Table of Contents

ToggleIntroduction

When Budget 2025 was announced, the big question in everyone’s mind was this: “Which tax regime is better for me—Old or New?” Whether you’re a government employee or working in the private sector, taxes affect your take-home salary, savings, and overall financial health.

If you’re scratching your head over deductions, slabs, and which regime to pick for the financial year 2025–26, you’re not alone. The government has introduced enhancements and fine-tuned rates in both tax regimes. That’s where the Automated Income Tax Calculator All-in-One comes in handy—tailored for both government and non-government salaried employees.

To make this even more helpful, we’ll break it all down in simple terms, compare the two regimes, use real-life examples, and explain how you can choose your Beneficial Tax Regime easily.

Table of Contents

| Sr# | Headings |

| 1 | Understanding the Two Tax Regimes |

| 2 | Key Changes in Budget 2025 |

| 3 | Tax Slabs for FY 2025–26 |

| 4 | Comparison: Old vs New Tax Regime |

| 5 | Deductions and Exemptions: What You Lose or Keep |

| 6 | Case Study: A Government Employee’s Tax Scenario |

| 7 | Case Study: A Private Sector Employee’s Tax Scenario |

| 8 | Benefits of the New Tax Regime |

| 9 | Why Some Still Prefer the Old Tax Regime |

| 10 | How to Use the Automated Income Tax Calculator |

| 11 | Tips to Choose Your Beneficial Tax Regime |

| 12 | Switching Between Regimes: Rules and Limits |

| 13 | Tax Planning Tips for FY 2025–26 |

| 14 | Common Mistakes to Avoid in Tax Filing |

| 15 | Conclusion: What’s Right for YOU? |

1. Understanding the Two Tax Regimes

India now offers two main personal income tax regimes:

- Old Tax Regime: Offers several exemptions and deductions (HRA, 80C, 80D, LTA, etc.).

- New Tax Regime: Offers lower tax rates but no major exemptions or deductions.

So, the key question becomes—do you want lower rates or higher deductions?

2. Key Changes in Budget 2025

Budget 2025 introduced some critical updates to both tax regimes:

- Standard Deduction of ₹50,000 is now available under the New Regime (earlier only in the old regime).

- Revised tax slabs under the new regime offer wider zero-tax thresholds.

- Default Regime: The New tax regime is now the default unless you opt for the old regime.

- Rebate under Section 87A extended up to ₹7 lakh income in the new regime (no tax up to ₹7L).

These updates significantly shift the benefit balance towards the New Tax Regime—but it’s not a one-size-fits-all.

3. Tax Slabs for FY 2025–26

Let’s look at how the tax slabs compare:

Old Tax Regime Slabs:

| Income Range | Tax Rate |

| Up to ₹2.5L | Nil |

| ₹2.5L – ₹5L | 5% |

| ₹5L – ₹10L | 20% |

| ₹10L+ | 30% |

New Tax Regime Slabs (FY 2025–26):

| Income Range | Tax Rate |

| Up to ₹3L | Nil |

| ₹3L – ₹6L | 5% |

| ₹6L – ₹9L | 10% |

| ₹9L – ₹12L | 15% |

| ₹12L – ₹15L | 20% |

| ₹15L+ | 30% |

The wider zero-tax bracket and lower rates in the new regime make it attractive, especially for those with minimal deductions.

4. Comparison: Old vs New Tax Regime

Let’s break it down:

| Feature | Old Regime | New Regime |

| Tax Rates | Higher | Lower |

| Deductions | Available | Not Available |

| HRA | Yes | No |

| 80C (₹1.5L) | Yes | No |

| Default Regime | No | Yes |

| Suitable For | High Deduction Claimers | Low Deduction Claimers |

Verdict? If you claim many deductions, the Old Regime may be better. If not, the New Regime could save more.

1. Deductions and Exemptions: What You Lose or Keep

Under the Old Tax Regime, you can claim several deductions and exemptions, including:

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Section 80C (LIC, PPF, ELSS, etc.)

