No Tax Up to ₹12.75 Lakhs? How Section 87A Makes It Possible (FY 2025-26)

Have you ever wondered how people keep saying “No Tax Up to ₹12.75 Lakhs?” and still sound confident? Well, you are not alone.

No Tax Up to ₹12.75 Lakhs? How Section 87A Makes It Possible (FY 2025-26)

Have you ever wondered how people keep saying “No Tax Up to ₹12.75 Lakhs?” and still sound confident? Well, you are not alone.

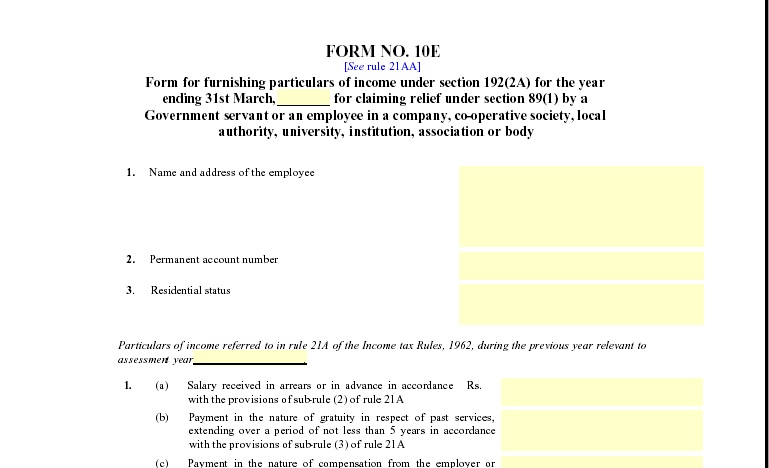

Automatic Arrears Relief Calculator U/s 89(1) with Form 10E for FY 2025–26

Everyone wants to save tax, and when arrears suddenly enter your salary slip, the tax burden often rises quickly. However, with the Automatic

Excel-based income tax calculators for the Financial Year (FY) 2025-26 are readily available for download from several finance and tax-related websites . These

Income tax rules change almost every year, and FY 2025-26 brings important updates that affect salaried individuals. With the introduction of new slab rates in

Old vs New Tax Regime Comparison With Automatic Excel Tax Software

Introduction Choosing between the old and new tax regimes often feels like standing at a crossroads. Many taxpayers struggle to decide which path

Introduction Salaried employees often face the challenge of selecting the right tax system, and this decision can significantly shape their yearly savings. When

Introduction Have you ever wished you could calculate your income tax without stress, confusion, or long hours hunting for formulas? If yes, you’re

When you receive salary arrears, it often feels like an unexpected bonus. However, when you see the tax deduction on those arrears, it

Filing income tax, although common, still feels complicated for many employees. However, when you understand the basics and use smart tools like Tax

Introduction The Standard Deduction for the F.Y. 2025-26, announced under Budget 2025, brings significant relief to salaried individuals, pensioners, and family pensioners. Since

Automatic Arrears Relief Calculator U/s 89(1) with Form 10E for FY 2025–26

Sometimes, you receive salary arrears unexpectedly, right? However, that extra income may push you into a higher tax slab. Therefore, the Government created

Download Excel Tax Calculator All in One for FY 2025-26

Managing income tax often feels confusing, yet it doesn’t have to be. Imagine having one simple Excel sheet that calculates everything for you

Salary Arrears Relief Calculator U/s 89(1) with Form 10E from the FY 2000-01 to FY 2025-26

Have you ever received your salary arrears and felt confused about the high tax deduction? You’re not alone! Many salaried employees face this

Filing income tax can feel like walking through a maze—confusing, time-consuming, and stressful. But what if you had a smart guide to lead

The Budget 2025 has brought fresh relief and simplicity for India’s hardworking middle class through the Income Tax New Regime. With reduced tax

Filing income tax returns often feels like navigating a maze; however, when you use Automatic Income Tax Preparation Software All-in-One in Excel, you

Filing income tax returns often feels like navigating a maze; however, when you use Automatic Income Tax Preparation Software All-in-One in Excel, you

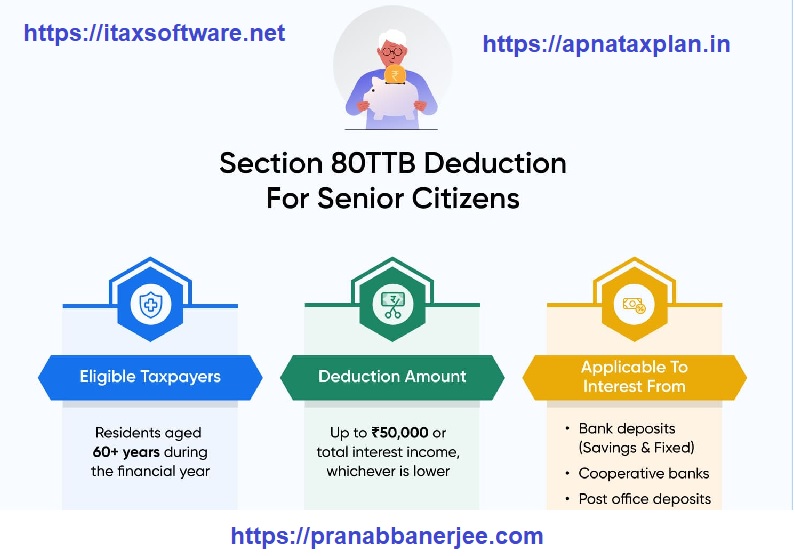

Section 80TTB of Income Tax Act – Deductions for Senior Citizens (Only for Old Tax Regime)

Introduction: What is Section 80TTB? Section 80TTB, introduced in the Union Budget 2018, is a beneficial provision under the Income Tax Act, 1961

Do you ever wonder how to reduce your Income Tax burden while staying compliant with the law? For most salaried individuals, understanding tax

Introduction to Income Tax Arrears Relief U/s 89(1) You start saving tax effectively when you understand the arrears rules under Section 89(1). You

© Copyright 2023 All Rights Reserved by Pranabbanerjee.com