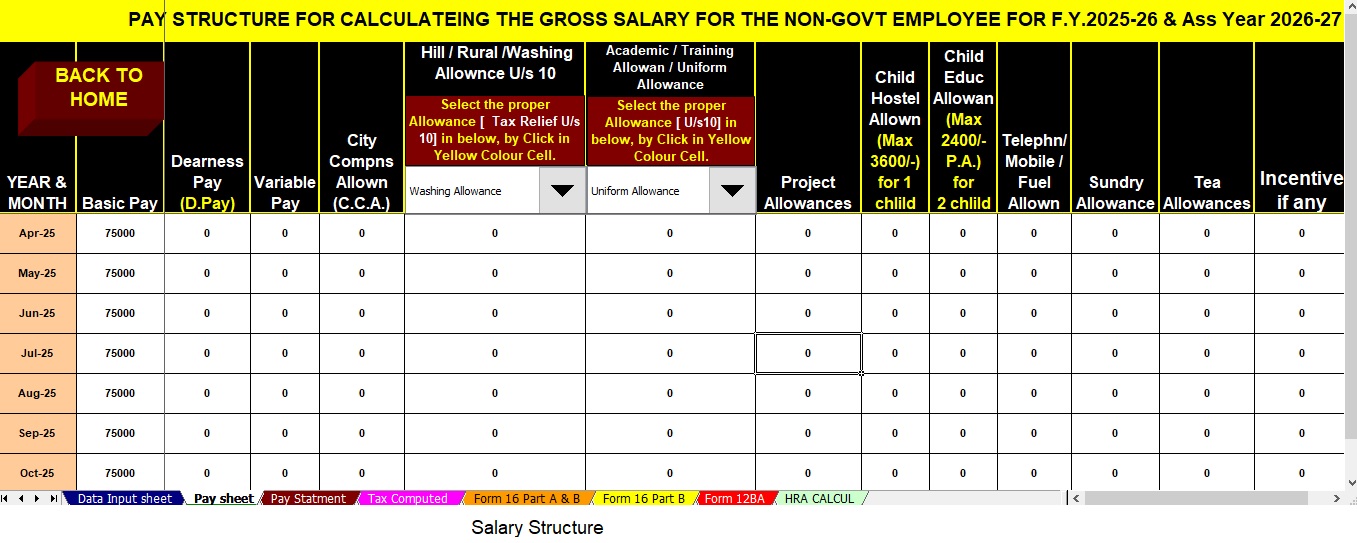

To make things even simpler, the Automated Income Tax Preparation All-in-One Software in Excel for F.Y. 2025–26 allows you to calculate, compare, and file your taxes efficiently—without complex formulas or confusion.

Let’s explore how this works and why it’s a game-changer for millions of taxpayers.

Table of Contents

| Sr# | Headings |

| 1 | Overview of Section 16(ia) – The Foundation of Standard Deduction |

| 2 | What’s New in Budget 2025 – The Enhanced ₹75,000 Deduction |

| 3 | Understanding the Old vs New Tax Regime |

| 4 | Who is Eligible for the Standard Deduction? |

| 5 | How the Standard Deduction Benefits Salaried Individuals |

| 6 | Benefits for Pensioners under Section 16(ia) |

| 7 | Family Pensioners and the Revised ₹25,000 Deduction |

| 8 | Why No Proof or Bills Are Required for Standard Deduction |

| 9 | Simplifying Tax with the New Tax Regime |

| 10 | Introduction to Automated Income Tax Preparation Software in Excel |

| 11 | Key Features of the Excel-Based Tool |

| 12 | Comparing Old vs New Regime Using the Excel Software |

| 13 | Step-by-Step Guide: How to Use the Automated Excel Tool |

| 14 | Common Mistakes to Avoid While Claiming Standard Deduction |

| 15 | Conclusion – A Simpler, Smarter Way to Save Taxes |

1. Overview of Section 16(ia) – The Foundation of Standard Deduction

The Standard Deduction U/s 16(ia) replaced multiple allowances such as transport and medical reimbursements. Instead of collecting bills or maintaining proof, salaried taxpayers now receive a flat deduction, making tax compliance more effortless.

This deduction works like a “no-questions-asked” discount on your taxable income. It provides instant relief, ensuring every taxpayer benefits regardless of their income bracket. Therefore, it simplifies the taxation process while maintaining fairness.

2. What’s New in Budget 2025 – The Enhanced ₹75,000 Deduction

The Finance Act 2025 introduced a landmark update. The Standard Deduction has increased from ₹50,000 to ₹75,000 for taxpayers opting for the new tax regime. Consequently, salaried individuals and pensioners can retain more of their hard-earned income.

This enhancement not only boosts take-home pay but also makes the new regime more appealing. As a result, many individuals are now shifting from the old to the new system to enjoy streamlined benefits and reduced paperwork.

3. Understanding the Old vs New Tax Regime

The old tax regime allows various exemptions and deductions such as HRA, Section 80C, and 80D, while maintaining the standard deduction at ₹50,000.

However, under the new tax regime, which is now the default system, the government has simplified slabs, reduced rates, and raised the standard deduction to ₹75,000.

Therefore, even though the new system limits other exemptions, it compensates taxpayers with simplicity, transparency, and automatic savings—making it highly attractive for individuals with limited investments.

4. Who is Eligible for the Standard Deduction?

Eligibility for the Standard Deduction U/s 16(ia) covers a broad range of individuals, including:

- All salaried employees in both the government and private sectors.