- Section 80D (Medical Insurance Premium)

- Home Loan Interest

- NPS, Education Loan, and Donations

However, under the New Tax Regime, you give up most of these benefits. Yet, you gain certain perks such as:

- Standard Deduction of ₹50,000

- Simplified and lower tax slabs

- Higher rebate under Section 87A

In essence, the Old Regime is like a buffet—you get multiple choices, but it takes effort to pick wisely. The New Regime, however, feels like a combo meal—simpler, faster, and easier to digest. Your best choice depends entirely on your financial lifestyle and goals.

2. Understanding the Old Tax Regime

The Old Tax Regime rewards taxpayers who plan, invest, and save. It encourages financial discipline by offering deductions for various investments and expenses.

If you prefer structured savings like PF, ELSS, insurance, or home loans, this regime ensures you get maximum tax benefits while securing your future. However, it requires paperwork, investment proofs, and regular monitoring.

3. Exploring the New Tax Regime

Introduced to simplify the tax system, the New Tax Regime removes the complexity of multiple deductions. Instead, it offers lower tax rates and straightforward slabs.

You no longer need to invest just to save tax, giving you more liquidity and freedom. This regime suits young professionals who prefer flexibility and higher take-home pay over long-term commitments.

4. Key Differences Between the Two Regimes

Let’s look at the main contrasts between both systems:

| Feature | Old Regime | New Regime |

| Deductions Allowed | Multiple (80C, 80D, HRA, etc.) | Limited (Standard Deduction ₹50,000) |

| Documentation | Required | Minimal |

| Suitable For | Regular investors, family planners | Young earners, freelancers |

| Tax Rates | Slightly higher | Lower and simple |

| Flexibility | Moderate | High |

Thus, while the Old Regime values savings, the New Regime values simplicity.

5. Case Study: A Government Employee’s Tax Scenario

Let’s take the example of Ravi, a Central Government employee earning ₹10 lakh annually.

He claims:

- ₹1.5 lakh under Section 80C

- ₹25,000 under Section 80D

- ₹50,000 as Standard Deduction

- ₹1 lakh towards HRA

So, under the Old Regime, his taxable income becomes ₹6.75 lakh, and his tax payable is roughly ₹32,500.

But under the New Regime, his taxable income jumps to ₹9.5 lakh, raising his tax to around ₹52,500.

Therefore, for Ravi, the Old Regime is clearly more beneficial as it significantly lowers his taxable income.

6. Case Study: A Private Sector Employee’s Tax Scenario

Now, let’s meet Priya, an IT professional earning ₹9 lakh annually. She claims only the Standard Deduction of ₹50,000.

Her taxable income is ₹8.5 lakh under both regimes. However:

- Old Regime tax payable: ₹72,500

- New Regime tax payable: ₹45,000

For Priya, the New Regime is ideal. It simplifies her tax process, reduces her payable amount, and eliminates unnecessary paperwork.

7. Benefits of the New Tax Regime

The New Regime offers several appealing benefits:

- Lower tax rates, resulting in direct savings.

- No need for investment proofs or long paperwork.

- More take-home pay every month.

- Zero tax liability for incomes up to ₹7 lakh (with rebate).

- Easy comparison between old and new regimes.

In short, it fits best for those who prefer convenience, liquidity, and simplicity.

8. Why Many Still Prefer the Old Tax Regime

Despite the New Regime’s simplicity, many still cling to the Old one. Why? Because it rewards long-term planning.

People prefer the Old Regime if they:

- Have active home loans

- Regularly invest in Section 80C instruments

- Claim multiple exemptions

- Enjoy HRA benefits

So, if you’re already committed to regular tax-saving investments, sticking with the Old Regime might make more sense.

9. How to Use the Automated Income Tax Calculator

Using the Automated Income Tax Calculator is quick and effortless.

