The Budget 2025 has brought fresh relief and simplicity for India’s hardworking middle class through the Income Tax New Regime. With reduced tax

The Budget 2025 has brought fresh relief and simplicity for India’s hardworking middle class through the Income Tax New Regime. With reduced tax

Filing income tax returns often feels like navigating a maze; however, when you use Automatic Income Tax Preparation Software All-in-One in Excel, you

Filing income tax returns often feels like navigating a maze; however, when you use Automatic Income Tax Preparation Software All-in-One in Excel, you

Section 80TTB of Income Tax Act – Deductions for Senior Citizens (Only for Old Tax Regime)

Introduction: What is Section 80TTB? Section 80TTB, introduced in the Union Budget 2018, is a beneficial provision under the Income Tax Act, 1961

Do you ever wonder how to reduce your Income Tax burden while staying compliant with the law? For most salaried individuals, understanding tax

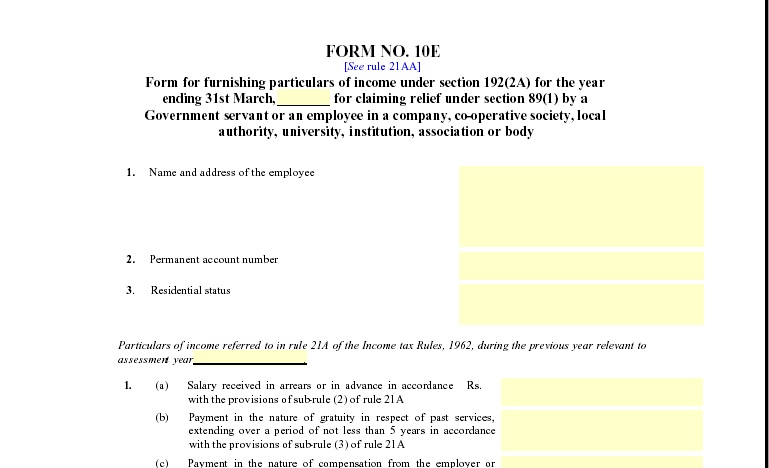

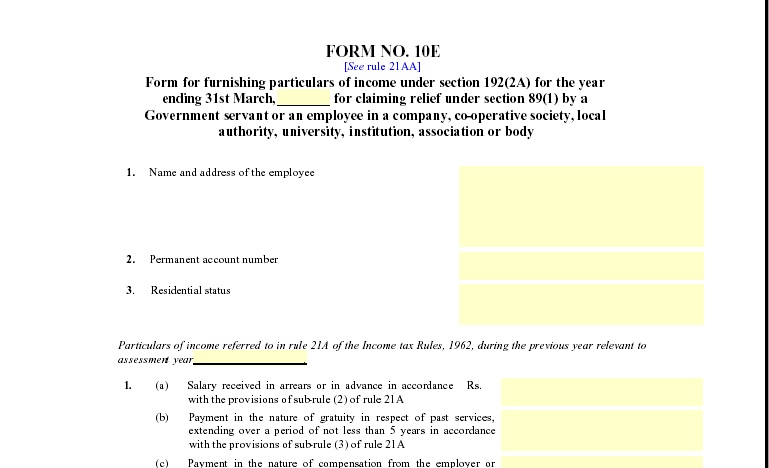

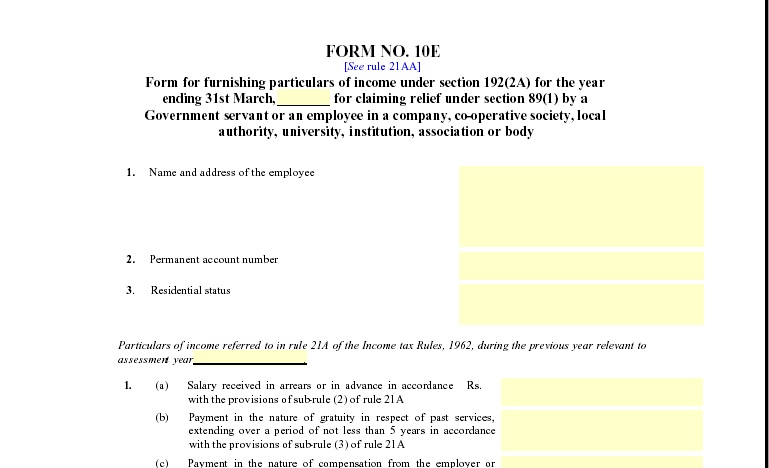

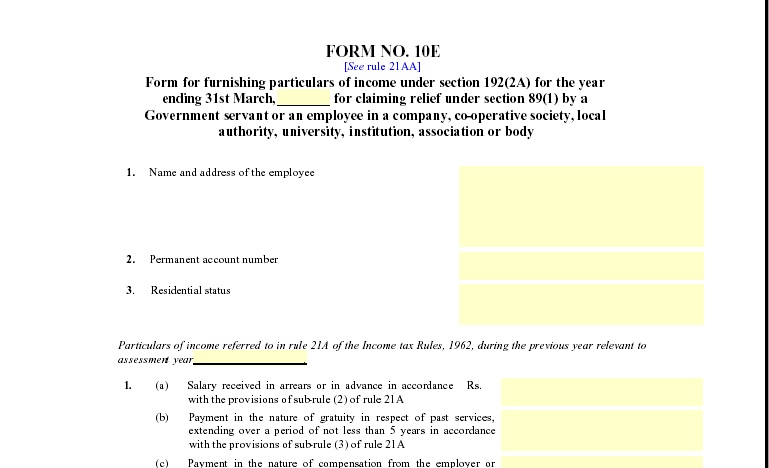

Introduction to Income Tax Arrears Relief U/s 89(1) You start saving tax effectively when you understand the arrears rules under Section 89(1). You

Introduction Preparing income tax can feel overwhelming, especially when new financial rules roll in every year. If you are a salaried employee, you

Download All-in-One Excel-Based Income Tax Preparation Software for Non-Govt Employees FY 2025-26

Filing income tax can sometimes feel like trying to untangle a long, messy string—no matter how hard you try, the knots just keep

Have you ever wondered whether those expensive wedding gifts—like gold sets, cash envelopes, or even a car—are taxable? Surprisingly, they’re not, but only

Standard Deduction U/s 16(ia): Complete Guide for F.Y. 2025-26