- Pensioners, whose pensions are taxed under “Income from Salary.”

- Family pensioners, who can claim ₹25,000 under Budget 2025.

This inclusive benefit ensures that almost every earning or retired person receives fair tax relief without discrimination or complexity.

5. How the Standard Deduction Benefits Salaried Individuals

For salaried taxpayers, this deduction directly reduces taxable income. For example, if you earn ₹10,00,000 annually, the ₹75,000 deduction reduces it to ₹9,25,000—before any other deductions.

Thus, your tax liability drops instantly. Moreover, you don’t have to collect bills, fill out lengthy forms, or justify expenses. As a result, the process becomes quicker, smoother, and more predictable—just the way modern tax systems should be.

6. Benefits for Pensioners under Section 16(ia)

Pensioners benefit equally from this enhanced deduction. Since pension income falls under “Salary,” retirees automatically qualify for the ₹75,000 standard deduction.

This update from Budget 2025 recognises the contribution of retired citizens while reducing their tax stress. Furthermore, it brings equality between working professionals and retirees—ensuring fairness across generations.

7. Family Pensioners and the Revised ₹25,000 Deduction

Budget 2025 made a compassionate revision by raising the family pension deduction from ₹15,000 to ₹25,000.

This benefit applies to family members receiving a pension after a taxpayer’s death. Therefore, families facing financial hardship gain valuable relief, ensuring continued dignity and support.

8. Why No Proof or Bills Are Required for Standard Deduction

Unlike other deductions, the Standard Deduction U/s 16(ia) requires no proof, bills, or receipts. The government introduced this feature to reduce bureaucracy and enhance transparency.

Hence, employees and pensioners can claim the deduction automatically—making it truly a “no-hassle” benefit. Consequently, this ease of compliance builds trust and encourages voluntary tax filing among citizens.

9. Simplifying Tax with the New Tax Regime

The new regime promotes simplicity and speed. It eliminates the need for dozens of exemptions but rewards taxpayers through lower rates and a higher standard deduction.

In addition, with ₹75,000 automatically deducted, you can focus on your income rather than paperwork. Therefore, for many professionals, this regime represents the future of India’s tax system—efficient, transparent, and inclusive.

10. Introduction to Automated Income Tax Preparation Software in Excel

Preparing taxes manually often leads to confusion. Thankfully, the Automated Income Tax Preparation All-in-One Software in Excel (F.Y. 2025–26) streamlines everything.

This user-friendly tool helps Non-Government Employees calculate their tax liability accurately—whether under the old or new regime—in just a few clicks. As a result, you save time, avoid errors, and gain confidence in your tax compliance.

11. Key Features of the Excel-Based Tool

The Excel-based tool integrates automation, accuracy, and compliance in one platform.

Key highlights include:

- Dual Regime Comparison: Automatically compare old vs new regimes.

- Custom Salary Structure: Easily adapt to your organisation’s format.

- Auto Form 12BA: Generate perquisite forms instantly.

- Updated Form 16 (Part A & B): Fully compliant with FY 2025–26.

- Error-Free Calculations: Built-in formulas prevent mistakes.

In short, it feels like having a tax consultant built right into Excel!

12. Comparing Old vs New Regime Using the Excel Software

The software instantly compares both regimes and highlights which one saves more.

For instance, if your Section 80C savings are minimal, the new regime with ₹75,000 deduction may yield better results. Conversely, if you have higher investments, the old regime might still work best. Either way, the tool ensures you make informed decisions quickly.

13. Step-by-Step Guide: How to Use the Automated Excel Tool

Follow these simple steps to use the Excel tool efficiently:

- Download the Excel file for FY 2025–26.

- Enter your salary and allowance details.

- Select your preferred regime—Old or New.

- Review the auto-calculated deductions and tax liability.

- Generate Form 16 and 12BA automatically.

Within minutes, you’ll have a precise tax summary ready for filing—fast, reliable, and compliant.

14. Common Mistakes to Avoid While Claiming Standard Deduction

Even with automation, avoid these common pitfalls:

- Forgetting to update Excel macros before use.

- Selecting the wrong regime during calculation.

- Excluding pension income from total salary.

- Ignoring the family pension deduction.

Therefore, double-check your entries before final submission to avoid losing any eligible deductions.

15. Conclusion – A Simpler, Smarter Way to Save Taxes

The Standard Deduction U/s 16(ia) stands as one of the most practical tax reliefs for both salaried and retired citizens. With ₹75,000 under the new tax regime, the Budget 2025 has made tax planning straightforward and inclusive.

When combined with the Automated Income Tax Preparation Software, taxpayers experience a powerful mix of simplicity, accuracy, and convenience.

Because in today’s fast-paced digital era, saving time and effort is just as valuable as saving money.

FAQs

- What is the Standard Deduction under Section 16(ia)?

It’s a fixed deduction from salary or pension income that reduces taxable income—₹50,000 under the old regime and ₹75,000 under the new regime (F.Y. 2025–26). - Who can claim the Standard Deduction?

All salaried employees and pensioners are eligible. Even family pensioners can claim ₹25,000 as per the Budget 2025. - Is any proof required to claim the Standard Deduction?

No. It’s a flat deduction, which means no receipts or proofs are needed. - How does the Automated Excel Tax Software help?

It automatically calculates tax, compares regimes, generates forms, and ensures 100% accuracy. - Which tax regime is better—Old or New?

It depends on your savings and investments. However, for those with limited deductions, the new regime with ₹75,000 Standard Deduction is often more beneficial.