- Enter your income details like Basic Pay, HRA, and Special Allowances.

- Select your regime — Old or New.

- Input your deductions, if applicable.

- Get an instant Tax Payable Summary.

This Excel-based utility or online calculator works for both Government and Non-Government employees, ensuring accurate, quick, and reliable results.

10. Tips to Choose Your Beneficial Tax Regime

Choosing between the Old and New Regime is easier if you follow these steps:

- Compare your tax under both systems.

- Evaluate annual deductions and investments.

- Consider long-term goals — savings or liquidity?

- Use an automated calculator for precision.

- Opt for the regime giving you higher post-tax income.

By revisiting this comparison each year, you ensure the most profitable tax planning.

11. Switching Between Regimes: Rules and Limits

While the Income Tax Department offers flexibility, there are rules to note:

- Salaried individuals can switch every financial year.

- Business owners can switch only once in their lifetime.

- Always declare your chosen regime before filing your ITR.

Pro Tip: Compare both annually before finalizing. This ensures maximum savings and minimum liability each year.

12. Comparing Tax Regimes: Buffet vs. Combo Meal Analogy

Think of the Old Tax Regime as a buffet — diverse but demanding. You get many options, but you must know what to pick.

In contrast, the New Regime resembles a combo meal — simple, predictable, and quick. There’s less choice but more clarity.

Your choice depends on whether you value flexibility or simplicity more.

13. Common Mistakes to Avoid When Choosing a Regime

Here are some common blunders taxpayers make:

- Ignoring annual comparisons.

- Choosing without calculating both scenarios.

- Overlooking Section 80C deductions.

- Assuming one regime fits all.

Avoiding these mistakes ensures you maximize benefits and minimize taxes smartly.

14. Pro Tips to Maximize Savings

- Use automatic tax calculators to test both regimes.

- Track investment proofs throughout the year.

- Reassess your tax strategy after salary revisions.

- Consult a tax advisor before switching regimes.

Remember, a smart taxpayer doesn’t just save — they plan strategically.

15. Conclusion

Choosing between the Old and New Tax Regime isn’t about right or wrong — it’s about what’s right for you. If you love investment-linked savings, the Old Regime is ideal. But if you prefer simplicity and higher liquidity, the New Regime wins.

Ultimately, your best bet is to compare both each year, use an automated calculator, and decide what enhances your take-home income and peace of mind.

FAQs

1. Which is better: the Old or New Tax Regime?

It depends on your financial profile. If you invest regularly and claim deductions, the Old Regime may be better. Otherwise, the New Regime offers simplicity and lower rates.

2. Can I switch between the regimes every year?

Yes, salaried employees can switch regimes every year, but business owners can switch only once.

3. What is the standard deduction under the New Tax Regime?

You can claim a standard deduction of ₹50,000, available for both salaried and pensioned taxpayers.

4. How can I calculate my tax easily?

Use an Automated Income Tax Calculator in Excel or online. It gives quick, accurate comparisons between both regimes.

5. Is the New Tax Regime compulsory from FY 2025-26?

No, it’s not mandatory. You can choose between the Old and New Regimes based on your financial situation and preferences.

Would you like me to optimize this version for Yoast SEO, including keyword density and readability scoring?

Is this conversation helpful so far?

Download Automatic Income Tax Preparation Software All-in-One in Excel for Government and Non-Government Employees (F.Y. 2025-26)

Now you can download the Automatic Income Tax Preparation Software All-in-One in Excel for both Government and Non-Government employees for the Financial Year 2025-26. This smart and user-friendly Excel tool streamlines your entire tax computation process while maintaining complete accuracy and compliance with the latest Budget 2025 updates.

Unlike manual calculations, this Excel-based utility automates every part of your salary and tax preparation, saving your precious time and effort. Let’s explore its key features and how it can simplify your tax filing experience.