Introduction Have you ever wondered how the Standard Deduction U/s 16(iA) lightens your tax load every year? You’re not alone! Every salaried employee

Introduction Have you ever wondered whether keeping your current Home Loan is costing you more than it should? Many people continue with the

Comprehensive Outline (Table Format) Section Heading/Subheading Description 1 H1: New Tax Regime More Beneficial Than the Old Tax Regime to All Taxpayers, F.Y.

Do you ever wonder how to reduce your Income Tax burden while staying compliant with the law? For most salaried individuals, understanding tax

Know your Tax Burden in the Old and New Tax Regime for the F.Y.2025-26 with Tax Calculator in Excel

For the Financial Year (FY) 2025-26, the tax rules have significantly changed, making the new tax regime the default option. To determine your

Filing income tax can feel like walking through a maze—confusing, time-consuming, and stressful. But what if you had a smart guide to lead

Imagine receiving an automatic discount on your tax bill—without keeping a single receipt! That’s exactly what the Standard Deduction under Section 16(ia) offers.

Filing income tax can feel like walking through a maze—confusing, time-consuming, and stressful. But what if you had a smart guide to lead

Salary Arrears Relief Calculator U/s 89(1) with Form 10E from the FY 2000-01 to FY 2025-26

Have you ever received your salary arrears and felt confused about the high tax deduction? You’re not alone! Many salaried employees face this

The Union Budget 2025 introduced significant reforms to simplify the Indian taxation system, particularly through the New Tax Regime. For non-government employees, this

To determine the best tax regime for the Financial Year (FY) 2025-26, you will need to perform a comparative calculation using your specific

© Copyright 2023 All Rights Reserved by Pranabbanerjee.com