✅ Prepares Your Tax Computation Sheet Instantly as per Budget 2025

The software instantly generates your comprehensive tax computation sheet in line with the latest Budget 2025 provisions. It ensures that every calculation strictly follows the updated Income Tax Rules, eliminating any risk of manual errors. Moreover, the automatic setup guarantees compliance and accuracy throughout your financial documentation.

✅ Includes Predefined Salary Structures for All Employees

This Excel utility comes with an in-built salary structure for both Government and Non-Government employees. Therefore, you can quickly input your income and deduction details without worrying about complex formulas or formats. The ready-to-use templates simplify your work and make tax planning more efficient.

✅ Generates Automatic Salary Sheet Effortlessly

With just a few clicks, the tool automatically prepares your complete salary sheet. It removes the need for repetitive data entry and prevents calculation mistakes. Additionally, the automated functions ensure that your monthly and annual figures remain consistent and easy to review at any time.

✅ Calculates HRA Exemption Automatically under Section 10(13A)

This advanced software smartly calculates your House Rent Allowance (HRA) exemption based on your salary, rent paid, and city type. By applying Section 10(13A) rules precisely, it provides accurate results while adhering to official tax norms. As a result, you can maximize your eligible tax relief confidently.

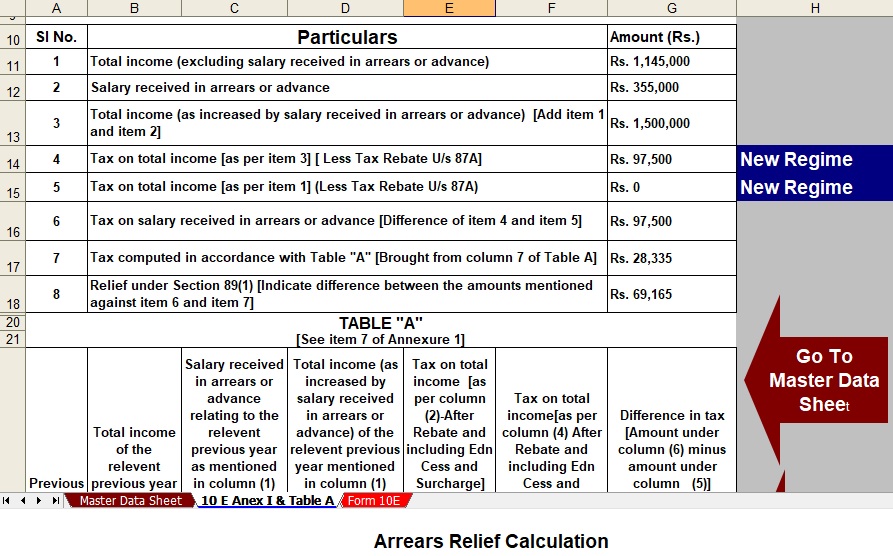

✅ Computes Income Tax Arrears Relief under Section 89(1) with Form 10E

Another powerful feature of this Excel utility is its ability to compute Income Tax Arrears Relief automatically under Section 89(1). It also prepares Form 10E seamlessly, ensuring you claim the correct relief amount without confusion or delay. This feature helps taxpayers avoid mistakes while filing arrears-related tax adjustments.

✅ Generates Form 16 Part A and Part B Automatically

Preparing Form 16 manually can be stressful, but this tool simplifies it entirely. The software automatically generates both Part A and Part B of Form 16, allowing you to distribute or file them with ease. Whether you’re an employer or an employee, you’ll appreciate the precision and speed this tool offers.

✅ Creates Automatic Form 16 Part B Separately

In addition, this utility also provides the option to generate a separate Form 16 Part B automatically. This ensures that your tax documentation remains complete and ready for submission within minutes. You no longer need to depend on external tools or spend hours preparing these forms manually.

✨ Your Digital Assistant for Smooth Tax Filing (F.Y. 2025-26)

In summary, the Automatic Income Tax Preparation Software All-in-One in Excel serves as your personal digital tax assistant for the Financial Year 2025-26. It simplifies tax computation, ensures 100% accuracy, and aligns perfectly with the latest updates under Section 115BAC and Budget 2025.

With this Excel tool, you can save time, reduce stress, and file taxes confidently—whether you’re a Government or Non-Government employee.

Download the Automatic Income Tax Preparation Software All-in-One in Excel today and experience effortless, error-free, and fully automated income tax management for the F.Y. 2025-26.

Pro Tip: Try both options every year before deciding.

Download Automatic Income Tax Preparation Software All-in-One in Excel for Government and Non-Government Employees (F.Y. 2025-26)

Now you can download the Automatic Income Tax Preparation Software All-in-One in Excel for both Government and Non-Government employees for the Financial Year 2025-26. This smart and user-friendly Excel tool streamlines your entire tax computation process while maintaining complete accuracy and compliance with the latest Budget 2025 updates.

Unlike manual calculations, this Excel-based utility automates every part of your salary and tax preparation, saving your precious time and effort. Let’s explore its key features and how it can simplify your tax filing experience.

✅ Prepares Your Tax Computation Sheet Instantly as per Budget 2025

The software instantly generates your comprehensive tax computation sheet in line with the latest Budget 2025 provisions. It ensures that every calculation strictly follows the updated Income Tax Rules, eliminating any risk of manual errors. Moreover, the automatic setup guarantees compliance and accuracy throughout your financial documentation.

✅ Includes Predefined Salary Structures for All Employees

This Excel utility comes with an in-built salary structure for both Government and Non-Government employees. Therefore, you can quickly input your income and deduction details without worrying about complex formulas or formats. The ready-to-use templates simplify your work and make tax planning more efficient.

✅ Generates Automatic Salary Sheet Effortlessly

With just a few clicks, the tool automatically prepares your complete salary sheet. It removes the need for repetitive data entry and prevents calculation mistakes. Additionally, the automated functions ensure that your monthly and annual figures remain consistent and easy to review at any time.

✅ Calculates HRA Exemption Automatically under Section 10(13A)

This advanced software smartly calculates your House Rent Allowance (HRA) exemption based on your salary, rent paid, and city type. By applying Section 10(13A) rules precisely, it provides accurate results while adhering to official tax norms. As a result, you can maximise your eligible tax relief confidently.

✅ Computes Income Tax Arrears Relief under Section 89(1) with Form 10E

Another powerful feature of this Excel utility is its ability to compute Income Tax Arrears Relief automatically under Section 89(1). It also prepares Form 10E seamlessly, ensuring you claim the correct relief amount without confusion or delay. This feature helps taxpayers avoid mistakes while filing arrears-related tax adjustments.

✅ Generates Form 16 Part A and Part B Automatically

Preparing Form 16 manually can be stressful, but this tool simplifies it entirely. The software automatically generates both Part A and Part B of Form 16, allowing you to distribute or file them with ease. Whether you’re an employer or an employee, you’ll appreciate the precision and speed this tool offers.

✅ Creates Automatic Form 16 Part B Separately

In addition, this utility also provides the option to generate a separate Form 16 Part B automatically. This ensures that your tax documentation remains complete and ready for submission within minutes. You no longer need to depend on external tools or spend hours preparing these forms manually.

✨ Your Digital Assistant for Smooth Tax Filing (F.Y. 2025-26)

In summary, the Automatic Income Tax Preparation Software All-in-One in Excel serves as your personal digital tax assistant for the Financial Year 2025-26. It simplifies tax computation, ensures 100% accuracy, and aligns perfectly with the latest updates under Section 115BAC and Budget 2025.

With this Excel tool, you can save time, reduce stress, and file taxes confidently—whether you’re a Government or Non-Government employee.

Download the Automatic Income Tax Preparation Software All-in-One in Excel today and experience effortless, error-free, and fully automated income tax management for the F.Y. 2025-26.